Fulcrum Perspectives

An interactive blog sharing the Fulcrum team's policy updates and analysis.

Recommended Weekend Reads

The Future of NATO and the Transatlantic Relationship, Are Trump’s Tariffs Working? And The Persistent Global Fertility Decline

February 13 - 15, 2026

Below are several reports and articles we read this past week that we found particularly interesting. I hope you find them both interesting and useful. Have a great weekend.

The Future of NATO and the Munich Security Conference

NOTE: With the Munich Security Conference taking place this weekend, we wanted to bring focus to several of the key issues being discussed and debated.

Trump’s NATO Dilemma – America Can’t Disengage from the Alliance and Also Lead It Sara Bjerg Moller/Foreign Affairs

Amid a sea of disruptions—territorial threats against Denmark, missed alliance meetings by senior U.S. diplomats, and planned personnel reductions at NATO installations—the Trump administration’s second-term approach to NATO is now coming into focus. Rather than openly abandoning the alliance, as some analysts feared, the United States appears to be “quiet quitting”: incrementally stepping away from the alliance it has led for close to eight decades. The White House seems to believe that only if the United States steps back will Europe finally be forced to step up. But it will find that walking away from overseeing NATO’s military machinery is far harder than anticipated. NATO’s command structure was built around U.S. infrastructure and personnel, and no other member of the alliance is currently equipped to replace Washington. If Trump does choose to push ahead with his planned disengagement, the logistics of succession would be the least of the United States’ concerns. No major power has ever voluntarily surrendered control, much less command, of an alliance it built and led. Doing so at a moment of profound geopolitical upheaval would weaken the transatlantic partnership—and leave the United States less secure.

Poll: Top NATO allies don’t think the US helps deter enemies anymore Politico EU

As global leaders convene in Germany for the Munich Security Conference, new results from The POLITICO Poll show President Donald Trump’s efforts to rewrite longstanding international relationships — particularly in Europe — are repelling longtime, traditionally loyal partners. The United States’ eroding reputation is raising fresh questions about the stability of the global order that has held for decades, and of the country’s strength on the world stage. Across all countries polled, far more people described the U.S. as an unreliable ally than a reliable one, including half the adults polled in Germany and 57 percent in Canada. In France, too, the share of people who called the U.S. unreliable was more than double the share who said it was reliable.

Can Germany's Merz be the savior of Europe? Reuters Commentary

European Union leaders are meeting this week to discuss how to boost the bloc's competitiveness. While President Donald Trump’s withering description of Europe last month as a "decaying" region was unwelcome, it may be what finally prompts them to take much-needed action. Germany has historically been a brake on EU reform, but Berlin now appears to be on board. Chancellor Friedrich Merz told the World Economic Forum in Davos last month that the EU now had no choice but to urgently pursue former European Central Bank president Mario Draghi’s blueprint for a competitive Europe.

Europe’s Next Hegemon: The Perils of German Power Liana Fix/Foreign Affairs

After many delays, Germany’s Zeitenwende—its 2022 promise to become one of Europe’s defense leaders—is finally becoming a reality. In 2025, Germany spent more on defense than any other European country in absolute terms. Its military budget today ranks fourth in the world, just after Russia’s. Annual military spending is expected to reach $189 billion in 2029, more than triple what it was in 2022. Germany is even considering a return to mandatory conscription if its military, the Bundeswehr, cannot attract enough voluntary recruits. Should the country stay the course, it will again be a great military power before 2030.

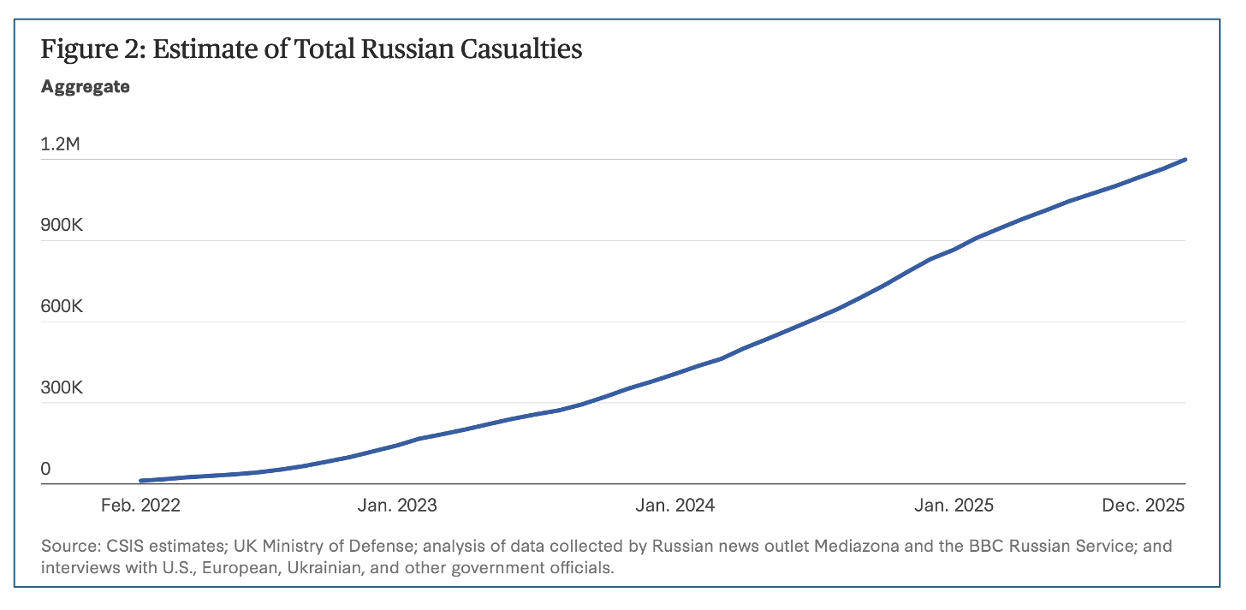

Vladimir Putin is trapped in a war he cannot win but dare not end Peter Dickerson/The Atlantic Council

Putin’s reluctance to accept Trump’s offer makes perfect sense when viewed from the perspective of the Russian ruler’s revisionist worldview and imperial ambitions. Crucially, Putin is well aware that any peace deal based on the current front lines of the war would leave 80 percent of Ukraine beyond Kremlin control and free to integrate into the democratic world. That is exactly what he is fighting to prevent. As the war enters a fifth year, Putin finds himself in an unenviable predicament. He has no obvious pathway to victory, but cannot agree to a compromise peace without acknowledging what would amount to a historic defeat and placing his own political survival in question.

