Fulcrum Perspectives

An interactive blog sharing the Fulcrum team's policy updates and analysis.

Recommended Weekend Reads

Germany’s Century-Long Re-Armament Challenge, How the EU Needs to Deal With Industrial Policy, Looking at Argentina President Milei’s Economic First Year, and The Return of Economic Statecraft

Please find below our recommended reads from reports and articles we read in the last week. We hope you find these useful and that you have a relaxing weekend. And let us know if you or someone you know wants to be added to our distribution list.

We hope you have a joyful Christmas and a happy Hanukkah! We’ll be back next Friday with our next set of recommended weekend reads.

The Future of Europe

Fit for War in Decades: Europe’s and Germany’s Slow Rearmament vis-a-vis Russia Kiel Institute for the World Economy

War is back in Europe, and as it becomes long-lasting, the question of armament gains central importance. This report finds that Russian military-industrial capacities have been rising strongly in the last two years, well beyond the levels of Russian material losses in Ukraine. Meanwhile, the build-up of German capacities is progressing slowly. We document Germany’s military procurement in a new Kiel Military Procurement Tracker and find that Germany did not meaningfully increase procurement in the one-and-a-half years after February 2022 and only accelerated it in late 2023. Given Germany’s massive disarmament in the last decades and the current procurement speed, we find that for some key weapon systems, Germany will not attain 2004 levels of armament for about 100 years. When taking into account arms commitments to Ukraine, some German capacities are even falling.

Industrial Policy in Europe: A Single Market Perspective International Monetary Fund Working Papers

European countries are increasingly turning to industrial policy to address the challenge of geopolitical fragmentation, enhance productivity, and accelerate the green transition. Well-targeted industrial policy has the potential to correct market failures and support production efficiency by exploiting scale effects and internalizing knowledge externalities. But even the most carefully designed unilateral industrial policies risk generating negative production externalities in other countries, and, under certain conditions, may not even be welfare-enhancing for the implementing country. The reason is that negative externalities of unilateral industrial policy can drive European and international production patterns away from underlying comparative advantages, create regional or global over-supply, and result in changes in terms of trade that reduce domestic welfare. This suggests significant benefits from coordination. Structural modeling and case studies show that a coordinated approach within the European Union and with international trading partners on a narrowly defined and carefully designed set of industrial policies could unlock untapped benefits. Closer European integration would facilitate the adjustment of firms and workers to coordinated and well-targeted industrial policies and amplify their benefits.

The Americas

Milei's Economics: The First Year and the Challenges Ahead Santiago Afonso & Sebastian Galiani/SSRN

President Javier Milei's first year in office rightly prioritized two fundamental issues: chronic fiscal deficits and economic regulations driven by rent-seeking groups. While achieving the most aggressive fiscal consolidations on record, the administration has heavily relied on inflation-driven cuts to social spending and public investment rather than on structural reforms. Despite a significant deregulation effort, limited congressional support has hindered more comprehensive reforms. Although President Milei remains strongly committed to the program implemented, the sustainability of these measures remains uncertain. As the administration approaches the 2025 midterm elections, its ability to maintain public support while managing potential currency pressures will be crucial for implementing deeper structural changes and avoiding the fate of previous reform attempts.

Latin America and the Caribbean in 2025: Ten Predictions to Shape the Year Ahead Atlantic Council

2024 was a transformative year for Latin America and the Caribbean. Elections brought some surprises, but the region also bucked the global trend as continuity was the theme. But what might be in store for Latin America and the Caribbean in 2025? How might the incoming Trump administration engage with the region? Can economies across the hemisphere grow beyond current predictions? How will leaders address security challenges? Might new tech hubs emerge? The Atlantic Council offers a fun quiz where you can see their predictions for 2025 and see if you agree.

Why a Normalization Strategy With Venezuela Is Not Viable Americas Quarterly

In less than a month, Nicolás Maduro is set to begin a third term as Venezuela’s president, even though vote tallies demonstrate that opposition candidate Edmundo González won the election by a landslide. Although the whole international community has an important role in holding Maduro and his elite accountable and supporting the Venezuelan people, all eyes point toward one country: the U.S. The return of Donald Trump to the presidency has triggered expectations of a return to the “maximum pressure” strategy of his first term. In contrast, many recent commentaries warned about the grave consequences of a return to that policy, suggesting instead a continuation of the sanction-easing measures taken under the Biden administration. But neither a return to 2019 nor normalizing relations with Maduro will create favorable conditions for a democratic transformation in Venezuela, especially considering the strong grassroots movement that coalesced to back González. New circumstances demand a new strategy.

Geopolitical Strategy and Economic Statecraft

The Price of American Retreat: Why Washington Must Reject Isolationism and Embrace Primacy Senator Mitch McConnell (R-KY)/Foreign Affairs

When he begins his second term as president, Donald Trump will inherit a world far more hostile to U.S. interests than the one he left behind four years ago. China has intensified its efforts to expand its military, political, and economic influence worldwide. Russia is fighting a brutal and unjustified war in Ukraine. Iran remains undeterred in its campaign to destroy Israel, dominate the Middle East, and develop a nuclear weapons capability. And these three U.S. adversaries, along with North Korea, are now working together more closely than ever to undermine the U.S.-led order that has underpinned Western peace and prosperity for nearly a century. Trump would be wise to build his foreign policy on the enduring cornerstone of U.S. leadership: hard power.

Economic Statecraft is Back. Here’s Why It Matters Bain Capital Group

As geopolitical tensions rise and multilateralism declines, nations are increasingly using trade and economic policies to advance foreign policy goals, complicating the global business landscape. Nations are negotiating a tapestry of new rules among smaller groups of allies, implementing sanctions and restrictions that impact firms around the world, scrutinizing inbound and outbound investments, and taking more extreme trade measures against geopolitical rivals. Winning in this new business environment has come to mean taking advantage of, defending against, or working around new rules and regulations. Yet most companies are only able to react to change. Companies need strong in-house capabilities to monitor developing geopolitical risks, understand the implications for their businesses and supply chains, and better prepare for whatever comes next.

Economics

Federal Reserve Structure, Economic Ideas, and Banking Policy During the “Quiet Period” in Banking Michael Bordo & Edward Prescott/National Bureau of Economic Research

Abstract: We evaluate the decentralized structure of the Federal Reserve System as a mechanism for generating and processing new ideas on banking policy in the 1950s and 1960s. We document that demand for research and analysis was driven by banking industry developments and legal changes that required the Federal Reserve and other banking regulatory agencies to develop guidelines for bank mergers. In response to these developments, the Board and the Reserve Banks hired industrial organization economists and young economists out of graduate school who brought in the leading theory of industrial organization at the time, which was the structure, conduct, and performance (SCP) paradigm. This flow of ideas into the Federal Reserve from academia paralleled the flow that was going on in monetary policy and macroeconomics at the time and contributed to the increased professionalization of research at the Federal Reserve. We document how several Reserve Banks, particularly Boston and Chicago, innovated by creating dissertation support programs, collecting specialized data, and creating the Bank Structure Conference, which became the clearinghouse for academic work on bank structure and later for bank risk and financial stability. We interpret these examples as illustrating an advantage that a decentralized central bank has in the production of knowledge.

Political Power and Market Power Bo Cowgill, Andrea Prat & Tommaso Valletti / National Bureau of Economic Research

Abstract: Brandeis (1914) hypothesized that firms with market power will also attempt to gain political power. To explore this hypothesis empirically, we combine data on mergers with data on lobbying expenditures and campaign contributions in the US from 1999 to 2017. We pursue two distinct empirical approaches: a panel event study and a differential exposure design. Both approaches indicate that mergers are followed by large and persistent increases in lobbying activity, both by individual firms and by industry trade associations. There is also weaker evidence for an association of mergers with campaign contributions (PACs). We also find that mergers impact the extensive margin of political activity, for example, by impacting companies’ choice to establish their first in-house lobbying teams and/or first corporate PAC. We interpret these results within an oligopoly model augmented with endogenous regulation and lobbying.

Gambling Away Stability: Sports Betting Impact on Vulnerable Households Scott Baker/Justin Balthrop/Mark Johnson/Jason Kotter/Kevin Pisciott for the National Bureau of Economic Research

We estimate the causal effect of online sports betting on households' investment, spending, and debt management decisions using household transaction data and a staggered difference-in-differences framework. Following legalization, sports betting spreads quickly, with both the number of participants and the frequency of bets increasing over time. This increase does not displace other gambling or consumption but significantly reduces savings, as risky bets crowd out positive expected value investments. These effects concentrate among financially constrained households as credit card debt increases, available credit decreases, and overdraft frequency rises. Our findings highlight the potential adverse effects of online sports betting on vulnerable households.

View of U.S. Healthcare Quality Declines to 24-Year Low Gallup

Americans' positive rating of the quality of healthcare in the U.S. is now at its lowest point in Gallup’s trend dating back to 2001. The current 44% of U.S. adults who say the quality of healthcare is excellent (11%) or good (33%) is down by a total of 10 percentage points since 2020 after steadily eroding each year. Between 2001 and 2020, majorities ranging from 52% to 62% rated U.S. healthcare quality positively; now, 54% say it is only fair (38%) or poor (16%). As has been the case throughout the 24-year trend, Americans rate healthcare coverage in the U.S. even more negatively than they rate quality. Just 28% say coverage is excellent or good, four points lower than the average since 2001 and well below the 41% high point in 2012.

Recommended Weekend Reads

Implications for the Middle East Post-Assad, Latin America is About to Become a Major Priority for Trump, Where is India Going? And The Looming U.S. Tax & Budget Battle

December 13 - 15, 2024

Please find below our recommended reads from reports and articles we read in the last week. We hope you find these useful and that you have a relaxing weekend. And let us know if you or someone you know wants to be added to our distribution list.

Post-Assad Syria and Implications for the Rest of the Middle East

Khamenei Loses Everything Eliot Cohen/The Atlantic

When Hamas’s Yahya Sinwar launched Operation Al-Aqsa Flood against Israel on October 7, 2023, he intended to deal a decisive blow against a powerful nation-state—and he succeeded. But the state his attack has devastated turned out not to be Israel, but Iran, his key sponsor.

In Post-Assad Middle East, Iran’s Loss Is Turkey’s Gain Foreign Policy

The cataclysmic events of the last few weeks in Lebanon and Syria—from Israel’s decimation of Hezbollah to the fall of the Assad regime—have opened a new chapter for the Middle East. The hope may be that the collapse of Iran’s so-called axis of resistance in the Levant augurs a period of peace and stability in the region. The more likely outcome, however, is an intensification of regional competition to fill the vacuum left by the diminishment of Iran and its allies. The collapse of Hezbollah changed the balance of power between Iran and Israel, and the fall of Bashar al-Assad has further weakened Iran. However, the broader consequence is a change in the balance of power between Turkey and everyone else.

Lines on a 1916 map may not keep Syria together Australian Strategic Policy Institute

Hayat Tahrir, al-Sham (HTS) has just taken Damascus. However, the capture of Damascus will be just the beginning to a massive change in the balance of power in the Middle East and perhaps the world. The boundaries of Syria were set following the collapse of the Ottoman Empire - lines on the map drawn Mark Sykes and Georges Picot in a secret agreement in 1916, known as the Picot-Sykes Agreement. Like many European borders drawn before and after the First World War, lines on maps did not match the population already present.

What's next for Syria's devastated economy? Deutsche Welle

Syria's economy was worth $67.5 billion (€63.9 billion) in 2011 — the same year that large-scale protests broke out against President Bashar Assad's regime, which sparked a rebel insurgency that escalated into a full-blown civil war. The country was placed 68th among 196 countries in global GDP rankings, comparable to Paraguay and Slovenia. By last year, the economy had fallen to 129 in the league table, having shrunk by 85% to just $9 billion, according to World Bank estimates. That put the country on par with the likes of Chad and the Palestinian Territories. Almost 14 years of conflict, international sanctions and the exodus of 4.82 million people — more than a fifth of the country's population — has taken its toll on what was already one of the poorest nations in the Middle East.

Latin America

Latin America Is About to Become a Priority for U.S. Foreign Policy Foreign Policy

Donald Trump’s second presidency seems destined to focus more attention on Latin America than any U.S. administration in perhaps 30 years, including the incoming president’s first term. The reason is straightforward: Trump’s top domestic priorities of cracking down on unauthorized immigration, stopping the smuggling of fentanyl and other illicit drugs, and reducing the influx of Chinese goods into the United States all depend heavily on policy toward Latin America.

Political Risk and Resource Nationalism in Latin American Mining and Minerals Baker Institute for Public Policy

South American economies now figure prominently in yet a new round of natural resource pursuits, focusing attention on minerals to support technologies bundled into the “energy transition” notion, a shift from fossil fuels with broad decarbonization and “net zero” imperatives. A question is whether a better job can be done to realize and distribute economic benefits from businesses that will continue to be characterized by sharp commodity cycles and robust international competition. The energy transition paradigm differs from past cycles in that governments and industry are under extreme pressure to demonstrate that mining and processing can also be decarbonized. Taken all together, the energy transition minerals “rush” appears to be creating expectations that could increase political and country risk factors across the region, invoking “resource nationalism” tendencies. How resource nationalism risks are defined, how these risk factors materialize, and how they might manifest across countries distinctive in traditions and languages will drive future results. These questions are the main focus of our paper.

Javier Milei’s Argentina in 6 Charts Gallup

At the one-year mark of Javier Milei’s presidency, Gallup data show that his “shock treatment” appears to be working in terms of public opinion. Argentines feel more optimistic about the economy and more confident under Milei’s government. However, many long-standing challenges remain, and people continue to struggle to meet basic needs and have a dim view of the current job market.

What is the future of democracy in Colombia? Analysis of the Tensions Between the Branches of Power Colombia Risk Analysis

Colombia is no exception to a global context marked by a significant decline in confidence in democracy and its institutions. President Gustavo Petro, through a confrontational and alarmist narrative, has further strained the system of checks and balances. While his rhetoric aims to mobilize a social base to support his transformative political agenda, it has also generated uncertainty about institutional stability and democratic equilibrium, impacting public perception of the political system’s functionality. In this context, and with an eye toward 2026, the potential rise of new populist leaders presents an additional challenge. Such leaders often advocate for reforms that weaken institutions by diminishing their independence or capacity for action.

India

India Will Carve Its Own Path Foreign Affairs

For more than a decade, the United States’ Asia policy has been consumed with one issue: the rise of China. But China is not the only rising power in Asia. The continent is also home to India: another nuclear-armed country with a huge population, army, and economy. And like China, India has a regional reputation for hegemonic behavior. Yet the United States hardly considers the possibility that India might pose a challenge of its own. Instead, American officials have reached out to India as a partner and encouraged its rise, hoping New Delhi will amass enough power to counterbalance Beijing. They seem to want India to become a regional power, perhaps even something akin to a “third pole” in the global order. American officials should consider a more complex strategy. Should India acquire the heft to become, as U.S. officials hope, a true counterbalance to China, it will likely also consider itself a counterbalance to the United States. In short, a tripolar world, with India as the third pole, will not strengthen Washington’s or Beijing’s hand. Instead, it will produce a more unstable global dynamic.

Where’s the Indian Economy Headed? Dereck Scissors/American Enterprise Institute

Optimism inside and outside India over the country’s economic performance is overdone. Recent quarters of fast official gross domestic product growth were accompanied by weak international competitiveness, fiscal irresponsibility, and low employment quality. For the longer term, India’s performance is decent but far from transformative. Talk of becoming rich by mid-century clashes with being by far the poorest among large economies and catching up much slower than is possible. The central question is why this is so. India claims a young labor force will carry it to preeminence. The labor force isn’t utilized properly, with tens of millions stuck on farms because laws discourage hiring and agricultural efficiency. This depresses export gains and investor interest. India’s demographic window is not indefinite, and its leaders are fiddling.