Tariffs, Trade, and Geoeconomics

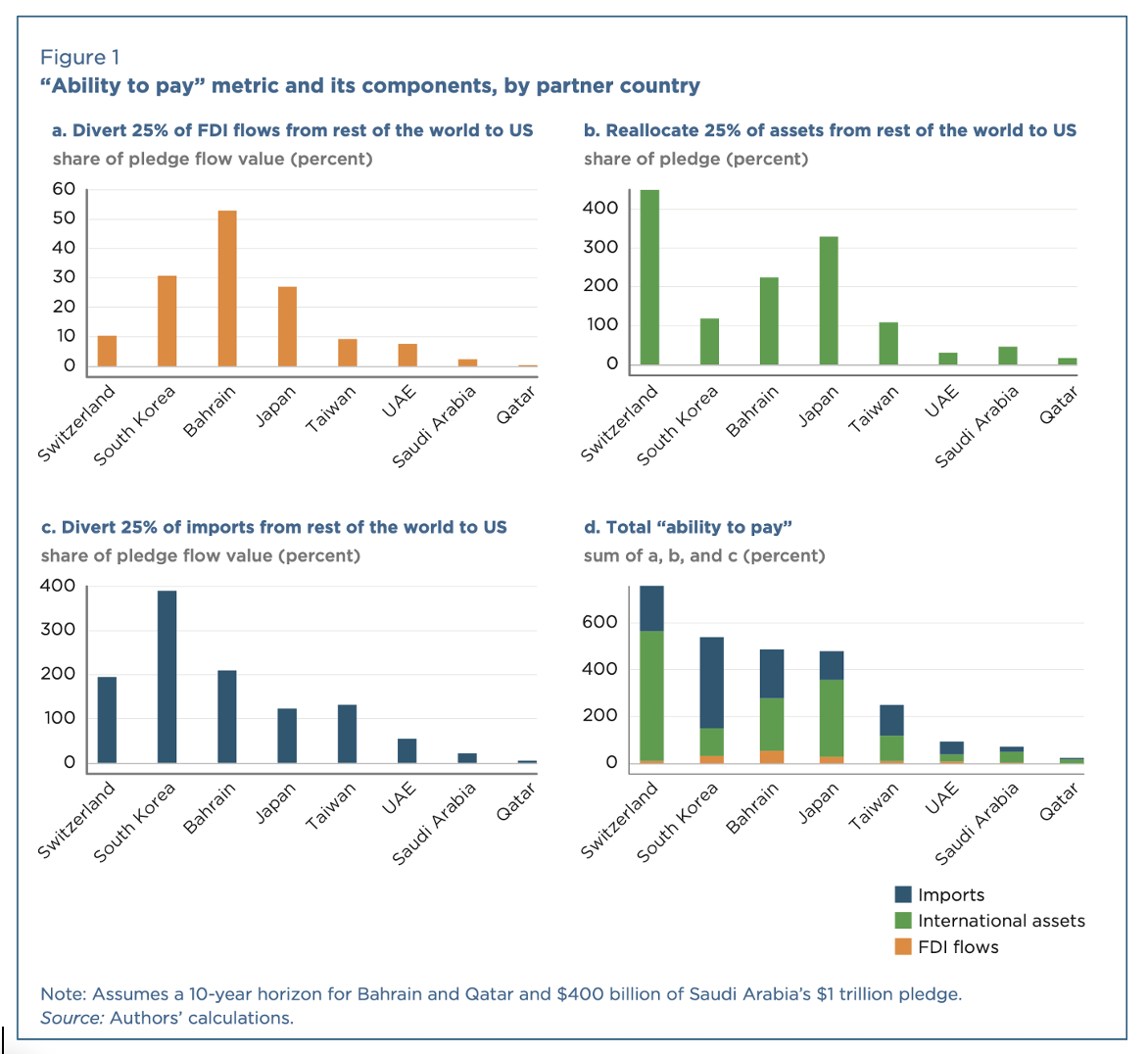

Who Is Paying for the 2025 U.S. Tariffs? Federal Reserve Bank of New York

The Federal Reserve Bank of New York is out with a new analysis that finds ~90% of tariffs’ economic burden was borne by American firms and consumers in the first 8 months of 2025. Between January and November, however, that incidence declined 88 percent as firms reorganized supply chains.