The Coming Battle Over U.S. Tax and Budget Policy

CBO’s Analysis Shows Importance of Fiscally-Sustainable Tax Reform Kyle Pomerleau/American Enterprise Institute

Last week, the Congressional Budget Office (CBO) released a new macroeconomic analysis of how the expiration of the Tax Cuts and Jobs Act (TCJA)’s individual provisions impacts their baseline. They found that the expiration would result in economic output to rise in the United States by the end of the next decade. This implies that if lawmakers were to extend these expiring provisions, it would be a negative for the US economy in the long run. This analysis highlights how important it is for lawmakers to approach TCJA as an opportunity to reform the tax code in a fiscally sustainable manner.

Principles-Based Illustrative Reforms of Federal Tax and Spending Programs Penn Wharton Budget Model

Expanding federal debt presents an opportunity to rethink U.S. federal fiscal policy while growing the economy and enhancing social insurance. This study offer illustrative fundamental reforms of federal tax and spending programs consistent with standard design principles that have emerged over time in the field of public economics. Specifically, the study analyze 13 major tax and spending reforms that include a full accounting of their budgetary and economic interactions, arguably one of the most ambitious computational public finance experiments performed to date. Over the next 30 years, relative to current law, these reforms: (i) reduce federal budget deficits by 38 percent; (ii) grow the capital stock by 31 percent, GDP by 21 percent, and wages by almost 7 percent; (iii) reduce health insurance premiums by 27 percent; (iv) produce almost universal health insurance enrollment along with improvements in average health and productivity; (v) reduce old-age poverty; and (vi) reduce carbon emissions, relative to current law. These changes improve the welfare of many current and all future generations, especially future lower-income households who gain the equivalent of $300,000 in lifetime value from the reforms.

Recommended Weekend Reads

What The Trump Tariffs May Mean for Latin America, Why Syria Matters So Much to Russia, China’s Irreversible Demographic Crisis, and Why Javier Milei Has Surprised Almost Everyone

December 6 - 8, 2024

Latin America

·What Would Trump’s Tariff Proposals Mean for U.S. Trade With Latin America? Americas Society

President-elect Trump’s proposed tariffs could mean big changes for industries in and outside the United States, North America's supply chains, and U.S. trade partners in Latin America. The United States has six free trade agreements in effect with 11 Latin American countries. The region is home to some of the country’s largest sources of imports, including its biggest trade partner, Mexico. These potential trade barriers could become a sticking point when it comes to the scheduled 2026 review of the United States-Mexico-Canada Agreement (USMCA). What could these tariffs mean for the United States’ trade partners in Latin America?

Ending the Strategic Vacuum: A U.S. Strategy for China in Latin America Center for Strategic & International Studies

The alarm bells are ringing in Latin America. Chinese president Xi Jinping’s recent visit to Latin America caps off a decade of remarkable advances for China in the United States’ shared neighborhood. Both Xi and President Biden attended the Asia-Pacific Economic Cooperation (APEC) forum in Lima, Peru. Both then traveled to Brazil for the G20 Summit meeting. The public imagery of the two meetings said a lot about China’s advance in Latin America with little to no U.S. pushback.

The Price of Neglecting Latin America: Guns, Drugs, and Migration have Destabilized the Region – and Fed Dysfunction in Washington Foreign Affairs

Backlash to the post-2020 spike in undocumented immigration from Latin America weighed strongly in Donald Trump’s favor. He made “closing the border” and the “largest deportation program in American history” centerpieces of his campaign, and voters rewarded him for it. Immigration turned out Trump’s base and was neck and neck with inflation in pushing swing voters to cast their ballots for him. But mass migration to the United States would not exist in its post-2020 proportions if Latin America’s economically diversified crime groups, and the states with which they have fused, were not pushing millions of people to flee north.

Javier Milei Has Surprised Almost Everybody Americas Quarterly

Milei’s successes were undeniable. He had beaten the budget into submission, slayed inflation, and did so without igniting social unrest or setting off a paralyzing brawl with organized labor. Inflation, driven by overspending and the wild printing of pesos, had dropped from 25% a month in December to below 3% per month today. The government now spends less than it takes in from taxes. “Country risk,” a measure of bond prices, is at a five-year low, meaning investors are confident they will be repaid. Milei’s radical economic policies hardly cost him public support. In his inaugural address, he warned that “there is no alternative to shock” and a year later, most Argentines apparently agree. In the November Poliarquía survey, Milei registered a 56% approval rating, the exact level of support he attracted in the election. Consumer confidence is rising. There have been several national strikes by confederations of labor unions and two multitudinous protests against spending cuts at public universities. But generally, Argentines are calmly sipping mate.

State capacity, mining and community relations in Peru Chatham House

With its rich reserves of copper, Peru is poised to play a key role in global supply chains for projects to reduce carbon emissions and enable the transition to a green economy. However, the polarized nature of Peruvian politics is a significant obstacle to realizing this potential. Political instability and the steady turnover of ministers and civil servants in relevant ministries over recent years have affected the capacity of the Peruvian state to promote an inclusive national vision for its mining industry. At the same time, fragmentation among political parties has hampered the capacity of the political system to represent consistent and coherent policy interests.

Syria and the Greater Middle East

Why Syria Matters to the Kremlin The Atlantic

As consuming as the war in Ukraine has been for Russia, the Kremlin does not see it as superseding its Middle East ambitions. That’s because Syria is not just a military outpost. It is a cornerstone of Russia’s claim to great-power status, a theater where it can demonstrate its diplomatic reach and its counternarrative to Western interventionism. This explains why Russia continues to invest in Syria even as it fights a costly war in Ukraine. Moscow may adjust its tactics, but abandoning Syria would mean surrendering something far more precious than territory: Russia’s hard-won position as an indispensable power broker in the Middle East.

China’s Demographic Crisis

·Is China’s population crisis irreversible? South China Morning Post

In a new six-part series, the Post examines how China’s marriage and fertility rates remain on a downward trajectory, fueling a demographic crisis that threatens the nation’s economic and social stability. In this six-part series, we examine the far-reaching consequences of a shrinking and ageing population, from the rise of a “companionship economy” to the challenges faced by the “one-child generation” and the economic risks associated with losing the demographic dividend.

Xi Jinping Doesn’t Have an Answer for China’s Demographic Crisis Foreign Policy

Chinese President Xi Jinping’s recent article in Qiushi, the Communist Party’s flagship journal for outlining core ideology and policy, frames China’s demographic challenges as a strategic opportunity. It offers Xi’s most detailed vision yet for addressing the country’s aging population: shifting from a labor-intensive, population-driven economy to one powered by innovation, education, and productivity. Yet beneath the lofty rhetoric lies a familiar and contentious concept: renkou suzhi, or “population quality.” On the surface, it advocates for cultivating a healthier, better-educated, and more skilled population. But its implications run deeper—and are more divisive. Historically, suzhi has been used to draw lines between urban elites and rural or migrant populations, carrying connotations of class bias and, at times, embracing eugenicist thinking. Implicit in calls for a “high-quality population” is the judgment of a “low-quality” counterpart, reinforcing societal divides in a way that is rarely acknowledged outright.

Geo-economics, AI, and Trade Policy

The Rapid Adoption of Generative AI Alexander Bick, Adam Blandin & David J. Deming/National Bureau of Economic Research

Generative Artificial Intelligence (AI) is a potentially important new technology, but its impact on the economy depends on the speed and intensity of adoption. This paper reports results from the first nationally representative U.S. survey of generative AI adoption at work and at home. In August 2024, 39 percent of the U.S. population age 18-64 used generative AI. More than 24 percent of workers used it at least once in the week prior to being surveyed, and nearly one in nine used it every workday. Historical data on usage and mass-market product launches suggest that U.S. adoption of generative AI has been faster than adoption of the personal computer and the internet.

Semiconductors and Modern Industrial Policy Chad Brown & Dan Wang/American Economic Association

Abstract: Semiconductors have emerged as a headline in the resurgence of modern industrial policy. This paper explores the political economic history of the sector, the changing nature of the semiconductor supply chain, and the new sources of concern that have motivated the most recent turn to government intervention. It also explores details of that turn to industrial policy by the United States, China, Japan, Europe, South Korea, and Taiwan. Modern industrial policy for semiconductors has included not only subsidies for manufacturing, but also new import tariffs, export controls, f

Recommended Weekend Reads

China’s Economic Spillovers to Emerging Markets, Does the U.S. Really Face an “Axis” of Enemies”? And the Growing Asymmetric Threat to Undersea Communication Cables

November 29 - December 1, 2024

Geoeconomics

China’s Financial Spillovers to Emerging Markets Banco de España

This paper analyzes the financial spillovers of shocks originating in China to emerging markets. Using a high-frequency identification strategy based on sign and narrative restrictions, we find that equity markets react strongly and persistently to Chinese macroeconomic shocks, while monetary policy shocks have limited or no spillovers. The impact is particularly strong in Latin American equity markets, with the likely channel being the effect of shocks in China on international commodity prices. These effects extend to various financial variables, such as sovereign and corporate spreads and exchange rates, suggesting that macroeconomic shocks in China may have implications for economic cycles and financial stability in emerging markets.

The Puzzle of Multinationals’ Profits: Why Tax Havens Yield Higher Returns Federal Reserve Bank of St. Louis On the Economy Blog

A striking pattern emerges when examining the returns that U.S. multinational companies generate on the assets they invest across different countries: Investments in tax havens consistently yield returns of 8% to 17%, while investments in other G7 economies (Canada, France, Germany, Italy, Japan and the U.K.) yield more modest returns of 4% to 9%. This remarkable difference raises a question about the nature of multinationals’ profit patterns.

Federal Reserve Independence and Congressional Intent: A Reappraisal of Marriner Eccles’ Role in the Reformulation of the Fed in 1935 Gary Richardson & David W. Wilcox/National Bureau of Economic Research

Congressional intent concerning the independence of the Federal Reserve matters because it protects the public from the politicization of monetary policy. Attempts to subordinate monetary policy to the President could easily end up in front of the Supreme Court. The outcome of such a case would depend, importantly, on the historical record. Understanding what Congress intended when it designed the decision-making structure of the Fed requires a clear understanding Marriner Eccles’ proposal for the structure of monetary policymaking in Title II of the Banking Act of 1935 and the Congressional response. Eccles' proposal vested monetary policymaking in a body beholden to the President. Eccles argued that leaders of the Fed should serve at the discretion of the President and implement the President's monetary program. The Senate and House rejected Eccles' proposal and explicitly designed the Fed's leadership structure to limit politicians'—particularly the President's—influence on monetary policymaking.

Ending Bailouts, At Last John Cochrane & Amit Seru/Hoover Institution

In 2008, we had a financial crisis. Our government responded once again with bailouts. Bailouts keep existing business going, and most of all protect creditors from losses. The instruments vary, including direct creditor guarantees like deposit insurance, mergers of failing companies with sound ones sweetened with government money or government purchases of bad assets, or government purchases, guarantees, and other efforts to prop up security prices and thereby cover up losses. Since actual or promised (contingent) resources flow from taxpayers to financial market participants, we include all of these interventions as “bailouts.”

The Threat of Asymmetric Attacks on Undersea Cables

Safeguarding Subsea Cables: Protecting Cyber Infrastructure Amid Great Power Competition Daniel Runde/ Center for Strategic and International Studies

Subsea cables are critical for nearly all aspects of commerce and business connectivity. For example, one major international bank moves an average of $3.9 trillion through these cable systems every workday. Cables are the backbone of global telecommunications and the internet, given that user data (e.g., e-mail, cloud drives, and application data) are often stored in data centers around the world. This infrastructure effectively facilitates daily personal use of the Internet and broader societal functions. In addition, sensitive government communications also rely extensively on subsea infrastructure. Western defense and intelligence officials are increasingly concerned about Russia’s threats to disrupt and destroy the cables. What can be done?

Understanding and Managing Global Catastrophic Risk Rand

In response to a request from the U.S. Department of Homeland Security (DHS)—specifically, FEMA—for support in meeting the requirements of the Congressionally mandated Global Catastrophic Risk Management Act (GCRMA)assessment requirement, RAND researchers developed a risk summary for each of the hazards and threats noted in the law. What are those hazards and threats? asteroid and comet impacts, super-volcanoes, severe pandemics, rapid and severe climate change, nuclear conflict, and AI.

The United States and the “Axis” of Its Enemies: Myths vs. Reality Eugene Rumer/Carnegie Endowment for International Peace

Since launching its all-out assault on Ukraine, Russia has drawn closer to China, Iran, and North Korea. But have they really formed an “axis?” Their interests have aligned but not merged. It makes little sense and can be even counterproductive to treat these four countries, each guided by its own vision, as a unified coalition.

China

The Clandestine Oil Shipping Hub Funneling Iranian Crude to China Bloomberg

Bloomberg has written a fantastic interactive report on how a burgeoning group of “dark fleet” vessels are operating with impunity on the edge of major maritime thoroughfares. And in these ships, hundreds of millions of barrels of sanctioned oil is being moved by Iran and China – with tremendous risk to the environment.

Recommended Weekend Reads

Latin America Holds the Key to Critical Mineral Needs, What Does Secretary of State-Designate Marco Rubio Have to Say About Latin America? And Just How Successful Has China’s Belt & Road Been?

November 15 - 17, 2024

Latin America

Latin America: The World’s Copper Stronghold Center For Strategic and International Studies

In this interactive report, CSIS points out that copper is vital to U.S. national, economic, and energy security. Everything—from clean energy technologies, electronics, and automotives to power transmission infrastructure, data centers, and defense systems—depends on copper. However, the United States only mines 5 percent of the world’s copper. Latin America, which cumulatively mines nearly half (46 percent) of the world’s raw copper—the largest share of any continent—holds significant potential as a sourcing partner. Chile and Peru have the two largest copper reserves globally.

What Marco Rubio Has Said About Latin America Americas Quarterly

President-elect Donald Trump has nominated Florida Senator Marco Rubio for Secretary of State, making him potentially the first Latino to hold the position. The three-term senator, a son of Cuban immigrants, was born in Miami and was highly influential on Latin America policy during Trump’s first administration. That influence is now likely to grow. He has consistently spoken out against dictatorships in Venezuela, Cuba, and Nicaragua. He has also criticized some of Latin America’s leftist leaders for their positions on Venezuela and China’s presence in the region. Here is a selection of some of Rubio’s recent statements on Latin America.

Boosting US-Japan Cooperation with Latin America in Critical and Frontier Sectors Wilson Center’s Latin America Program

As they recover from the effects of the COVID-19 pandemic, Latin American and

Caribbean countries are facing a pivotal moment in their economic development. Many Latin American governments are beset by longstanding and emerging challenges, caught between rival global powers and weighed down by a daunting infrastructure deficit, a growing digital divide, high debt, low growth, and the intensifying effects of a changing climate. Looking ahead, cooperation with key extrarational partners, especially those committed to strengthening governance and accountability, will be fundamental to economic growth and sustainable development. In this context, the United States and Japan will be potentially decisive actors. Both have separately committed to advancing the region’s economic development and, importantly, to promoting transparency and good governance. Japanese finance and investment in the region have grown (see Figure 1) as part of the late Prime Minister Shinzo Abe’s “Juntos” policy, which promoted enhanced engagement across the region. At the same time, Japan has emphasized the links between democracy and development, what it calls the “two D’s.”

Africa

As countries across Africa grapple with the challenge of mobilizing resources for critical development initiatives, an increasingly popular financial instrument has emerged as a promising solution – diaspora bonds. Designed to tap into the substantial savings and investment potential of citizens living abroad, these bonds offer governments, project sponsors and corporations an opportunity to diversify funding sources through what’s known as a ‘diasporic discount’, enabling domestic entities to borrow at below-market rates with extended maturities. The timing couldn’t be better. According to World Bank data, annual remittance inflows to Africa in 2023 amounted to $90.3bn, or approximately 259% of the continent’s gross domestic product. And this figure is expected to rise further in 2024. It is the second highest after Asia, where remittance inflows as a share of GDP come to 278%. Channeling these flows through purpose-specific bonds serves a dual purpose: it deepens often underdeveloped financial markets while broadening the retail investor base.