Americans Largely Disapprove of Trump’s Tariff Increases Pew Research Center

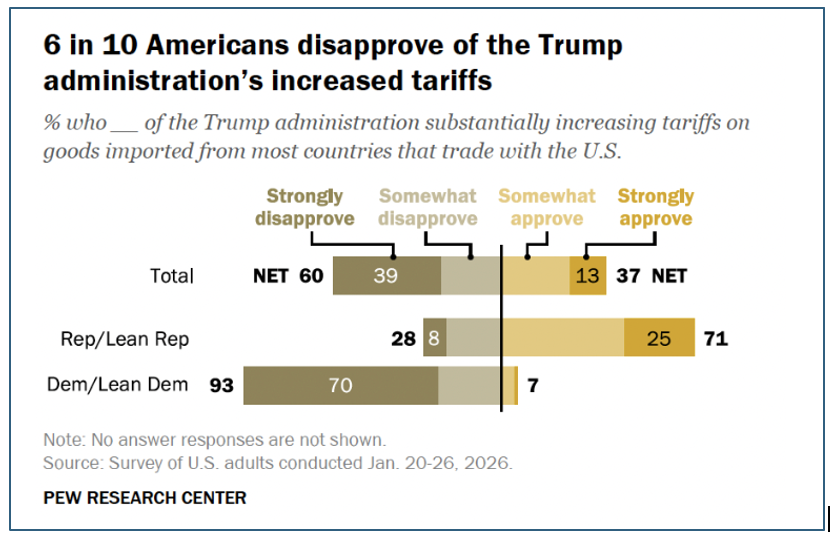

By a wide margin, Americans continue to say they disapprove of the Trump Administration substantially increasing tariffs: 60% say, including 39% who say they strongly disapprove. By contrast, 37% say they approve of the increased tariffs, and just 13% strongly approve. Views of the Administration’s tariff increase have been relatively stable since last April, when President Donald Trump unveiled his far-reaching tariff policy.

Trump Tariffs: Tracking the Economic Impact of the Trump Trade War The Tax Foundation

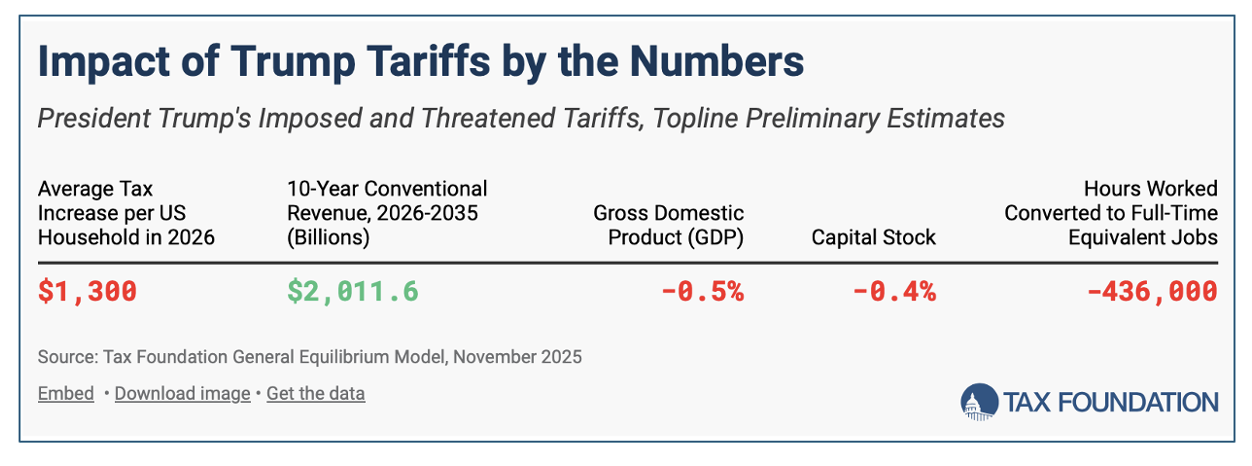

President Trump has imposed International Emergency Economic Powers Act (IEEPA) tariffs on US trading partners, including China, Canada, Mexico, and the EU. In addition, he has threatened and imposed Section 232 tariffs on autos, heavy trucks, steel, aluminum, lumber, furniture, semiconductors, pharmaceuticals, and copper, among others. The Trump tariffs amount to an average tax increase per US household of $1,000 in 2025 and $1,300 in 2026. Under the tariffs imposed and scheduled as of February 6, 2026, the weighted average applied tariff rate on all imports rises to 13.5 percent, and the average effective tariff rate, reflecting behavioral responses, rises to 9.9 percent—the highest average rate since 1946. The Trump tariffs are the largest US tax increase as a percent of GDP (0.54 percent for 2026) since 1993. Trump’s imposed tariffs will raise $2.0 trillion in revenue from 2026-2035 on a conventional basis and reduce US GDP by 0.5 percent, all before foreign retaliation. Accounting for negative economic effects, the revenue raised by the tariffs falls to $1.6 trillion over the next decade. We estimate that the tariffs raised $132 billion in net tax revenue in 2025. The Trump tariffs threaten to offset much of the economic benefits of the new tax cuts, while falling short of paying for them.