China

China’s Belt & Road Initiative: How Successful Has It Been? Hinrich Foundation

Assessing the success of BRI requires a comprehensive examination of its financial investments, opportunity costs, and role in augmenting China’s global influence. Over the past decade, China's substantial increase in overseas assets, coupled with significant expenditure on industrial subsidies, amounts to an estimated cost of roughly 1.5% of China’s gross domestic product (GDP) annually. When factoring in indirect financial costs, such as international subsidies and geopolitical tensions, this conservative estimate increases to approximately 1.7% of GDP. Despite BRI's success in reshaping global trade dynamics and enhancing China's footprint in the global South, it has also triggered geopolitical pushback and skepticism from Western powers. The shifting attitudes toward China among Western elites, alongside China's continued economic reliance on democratic nations, cast doubt on the long-term efficacy of BRI in fulfilling China's strategic goals.

The Belt and Road Isn’t Dead. It’s Evolving Foreign Policy

Chinese President Xi Jinping visits Peru this week for the Asia-Pacific Economic Cooperation (APEC) summit, during which he will inaugurate the deep-water port of Chancay, about 45 miles north of Lima. It’s a $3.6 billion project—one of China’s largest infrastructure investments in the region in the past two decades. It also may be one of the last of its kind.

Beijing Has Already Prepared for Trump’s Return Foreign Policy

As U.S. President-elect Donald Trump prepares to return to the White House, global observers watch with a mix of nervousness and caution. Conversations with Chinese academics, economists, and policy insiders reveal a far more nuanced outlook as Beijing dissects the implications of a second Trump presidency. Trump’s 2016 victory caught Beijing off guard, triggering a scramble to recalibrate. But four years of navigating tariffs, tech restrictions, and trade tensions have given Chinese President Xi Jinping and his advisors a deeper understanding of the U.S. president’s playbook.

Recommended Weekend Reads

The 2nd Trump Presidency, Ukraine: What Happens Now?, And China’s Axis of Losers

November 8 - 10, 2024

Please find below our recommended reads from reports and articles we read in the last week. We hope you find these useful and that you have a relaxing weekend. And let us know if you or someone you know wants to be added to our distribution list.

The 2nd Trump Presidency

The 2024 Election Results Tiber Creek Group

One of Washington’s leading government consulting firms offers a comprehensive and superb overview of the November 5th elections from the Presidential race to the Congressional elections, all the way down to state and local elections.

Mandate for Leadership: The Conservative Promise Project 2025/The Heritage Foundation

Much criticized during the presidential campaigns, the Washington, D.C. based think tank the Heritage Foundation published a comprehensive, highly detailed set of policy recommendations for Donald Trump to consider. While Trump went on to repudiate his relationship with Project 2025, it will undoubtedly play a role in policy development in the new Trump Administration as well as with the newly elected Republican Senate majority and what appears to be a likely House Republican majority.

Policy Issues America First Policy Institute

Established by a group of senior advisors to then-former President Donald Trump, the American First Policy Institute (AFPI) set out define policy positions for a future Trump Administration. Like the Heritage Foundation’s Project 2025, their policy ideas will play a major role in policy development in the newly elected Trump Administration.

Donald Trump just won the presidency. Our experts answer the big questions about what that means for America’s role in the world. Atlantic Council

When Donald Trump returns to the presidency on January 20, Trump’s inbox will be full of global challenges. How will he respond? And what will the consequences be? Below, our experts provide answers across twenty-four of the most significant policy matters awaiting the next administration.

The 2024 Trump Campaign Policy Proposals: Budgetary, Economic and Distributional Effects Penn Wharton Budget Model

We project that conventionally estimated tax revenue falls by $5.8 trillion over the next 10 years, producing an equivalent amount of primary deficits. Accounting for economic feedback effects, primary deficits increase by $4.1 trillion over the same period. While GDP increases during part of the first decade (2025 – 2034), GDP eventually falls relative to current law, falling by 0.4 percent in 2034 and by 2.1 percent in 30 years (year 2054). After initially increasing, capital investment and working hours eventually fall, leaving average wages unchanged in 2034 and lower by 1.7 percent in 2054. Low, middle, and high-income households in 2026 and 2034 all fare better under the campaign proposals on a conventional basis. These conventional gains and losses do not include the additional debt burden on future generations who must finance almost the entirety of the tax decreases.

What Does Donald Trump’s Win Mean For U.S. Foreign Policy? National Security Journal

It is time to discuss what a foreign policy under President-elect Donald Trump would mean. First, there are two blazing wars to settle that have no easy answers. Next is the Taiwan question and what to do with China overall. Then we have border security. Don’t forget North Korea, which is in bed with Russia and threatening to go to war with South Korea. There is also the problem of a nuclear-equipped Iran.

How Europe Should Woo Trump The Strategist/Australian Strategic Policy Institute

Donald Trump’s re-election as US president is a shock to Europe, which is woefully unprepared. His promised protectionism threatens the European Union’s struggling export-led economies, and his transactional attitude toward NATO endangers Europe’s already feeble security. Ukraine could soon be sacrificed to Russia, and by emboldening nationalist fellow-travelers such as Hungarian Prime Minister Viktor Orban, Trump may cause EU unity to be further undermined from within. Shell-shocked Europeans will be tempted to hunker down and hope that Trump does not make good on his most extreme policies: slapping blanket tariffs on European exports, abandoning Ukraine and quitting NATO. But this would be a catastrophic mistake. Europeans must swallow their pride and try to win Trump over.

Ukraine: What Happens Now?

The Perfect Has Become the Enemy of the Good in Ukraine: Why Washington Must Redefine Its Objectives Richard Haass/Foreign Affairs

Most U.S. policymakers would probably define winning in Ukraine in a way similar to how Kyiv defines it, including in its most recent “victory plan”: ousting Russian troops from the entirety of Ukraine’s territory, Crimea included, and reestablishing control over its 1991 borders. There is good reason for adopting this definition. But Washington must grapple with the grim reality of the war and come to terms with a more plausible outcome. It should still define victory as Kyiv remaining sovereign and independent, free to join whatever alliances and associations it wants. But it should jettison the idea that, to win, Kyiv needs to liberate all its land. So as the United States and its allies continue to arm Ukraine, they must take the uncomfortable step of pushing Kyiv to negotiate with the Kremlin—and laying out a clear sense of how it should do so. Such a pivot may be unpopular. It will take political courage to make, and it will require care to implement. But it is the only way to end the hostilities, preserve Ukraine as a truly independent country, enable it to rebuild, and avoid a dire outcome for both Ukraine and the world.

What do North Korean Troop Deployments to Russia Mean for Geopolitics? Brookings Institution

In early October, Ukrainian intelligence reported that several thousand North Korean soldiers were undergoing training in Russia in preparation for deployment to the Ukrainian front line later this year. South Korea’s National Intelligence Service (NIS) later corroborated Ukraine’s assertions, sharing satellite images of Russian vessels transporting the first batch of 1,500 North Korean special forces to Russia’s Far East. On October 23, White House National Security Communications Advisor John Kirby confirmed the presence of at least 3,000 soldiers. The Pentagon now believes that 10,000 North Korean troops are in Russia with a contingent heading toward the Kursk region in western Russia to battle Ukrainian forces. The large deployment of North Korean troops in Russia represents a troubling new phase in the Russia-Ukraine war while carrying deeper implications for global politics. We address five key questions related to accelerating North Korea-Russia military cooperation.

Crossing the Rubicon: DPRK Sends Troops to Russia Center for Strategic and International Studies

The U.S. government has confirmed and released evidence that North Korea (DPRK) sent troops to Russia. Speaking in Italy after a trip to Ukraine, U.S. secretary of defense Lloyd Austin called this development a “very, very serious issue” and warned of impacts not only in Europe but in the Indo-Pacific as well. While the U.S. government is still uncertain of the role the North Korean troops will play, Austin suggested that this is an indication that Vladimir Putin “may be even in more trouble than most people realize.” But what is in it for North Korea?