Demographic Trends and Employment Gaps

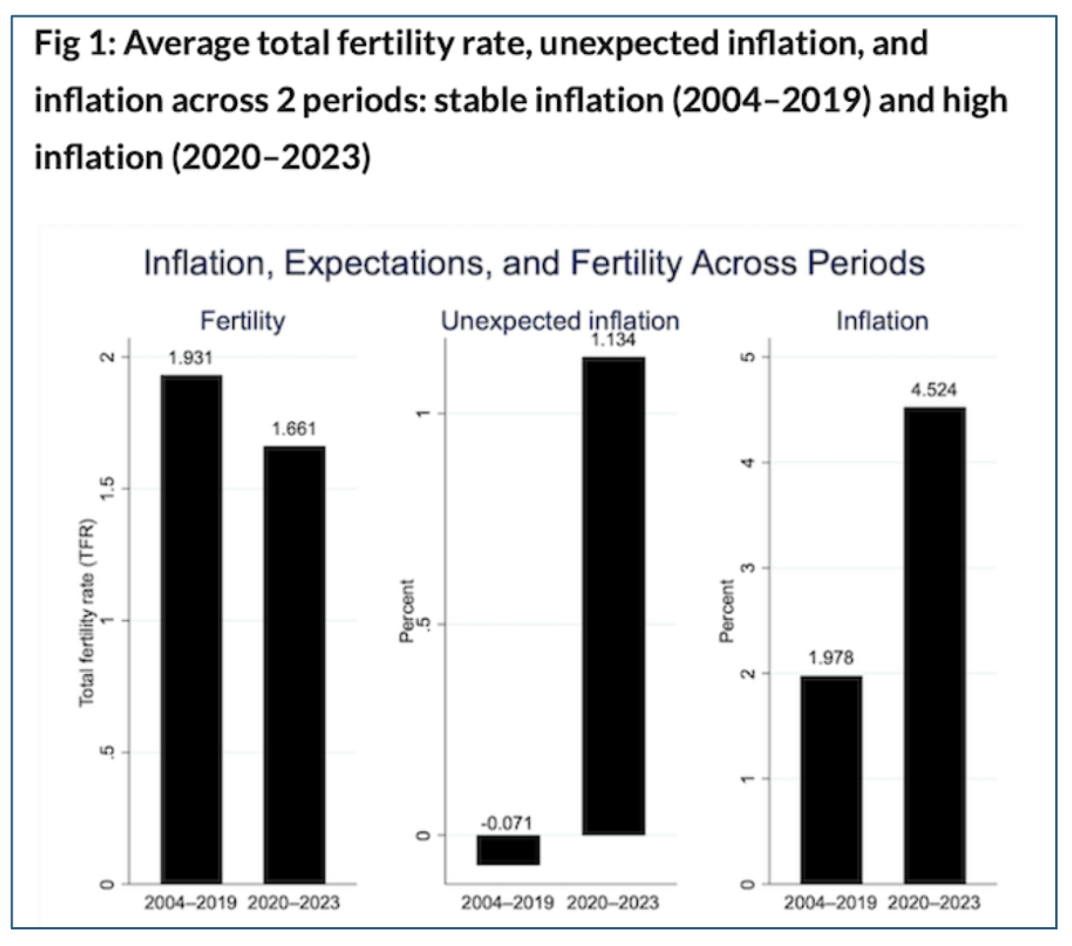

The Likelihood of Persistently Low Global Fertility Journal of Economic Perspectives

Low fertility is likely to persist as a global phenomenon as pro-natal policies have been insufficient to “adequately challenge conventions, challenge social orders, and challenge what gets society’s attention, power, and investment.”

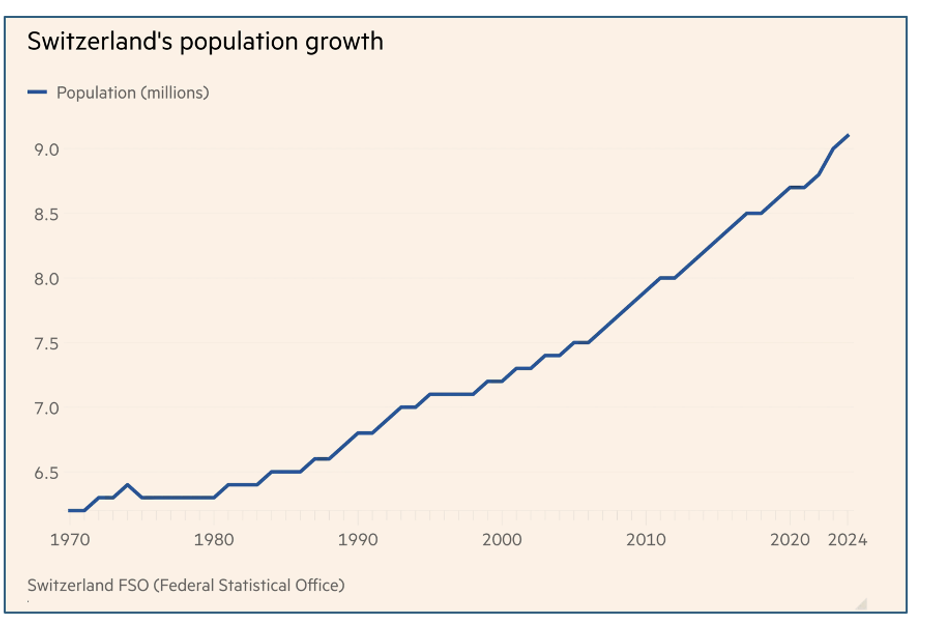

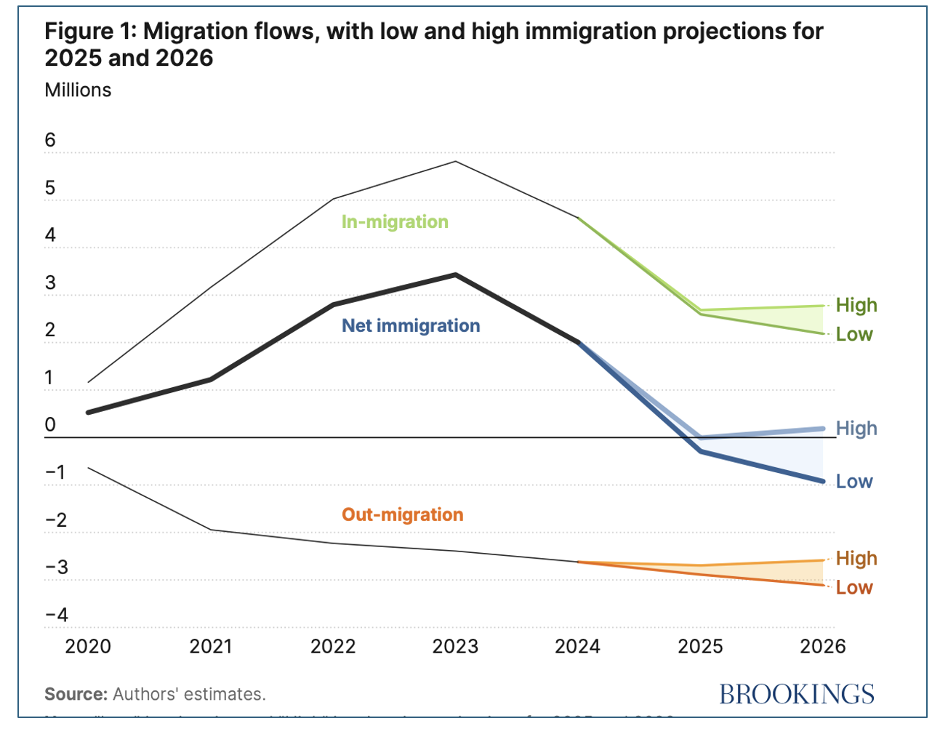

Switzerland To Vote On Plan To Cap Population At 10mn Financial Times

Switzerland will hold a vote on a radical proposal to cap the country’s population at 10mn people, a move that could threaten crucial agreements with the EU and limit companies’ access to skilled foreign workers. The country’s current population is 9.1 million people, and Switzerland has a high level of immigration, as people are drawn by its high wages and quality of life. It has one of the largest proportions of foreign residents in Europe, at 27% according to official figures, and its population has grown by some 25% since 2000, much higher than most neighboring countries.

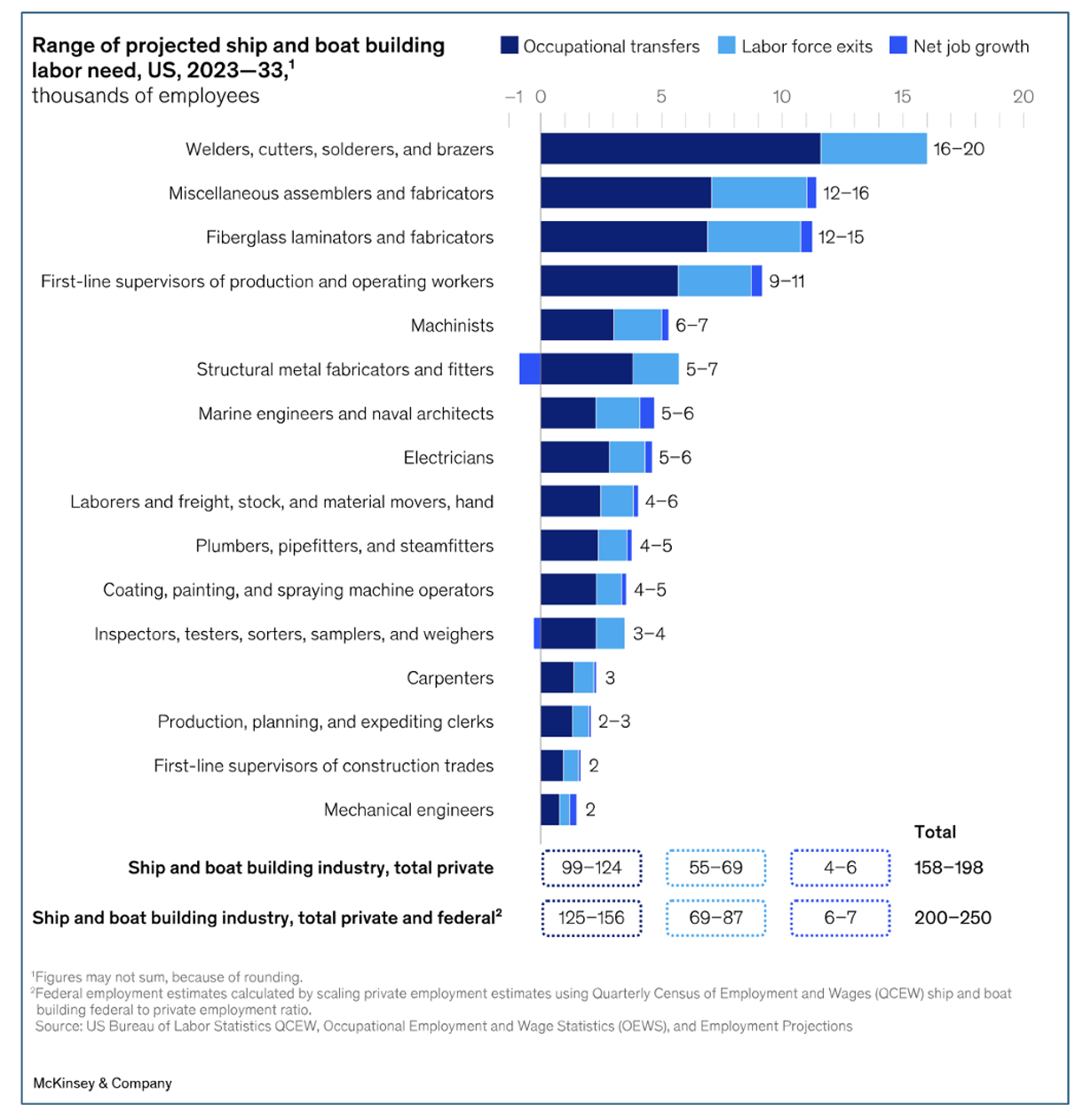

The H-1B Wage Gap, Visa Fees, and Employer Demand George J. Borjas/National Bureau of Economic ResearchAbstract: The H-1B program lets firms hire high-skill foreign workers for a six-year term. The annual number of visas allocated to for-profit firms is capped at 85,000 and there is excess demand for those visas. The analysis merges administrative data, including the I-129 petitions that report the wage offer made to specific H-1B beneficiaries, with the American Community Surveys. On average, H-1B workers earn 16 percent less than comparable natives, suggesting that firms may be willing to pay a one-time fee to obtain the visa. The data are examined using a labor demand model to simulate how a fee alters the hiring decision. Depending on the level of excess demand, the unobserved productivity gains or costs from an H-1B hire, and the rate of job separations, the revenue-maximizing fee is between $118,000 and $264,000, has little or no impact on the number of H-1Bs hired, and generates between $6.2 and $22.4 billion in revenues. The demand for visas remains strong even if firms offshore some of the jobs currently held by H-1Bs. The fee also changes the skill composition of the H-1B workforce, making it more skilled.