China

Xi Jinping’s Axis of Losers – The Right Way to Thwart the New Autocratic Convergence Stephen Hadley/Foreign Affairs

The United States is contending with the most challenging international environment it has faced since at least the Cold War and perhaps since World War II. One of the most disconcerting features of this environment is the burgeoning cooperation among China, Iran, North Korea, and Russia. Some policymakers and commentators see in this cooperation the beginnings of a twenty-first-century axis, one that, like the German-Italian-Japanese axis of the twentieth century, will plunge the world into a global war. Others foresee not World War III but a slew of separate conflicts scattered around the globe. Either way, the result is a world at war—the situation is that serious. What should be done about this cooperation is another matter. Washington’s aim should be to make clear to Chinese President Xi Jinping how counterproductive and costly to Beijing’s interests these new relationships will turn out to be. That means effectively countering Iran, North Korea, and Russia in their own regions, thereby demonstrating to China that tethering itself to a bunch of losers is hardly a path to global influence.

China’s long shadow over Asia’s critical minerals Hinrich Foundation

When it comes to securing supply for critical minerals it does not possess in sufficient quantities at home, China has been investing heavily overseas. In Southeast Asia, Beijing has invested about US$4 billion since 2012 in 12 projects, a lot of it concentrated in Indonesia, which exports 16% of the world’s nickel. From a long-term geopolitical, economic, and sustainability perspective, it is not in ASEAN’s interests to be drawn exclusively into one Great Power’s sphere of influence.

Geoeconomics and Trade

Did Tariffs make American Manufacturing Great? New Evidence from the Gilded Age Alexander Klein & Christopher Meissner/National Bureau of Economic Research

We study the relationship between tariffs and labor productivity in US manufacturing between 1870 and 1909. Using highly dis-aggregated tariff data, state-industry data for the manufacturing sector, and an instrumental variable strategy, results show that tariffs reduced labor productivity. Tariffs also generally reduced the average size of establishments within an industry but raised output prices, value-added, gross output, employment, and the number of establishments. We also find evidence of heterogeneity in the association between tariffs and value added, gross output, employment, and establishments across groups of industries. We conclude that tariffs may have reduced labor productivity in manufacturing by weakening import competition and by inducing entry of smaller, less productive domestic firms. Our research also reveals that lobbying by powerful and productive industries may have been at play. The era’s high tariffs are unlikely to have helped the US become a globally competitive manufacturer.

Recommended Weekend Reads

Entering the Age of Global Depopulation, The Surprising Resilience of Globalization, and How Brazil Could Become the Global Engine for Global Clean Energy Revolution

November 1 - 3, 2024

Global Demographics

The Age of Depopulation: Surviving a World Gone Gray Nicholas Eberstadt/Foreign Affairs

Although few yet see it coming, humans are about to enter a new era of history. Call it “the age of depopulation.” For the first time since the Black Death in the 1300s, the planetary population will decline. But whereas the last implosion was caused by a deadly disease borne by fleas, the coming one will be entirely due to choices made by people. With birthrates plummeting, more and more societies are heading into an era of pervasive and indefinite depopulation, one that will eventually encompass the whole planet. What lies ahead is a world made up of shrinking and aging societies. Net mortality—when a society experiences more deaths than births—will likewise become the new norm. Driven by an unrelenting collapse in fertility, family structures, and living arrangements heretofore imagined only in science fiction novels will become commonplace, unremarkable features of everyday life.

To Combat Demographic Decline, Moscow Must Focus on Mortality Rather than Fertility Jamestown Foundation

Russia’s continuing population decline means it will soon not have enough people to run its economy and fight in its wars. Russian President Vladimir Putin is talking ever more about falling fertility rates but doing little to decrease the increasingly high mortality rates. Russia’s birthrate reflects underlying social changes, such as urbanization, and is at about the same level as other industrialized countries. Its mortality rate, however, is far higher, in part due to Russia’s failure to support the health of its citizens. Putin is loath to address the mortality rate, as it would be both expensive and require him to change his goals in Ukraine. As a result, Russia’s demographic decline and the restrictions it will impose are likely to last as long as he remains in power.

Geoeconomics

The Surprising Resilience of Globalization: An Examination of Claims of Economic Fragmentation Brad Setser/Aspen Economic Strategy Group

This paper evaluates the current landscape of global trade and financial flows and proposes a set of reforms to support healthier forms of integration. Setser finds that, despite the growing bipartisan skepticism about the value of liberal trade, global economic integration remains surprisingly resilient. In fact, Setser argues, the immediate risk facing the global economy is more accurately described as unhealthy integration than fragmentation. Setser identifies two unhealthy forms of globalization that have proven to be resilient – those driven by corporate tax avoidance strategies and persistent trade and payment imbalances with China – and offers three policy reforms to address these risks.

Geopolitical fragmentation in global and euro area greenfield direct investment The European Central Bank

As companies and policymakers increasingly look at ways to reduce the vulnerability of their supply chains, understanding recent dynamics in greenfield investment is important as these may foreshadow a reconfiguration of global trade networks, the fragmentation of which could be particularly detrimental for the euro area. In the last decade, annual FDI outflows and inflows amounted to 1.4% and 0.6%, respectively, of euro area GDP and 1.0% and 1.2%, respectively, of global GDP excluding the euro area. The euro area is the largest source of outward greenfield FDI, accounting for 19% of global outflows in the last two years, followed by the United States, which accounted for 15%. Ex-ante, the effect of geopolitical fragmentation on the direction of FDI flows is ambiguous. On the one hand, firms and policymakers might look to friend-shore and/or near-shore production to make supply chains less vulnerable to geopolitical tensions or to safeguard their assets from potential future violations of property rights. On the other hand, firms might increase their investments in geopolitically distant countries, i.e., countries that take an observably different stance on foreign policy issues, if they think that future trade tensions might impede their access to local markets.

The gradual decline in dollar dominance could quicken OMIF

The dollar’s share in world currency reserves could decline until 2050 to 40-45% from around 60% at present, under scenarios discussed by the OMFIF advisory council. The gradual fall, alongside an increase in the importance of the euro and the renminbi, is seen as a natural consequence of the gradual reduction in America’s relative importance in the world economy. Factors that could speed up the fall include more aggressive action by emerging market economies to promote the use of non-dollar currencies as well as persistent US budget and current account deficits, according to participants at the advisory council meeting on 15 October. Kamala Harris and Donald Trump, the contestants in the US presidential election on 5 November, show little readiness to take action on this issue. Concerns about the use of US power over the dollar system in sanctions against Russia and allies in the war with Ukraine could worsen, as well as worries about ballooning American deficits, depending on the next White House incumbent. These anxieties are also helping spur the latest spurt in the gold price.

Not Picking Sides Is Paying Off For These Countries Bloomberg

Geopolitics is shaping the flow of trade and investment around the world in ways it hasn’t in decades, fueling talk of another Cold War. Sandwiched between a US-led Western Bloc and another dominated by Russia and China sit at least 101 nations that we’ve dubbed the “New Neutrals.” Members of this informal group are betting they can attract investment from both blocs and benefit economically if they avoid picking sides. And there’s evidence that’s happening. More than 100 nations are embracing a new kind of geopolitical neutrality. For many, it’s working.

Can BRICS Finally Take On the West? Foreign Policy

One of the more remarkable developments over the last 25 years is that an investment banker’s arbitrary acronym for a quartet of emerging market economies has become the rubric for rebellion. The BRICS countries—or BRICS+, since the original grouping of Brazil, Russia, India, China, and later South Africa has since further expanded to include four more members—are meeting this week for their headline summit in glitzy Kazan, Russia, on the banks of the Volga. On the agenda this year, the first full summit after the formal incorporation of Iran, Egypt, Ethiopia, and the United Arab Emirates into the bloc, will be the usual talk of creating a truly multipolar world order to challenge U.S. and Western hegemony. A big part of that, especially for sanctions-battered members such as Iran and Russia, will be efforts to come up with viable alternatives to the global dominance of the U.S. dollar.

Latin America

The Past, Present and Future of Soy in South America Americas Quarterly

Over the past five decades, the continent has become a soy-growing behemoth, feeding much of the world. But is the boom over? And what does it mean for South America?

What does the U.S. Election mean for Latin America? Canning House

Canning House is a UK-based think tank focused on Latin American. In their new paper, they consider the potential impact of either leading candidate's victory on Latin America and how the region sees the contest for the White House. This includes analysis covering: The Latino vote, The Border Czar story: success or failure?, Harris and Trump - global policy positions, The view from Mexico City, The Bolsonaro factor in Brasília, Outlook for the 'Northern Triangle', A tricky trio, How the rest of Latin America sees the race for the White House.