U.S. Financial Regulatory Week Ahead

SEC Chair Atkins Testifies Before Congress on The SEC’s Agenda, Fed Vice Chair Bowman Speaks on the Regulatory Outlook, And Treasury Secretary Bessent Gives a Peek into The Trump Regulatory Reform Plan

February 9 - 13, 2026

It is a busy week for financial regulatory strategy. First, Securities and Exchange Commission Chair Paul Atkins will testify before the House Financial Services Committee on Wednesday and the Senate Banking Committee regarding his strategic plans for the SEC.

While this is happening, Federal Reserve Vice Chair for Supervision Michelle Bowman will be giving a closely watched virtual speech at the Keefe, Bruyette & Woods 33rd Annual Winter Financial Services Conference. Both Atkins's and Bowman’s remarks follow Treasury Secretary Scott Bessent’s testimony last week before Congress on the Financial Stability Oversight Council (FSOC).

Bessent said the Administration will focus on regulations that hinder economic growth. “FSOC should … work with its members to support efforts to avoid or pare back existing regulation that stifles pro-growth lending, capital formation, and innovation. And the best way to achieve these goals is by centering economic growth and economic security at the heart of FSOC’s agenda,” he said.

Bessent said he supports higher deposit insurance levels and that we should expect new nonbank guidance later this year that updates Biden-era standards for nonbank financial institutions. Overall, Bessent made it very clear that he and the White House intend to direct deregulatory changes rather than maintain regulatory independence and hope for the best.

Also, last week, CFTC Chair Michael Selig announced that the agency would support prediction markets and craft new rules for them. “Consistent with my commitment to fostering responsible innovation in crypto asset markets, I will continue to support the responsible development of event contract markets,” said Selig.

For banks, the big event was the Federal Reserve's finalization of the 2026 stress test exams. You can find them HERE. Thirty-two large banks will be tested against a severe global recession scenario, including a nearly 5.5 percentage-point rise in unemployment, a roughly 30% decline in home prices, and stress in commercial real estate and corporate debt markets.

Below is the full report on financial regulatory-related events this week. Please let us know if you have any questions.

U.S. Congressional Hearings

U.S. Senate

· Thursday, February 12, 10:00 a.m. – SEC Chair Paul Atkins will testify before the House Financial Services Committee at a hearing entitled “Oversight of the Securities and Exchange Committee.”

House of Representatives

· Tuesday, February 10, 2:00 p.m. – The House Financial Services Committee holds a hearing entitled “Building a Solid Foundation: Restoring Trust and Transparency in Public Housing Agencies.”

· Wednesday, February 11, 10:00 a.m. – SEC Chair Paul Atkins will testify before the House Financial Services Committee at a hearing entitled “Oversight of the Securities and Exchange Committee.” You can read the Committee’s background memorandum on the hearing HERE.

· Wednesday, February 11, 2:00 p.m. – The House Financial Services Committee’s Subcommittee on Housing and Insurance will hold a hearing entitled “Homeownership and the Role of the Secondary Mortgage Market.”

Federal Department & Regulatory Meetings & Events

The White House

· Nothing significant to report.

Federal Reserve Board and Federal Reserve Banks

· Monday, February 9, 1:30 p.m. PST – Federal Reserve Board Governor Christopher J. Waller will give a speech on digital assets at the Global Interdependence Center Summit: The Dollar and Continued U.S. Exceptionalism, La Jolla, California.

· Monday, February 9: 23 p.m. – Federal Reserve Board Governor Stephen I. Miran will participate in a conversation on the economy at the Boston University Questrom School of Business Events and Conference Center, Boston, Massachusetts. Later (5:00 p.m.), he will participate in a conversation at the WBUR Podcast: Is Business Broken, in Boston.

· Tuesday, February 9, 12:00 p.m. – Cleveland Federal Reserve Bank President Beth Hammack speaks on “Banking and the Economic Outlook" before the 2026 Ohio Bankers League Economic Summit

· Tuesday, February 10, 1:00 p.m. – Dallas Federal Reserve Bank President Lorie Logan speaks and participates in a moderated question-and-answer session before the 2026 Asset Management Derivatives Forum hosted by SIFMA and FIA.

· Wednesday, February 11, 10:10 a.m. – Kansas City Federal Reserve Bank President Jeffrey Schmid speaks on monetary policy and the economic outlook before the Economic Forum of Albuquerque, New Mexico.

· Wednesday, February 11, 10:15 a.m. - Federal Reserve Board Vice Chair for Supervision Michelle W. Bowman will speak on supervision and regulation at the Keefe, Bruyette & Woods 33rd Annual Winter Financial Services Conference (virtual)

· Wednesday, February 11, 4:00 p.m. – Cleveland Federal Reserve Bank President Beth Hammack participates in Leadership Dialogue, “Exploring Leadership, Economic Policy, and Career Pathways in Public Service" Leadership Dialogue hosted by the Ohio State University John Glenn College of Public Affairs.

· Thursday, February 12, 7:05 p.m. CT – Federal Reserve Board Governor Stephen I. Miran will participate in a conversation at the Federal Reserve Bank of Dallas Global Perspectives Event, Dallas, Texas.

U.S. Treasury Department

· Nothing significant to report.

Department of Commerce

· There are no significant events scheduled at this time.

Department of Housing and Urban Development

· There are no significant events scheduled at this time.

Securities and Exchange Commission

· Wednesday, February 11, 10:00 a.m. – SEC Chair Paul Atkins will testify before the House Financial Services Committee at a hearing entitled “Oversight of the Securities and Exchange Committee.” You can read the Committee’s background memorandum on the hearing HERE.

· Thursday, February 12, 10:00 a.m. – SEC Chair Paul Atkins will testify before the Senate Banking Committee hearing entitled “Oversight of the U.S. Securities and Exchange Commission.”

· Thursday, February 12, 2:00 p.m. – The SEC will hold a Closed Meeting.

Commodities Futures Trading Commission

· Nothing significant to report.

Federal Deposit Insurance Corporation

· Nothing significant to report.

Office of the Comptroller of the Currency

· Nothing significant to report.

The Consumer Financial Protection Bureau

· There are no significant events scheduled at this time.

FINRA

· There are no significant events scheduled at this time.

National Credit Union Administration

· There are no significant events scheduled at this time.

Federal Trade Commission & Department of Justice Antitrust Division

· There are no significant events scheduled at this time.

Farm Credit Administration

· Thursday, February 12, 10:00 a.m. – the FCA Board meets to consider a new Human Capital Overview Report and the final rule dealing with business planning.

Farm Credit System Insurance Corporation

· Wednesday, February 11, 10:00 a.m. – the FCSIC Board meets. In open/new business session they will consider: The Review and Setting of Insurance Premium Accrual Rates, Payment from Allocated Insurance Reserves Accounts, A Policy Statement re: Allowance for Insurance Fund Loss, A Policy Statement re: Alternative Means of Dispute Resolution, and a Policy Statement re: Receivership and Conservatorship Counsel. In Closed Session, they will review the Annual Report of Contracts and the Annual Report on Whistleblower Activity.

International Monetary Fund & World Bank

· There are no significant events scheduled at this time.

North American Securities Administrators Association

· There are no significant events scheduled at this time.

Small Business Administration

· There are no significant events scheduled at this time.

Trade Associations & Think Tank Events

Trade Associations

· Sunday – Wednesday, February 8 – 11: SIFMA and the FIA hold their Asset Management Derivatives Forum in Austin, Texas.

Think Tanks and Other Events

· Tuesday, February 10, 3:00 p.m. – The Urban Institute holds a virtual discussion on "The Next Chapter of Community Development Finance and Place-Based Investment."

· Thursday, February 12, 1:00 p.m. – The Brookings Institution hosts a discussion on “The Future of the Digital Economy.”

Please let us know if you have any questions or would like to be added to our email distribution list.

The Global Week Ahead

NATO Defense Ministers Meet to Discuss Ukraine, The Munich Security Conference Brings Focus to the Future of NATO, the Lunar New Year Begins, and a Week of Big Earnings

February 8 - 15, 2026

The geopolitical focus this week will be on Europe, with a focus on Ukraine and NATO. The big event of the week is the annual Munich Security Conference (MSC), which begins on Friday. There is always a lot of news from the MSC, and we expect this year to be no different, as a major theme of the conference is the future of NATO and Europe’s drive to build a stronger, more integrated defense sector.

However, the MSC comes on the heels of an important meeting of NATO defense ministers in Brussels on Thursday to discuss further military support for Ukraine. US Defense Secretary Pete Hegseth has indicated he plans to skip the meeting. Later in the day, EU defense ministers will meet amongst themselves and with Ukrainian Defense Minister Mykhailo Fedorov to discuss the situation in Ukraine.

We would also note that, while it has yet to be formally announced, Ukrainian President Volodymyr Zelensky has told reporters he expects the first trilateral peace talks among Ukraine, Russia, and the USto take place sometime this week, most likely in Miami.

The biggest event of the week took place today (Sunday) in Japan, with Prime Minister Sanae Takaichi’s landslide win in snap elections. Takaichi’s Liberal Democratic Party (LDP) gained a historic supermajority in the Japanese Diet (Parliament), winning 316 of the 465 seats. The results are expected to have major impacts on Japan’s defense strategy and tax cuts, and to put pressure on the Bank of Japan to hold rates.

In the US, Washington’s growing focus on Latin America continues as summit on Friday to discuss common security concerns.

This comes as President Trump hosts a Hispanic Prosperity Gala at Mar-a-Lago, Florida. Argentine President Javier Milei and former Brazilian President Jair Bolsonaro are expected to attend.

Looking at the global financial and economic radar screen this week, markets are watching for the delayed January jobs data, released on Wednesday, and the delayed January CPI report, released on Friday.

In Europe this week, it is a relatively light data week. European Central Bank President Christine Lagarde will give several speeches, including two at the Munich Security Conference. In the UK, Q4 GDP is released on Thursday.

Moving to Asia, Japan’s Economy Watchers survey is out on Monday, and PPI on Thursday. China’s inflation reports are out on Wednesday.

Finally, this is a heavy earnings week in the US and Europe. Below is the rest of our detailed report of the major geopolitical and geoeconomic events in the coming week:

Sunday, February 8, 2026

Global

· In Bahrain, the UN-sponsored World Entrepreneurs Investment Forum 2026 will be held through February 10th.

· The 2026 Winter Olympics continue through February 22nd in Milan, Italy.

Americas

Political/Social Events –

· NASA may launch three American astronauts and a Canadian from the Kennedy Space Center in Cape Canaveral, Florida. This would be the first crewed lunar voyage in over 50 years. The 10-day flight around the moon and back will mark the second mission of Artemis, the successor to the Apollo programmed the cold war era. A moon landing is the goal of the next Artemis mission

· Super Bowl LX will be played in Santa Clara, California.

Economic & Financial Reports/Events –

· Nothing significant to report.

Asia

Political/Social Events –

· Japan holds lower house elections. Prime Minister Sanae Takaichi called for snap elections to solidify her party’s position. More than 1,200 candidates are competing for 465 seats.

· Thailand holds general elections for its 500 seat lower house. This is the first election since 2023.

Economic & Financial Reports/Events –

· Nothing significant to report.

Europe

Political/Social Events –

· Portugal holds second round election votes for president.

Economic & Financial Reports/Events –

· Bank of England Governor Andrew Bailey gives a speech at the IMF/Saudi Ministry of Finance 2nd AlUla Conference for Emerging Market Economies in Saudi Arabia.

Middle East

Political/Social Events –

· The World Defense Show begins in Riyadh, Saudi Arabia through February 12th.

Economic & Financial Reports/Events –

· Nothing significant to report.

Africa

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Nothing significant to report.