Brazil’s Critical Minerals and the Global Clean Energy Revolution the Wilson Center

Brazil has all the elements for becoming an engine of the rapidly evolving global energy transformation. The country boasts some of the world’s largest deposits of critical minerals essential to make possible the transition from fossil fuels. Brazil is already an exporter of some of these minerals. But beyond exporting raw materials, the country is also looking to develop critical minerals value chains at home, leveraging its leadership in renewable energy. In the process, Brazil could emerge as a trailblazer in green technology and climate change solutions.

Recommended Weekend Reads

Our U.S. Election Special: Election Integrity, Who Your Neighbors Gave To, and How Economic Indicators Impact Votes. Plus, Why Europe is Unprepared to Defend Itself, and Mexico’s Economic Challenges

October 25 - 27, 2024

Please find below our recommended reads from reports and articles we read in the last week. We hope you find these useful and that you have a relaxing weekend. And let us know if you or someone you know wants to be added to our distribution list.

U.S. 2024 Elections

“The Good, the Bad and the Ugly” of Election Integrity The Hoover Institution Podcast

Are battleground states better prepared this election cycle than in recent election cycles? Ben Ginsberg, the Hoover Institution’s Volker Distinguished Visiting Fellow and a preeminent authority on election law, examines whether battleground states are better prepared this election cycle than in recent election cycles. Ginsberg also explores possible legal challenges that might happen before, during, and after the vote count.

See How Your Neighborhood Is Giving to Trump and Harris Washington Post

Want to know which political campaigns your neighbor contributed to? The Washington Post makes it easy: Enter your zip code and find out which campaign your neighbors gave money to! In every state across the country, more people donated to Vice President Kamala Harris than to former President Donald Trump. Registered voters in the suburbs were about twice as likely to give to Harris as to Trump. A vast majority of Trump’s donors under 35 were men. And in the battleground state of Georgia, where Black voters make up one-third of the electorate, less than 4 percent of Trump donors were Black. Those are among the findings from a Washington Post analysis of online contributions to the Trump, Harris, and President Joe Biden campaigns, combined with voter registration data. There are outside groups that don’t have to disclose donors and that make up some of the spending for both Harris and Trump, so this is only a part of the funds backing the two candidates. The result is still a detailed snapshot, down to the Zip code level, of who clicked and tapped to send a few dollars to the leading candidates since Trump launched his campaign in November 2022.

How Do Electoral Votes, Presidential Approval, and Consumer Sentiment Respond to Economic Indicators? National Bureau of Economic Research Working Paper/Robert J. Gordon

Abstract: This paper studies the effect of economic indicators on the Michigan Consumer Sentiment Index, Presidential approval ratings, and Presidential election outcomes since 1956. How closely do the indicators predict sentiment, how well does sentiment predict approval, and what role does approval have in explaining election outcomes measured by electoral votes? How much of the variance of approval ratings depends on non-economic factors like the “honeymoon effect”? Is there a role for economic indicators in explaining election outcomes once the contribution of approval ratings is taken into account? Regression equations provide answers to these questions and allow new interpretations of political history. Equation residuals and the contributions of specific variables are graphically displayed, providing insights into time intervals when sentiment was above or below the prediction of economic indicators, when approval differed from its usual relation with sentiment and the indicators, and when and why the electoral vote totals in each election since 1956 exceeded or fell short of the predictions of the econometric equations.

As the U.S. elections nears, Russia, Iran, and China Step Up Influence Efforts Microsoft Threat Analysis Center

With two weeks until Election Day 2024, the Microsoft Threat Analysis Center (MTAC) observes sustained influence efforts by Russia, Iran, and China aimed at undermining U.S. democratic processes. Since our last two reports, the U.S. government has taken many actions revealing cyber and influence activity from foreign adversaries related to election 2024. Most recently, that includes revealing malicious Iranian cyber actors’ sending of “stolen, non-public material from former President Trump’s campaign” to both individuals then associated with President Biden’s campaign and U.S. media organizations, and the indictment of three Iranian actors for the hack-and-leak operation targeting the Trump-Vance campaign.

Africa

How Can African Countries Participate in U.S. Clean Energy Supply Chains? Carnegie Endowment for International Peace

The combination of key mineral endowments in African countries and U.S. objectives to reorient clean energy supply chains away from competitors like China can serve as the foundation for a new economic and strategic relationship.

Europe

Why Europe is Unprepared to Defend Itself Bloomberg

For decades, European NATO members curbed defense spending to fund other priorities. What remains, in the view of some US military experts, is a “Potemkin Army” that couldn’t stand up to an invader without American support.

Is a UK rapprochement with the EU possible? The Peterson Institute for International Economics

A clear majority of Brits consider the decision to leave the EU a mistake. A You Gov poll from August this year shows 51 percent saying that the negatives of Brexit have outweighed the benefits; only 17 percent think the opposite.

Macroeconomic implications of the recent surge of immigration to the EU Francesca Caselli, Allan Gloe Dizioli, and Frederik Toscani/Center for Economic Policy Research

This research piece discusses the macroeconomic implications of this immigration surge and suggests a positive effect on potential output in the range of 0.2-0.7% by 2030 for recipient countries. On the flip side, the large inflow had initial fiscal costs and likely led to some congestion for local public services, such as schooling. Future policy efforts should seek to continue to integrate immigrants into the Labour force while ensuring the supply of public services and amenities keeps up with the population increase.

Mexico

Forget the US Election, Mexico’s Real Economic Challenges Lie At Home OMFIF

As the world anxiously watches the unfolding US election, many analysts are speculating about its impact on Mexico’s economy. Will trade relations be upended? Will the peso come under pressure from political uncertainty? While these are valid concerns, the bigger story might not lie north of the border. Mexico’s real challenge stems from its domestic policies – a challenge that could shape the nation’s economic future more than any external events.

A U.S. Reset with Mexico Is Still Possible Shannon O’Neil/Foreign Affairs

Mexican President Claudia Sheinbaum, who was inaugurated on October 1, has come into office with more political power than any Mexican leader since the country’s transition away from single-party rule in the 1990s. She received a record 35.9 million votes—nearly 60 percent of those cast for the top office—and effectively controls a two-thirds supermajority in Congress. Her party, Morena, governs 22 of the country’s 31 states. Yet economic headwinds will temper this political gift, as expectations for fast and meaningful action on wage increases, a greener energy grid, expanded public benefits, and other issues will likely outpace Sheinbaum’s ability to deliver. No matter who enters the White House in January, there is an opportunity—albeit a narrow one—for a reset with Mexico, one that could make both countries safer and more prosperous rather than beset with crises and consistently at odds with each other.

How Does Debt Affect Ecuador-China Relations? Latin American Advisors

Ecuador’s minister of economy and finance, Juan Carlos Vega, met with his Chinese counterpart, Lan Fo’an, in Beijing on Sept. 23 for talks about bilateral cooperation and economic relations. The discussion included Ecuador’s debt to China, which is close to $3 billion, in addition to Ecuador’s energy problems, some of which stem from flaws in Chinese-built energy infrastructure projects that have come to light in recent years. How does Ecuador’s debt influence its relationship to China? How does it complicate President Daniel Noboa’s attempts to improve the country’s fiscal situation? What leverage does Ecuador have in pressing China to address the flaws in its energy infrastructure?

Recommended Weekend Reads

The Latin American Nations are Best Positioned for Nearshoring, How America’s Gender Gap is Reshaping the Election, and Macroeconomic Limits of China’s Africa Strategy

October 18 - 20, 2024

Please find below our recommended reads from reports and articles we read in the last week. We hope you find these useful and that you have a relaxing weekend. And let us know if you or someone you know wants to be added to our distribution list.

Americas

Solving Latin America’s Food Paradox Americas Quarterly

Latin America has, in many ways, become the world’s breadbasket. Over the past two decades, the value of its agricultural exports rose a whopping 500% to $316 billion in 2022, the last full year data was available. No other region has a larger farming surplus. It is the source of more than 60% of the world’s soybean trade, almost half its corn, and more than a quarter of its beef. Three out of four avocados come from Latin America, as does much of the world’s coffee. At the same time, about 28% of people in Latin America and the Caribbean suffer today from moderate or severe food insecurity, meaning they lack regular access to enough safe and nutritious food for normal health and development. That number is down from its peak during the COVID-19 pandemic but still six percentage points higher than in 2014, according to the United Nations Food and Agriculture Organization (FAO). That means an additional 48 million people are suffering from food insecurity compared to a decade ago. What can be done?

China invites Colombia to Join the Belt and Road Initiative, “Exploring” Free Trade Agreement South China Morning Post

Colombia has confirmed formation of working group to discuss matter and hails ‘great potential’ to lure mainland investment, alarming US officials.

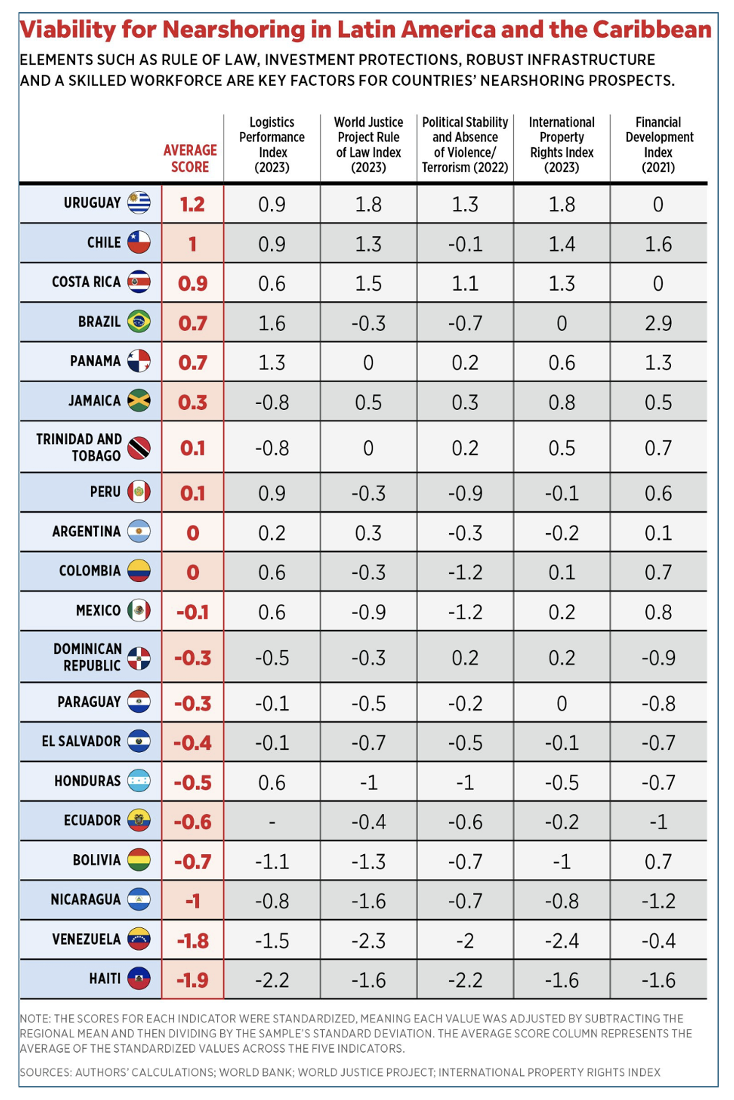

Which Latin American Countries are Best Positioned for Nearshoring? Brian Winter/Editor-in-Chief of Americas Quarterly

Winter posted a fascinating tweet showing a chart prepared by former Chilean Finance Minister Felipe Larraín showing which countries in Latin America are best positioned for nearshoring.

The U.S. Elections

The Politics of Progress and Privilege: How America’s Gender Gap Is Reshaping the 2024 Election American Enterprises Institute’s Survey Center on American Life

The United States is experiencing a tumultuous shift in how Americans recognize traditional gender hierarchies. Women still feel there is a significant need to address gender inequality, whereas many men are more ambiguous on the matter. Gen Z is particularly sensitive to the reassessment of these norms, with young men and women increasingly stratified along party lines. Young women are more likely to support Democratic candidates, take liberal policy stances, and believe that a more concerted effort is needed to ensure equality between the sexes. Young men, comparatively, have sorted in the opposite manner. With Gen Z increasingly at odds in their politics and social identities, the common ground between American men and women is diminishing rapidly.

China

Renminbi dilemma for Chinese authorities Mark Sobel/ OMFIF

China’s economy is being rocked by enormous headwinds – excess leverage, local government debt, housing sector woes, de/disinflation, contracting manufacturing and weak service sector growth. The authorities have announced measures to reduce interest rates, spur housing and boost equity prices. However, the fiscal pronouncements made over the past weekend – though apparently not directly aimed at boosting consumption –were lacking in details, terms and amounts. Together, these efforts, while helping to limit downside risks to the economy, are so far unlikely to restore confidence and significantly strengthen activity. Amid weak domestic demand and low confidence, how then might Chinese authorities view the renminbi?

U.S. – China Relations for the 2030s: Toward a Realistic Scenario for Coexistence Carnegie Endowment for International Peace

It has become difficult to imagine how Washington and Beijing might turn their relationship, which is so crucial to the future of world order, toward calmer waters. If there is to be any hope of doing so, however, a group of some of the leading policy experts on US China relations offer, via individual essays, a realistic vision of what those calmer waters might look like.

Value-added and Value Lost: The Macroeconomic Limits of China’s Africa Strategy European Council on Foreign Relations

China’s overcapacity has hit Europe’s economies hard, but it is also damaging Africa’s. With both continents suffering, Africa and Europe can make common cause in confronting this mutual challenge.

Geoeconomics

Immigration and Macroeconomy After 2024 Stan Veuger/Wendy Edelberg/Cecilia Esterline/Tara Watson

Few issues have dominated the US political debate in recent years like immigration. The starting point for our analysis is the creation of a “high immigration” and a “low immigration” scenario for each presidential candidate. These scenarios reflect a combination of the historical record under the Trump administration and the Biden-Harris administration, announced and inferred immigration policies, as well as our judgment of likely developments. They are constructed from the ground up, starting by predicting inflows from specific visa categories, border and parole policy, and entries without inspection. We also predict removals, reflecting both the candidates’ visions and logistical constraints as well as other factors that affect outflows. We provide two scenarios for each candidate given the considerable uncertainty about policy actions as well as responses by migrants.

Challenging the deglobalization narrative: Global flows have remained resilient through successive shocks Journal of International Business Policy

Abstract: We challenge the popular narrative that the world has entered a period of deglobalization, arguing that deglobalization is still a risk rather than a current reality. Drawing upon the DHL Global Connectedness Index, we show that international flows have not decreased relative to domestic activity, there is not an ongoing shift from global to regional business, and geopolitically driven shifts in international flows still primarily involve countries at the center of present conflicts. We propose policy and research implications, warning that misperceptions of deglobalization could themselves contribute to costly reductions in international openness.

The Great Transfer-mation: How American communities became reliant on income from government Economic Innovation Group

This interactive research report shows how transfers’ share of Americans’ total personal income has more than doubled over the past 50 years, from 8.2% in 1970 to 17.6% in 2022. They are the third largest source of Americans’ personal income, after income from work and investments. The average American received $11,500 in income from government transfers in 2022, compared to $40,500 in income derived from work and $12,900 from investments. Today, most U.S. counties depend on a level of government transfer income that was once reserved only for the most distressed places.

Recommended Weekend Reads

October 11 - 13, 2024

What to Watch For At The Upcoming BRICS+ Summit, China’s Dollar Dilemma, Time for A Containment Strategy for Venezuela, and How Protectionism is Failing as an Economic Strategy

Please find below our recommended reading from reports and articles we read last week. We hope you find these useful and that you have a relaxing weekend. And let us know if you or someone you know wants to be added to our distribution list.

The BRICS+ Upcoming Leadership Summit

BRICS Expansion, the G20, and the Future of World Order Stewart Patrick/Carnegie Endowment for International Peace