Monday, February 9, 2026

Global

· The UN Security Council is scheduled to hold a briefing, followed by consultations, on the United Nations Mission in South Sudan (UNMISS).

Americas

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Federal Reserve Board Governor Christopher J. Waller will give a speech on digital assets at the Global Interdependence Center Summit: The Dollar and Continued U.S. Exceptionalism, La Jolla, California.

· Federal Reserve Board Governor Stephen I. Miran will participate in a conversation on the economy at the Boston University Questrom School of Business Events and Conference Center, Boston, Massachusetts. Later, eh will participate in a conversation at the WBUR Podcast: Is Business Broken, in Boston.

· Atlanta Fed President Raphael Bostic participates in a moderated conversation with Pro Farmer.

· Chile Imports/ Exports/ Balance of Trade (January)

· Mexico Inflation Rate (January)

· USA Consumer Inflation Expectations

· Brazil BCB Focus Market Readout

Asia

Political/Social Events –

· Hong Kong media tycoon Jimmy Lai is due to be sentenced, following his conviction in a controversial trial that drew global attention. Lai was found guilty of colluding with foreign forces under the National Security Law that China imposed on Hong Kong in 2020, and of publishing seditious materials. He could receive a life sentence.

· The Philippines' House of Representatives is expected to vote on whether to revive impeachment complaints against President Ferdinand Marcos Jr. While a lower house committee previously dismissed the bid for "lack of substance," a one-third vote from the chamber could still overturn that decision.

Economic & Financial Reports/Events –

· Japan Average Cash Earnings (December)/ Overtime Pay (December)/ Overtime Pay (December)/ Bank Lending (January)/ Eco Watchers Survey Current & Outlook (January)

· Australia Household Spending (December)

· Indonesia Consumer Confidence (January)/ Motorbike Sales (January)

· Malaysia Industrial Production (December)

· Taiwan Imports/ Exports/ Balance of Trade (January)

· Singapore Foreign Exchange Reserves (January)

· EARNINGS: DBS

Europe

Political/Social Events –

· Great Britain’s Prince William is scheduled to visit Saudi Arabia.

Economic & Financial Reports/Events –

· European Central Bank President Christine Lagarde participates in debate on the state of the EU economy and ECB activities in Strasbourg, France.

· European Central Bank Chief Economist Philip R. Lane gives a lecture at Maynooth University in Maynooth, Ireland.

· European Central. Bank Governing Council member Gediminas Simkus speaks in Vilnius, Lithuania.

· European Central Bank Governing Council member Joachim Nagel joins panel discussion on inflation in Karlsruhe, Germany.

· Romania Balance of Trade (December)

· Slovakia Construction Output (December)

· Switzerland Consumer Confidence (January)

· Slovenia Inflation Rate (January)

· Hungary Budget Balance (January)

· EARNINGS: UniCredit

Middle East

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Nothing significant to report.

Africa

Political/Social Events –

South Africa will host the Mining Indaba conference in Cape Town through February 12th.

Economic & Financial Reports/Events –

· Angola Inflation Rate (January)

Tuesday, February 10, 2026

Global

· International Energy Week runs through February 12 in London, assembling global leaders to tackle key issues in the energy transition.

· The Oslo Energy Forum is being held in Oslo, Norway.

Americas

Political/Social Events –

· US Vice President JD Vance will visit Armenia.

· President Trump hosts the Hispanic Prosperity Gala at Mar-a-Lago, Florida. Argentine President Javier Milei and former Brazilian President Jair Bolsonaro are expected to attend.

Economic & Financial Reports/Events –

· Cleveland Fed President Beth Hammack speaks at the Ohio Bankers League Economic Summit in Cleveland, Ohio.

· Dallas Fed President Lorie Logan speaks at the Asset Management Derivatives Forum.

· USA NFIB Business Optimism Index (January)/ ADP Employment Change Weekly/ Retail Sales (December)/ Employment Cost Index Q4/ Export Prices (December)/ Import Prices (December)/ Redbook (February/07)/ Business Inventories (November)/ Total Household Debt Q4/ Fed Hammack Speech/ Fed Logan Speech/ API Crude Oil Stock Change (February/06)

· Brazil Inflation Rate (January)/ Car Production (January)/ New Car Registrations (January)

· Mexico Auto Exports & Production (January)

· Argentina Inflation Rate (January)

· El Salvador PPI (January)

· EARNINGS: Ford, Mattel, Principal Financial, CVS Health, Duke Energy, AstraZeneca, AIG, Coca-Cola, Spotify

Asia

Political/Social Events –

· Cryptocurrency data company CoinDesk holds its Consensus HK Conference through Thursday in Hong Kong, bringing industry luminaries to a city striving to develop as a hub for the sector. But the shaky performance of Bitcoin and other digital currencies so far this year will be looming over the festivities.

Economic & Financial Reports/Events –

· Australia Westpac Consumer Confidence Index (February)/ NAB Business Confidence (January)/ Building Permits (December)/ Private House Approvals (December)

· Indonesia Retail Sales (December)

· Malaysia Retail Sales (December)

· India RBI Market Borrowing Auctions

· EARNINGS: Mazda, Honda

Europe

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Great Britain BRC Retail Sales Monitor (January)

· Ireland Construction PMI (January)

· France Unemployment Rate Q4

· Turkey Industrial Production (December)

· Slovakia Industrial Production (December)

· Slovenia Industrial Production (December)

· Greece Industrial Production (December)

· Ukraine Inflation Rate (January)

· Belarus Inflation Rate (January)

· EARNINGS: Barclays, BP,

Middle East

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Saudi Arabia Industrial Production (December)

· Israel Consumer Confidence (January)

Africa

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Kenya Interest Rate Decision

· Egypt Inflation Rate (January)

· Mozambique Inflation Rate (January)

· Ethiopia Inflation Rate (January)

Wednesday, February 11, 2026

Global

· The UN’s the 6th Global Conference on the Elimination of Child Labour will be held from through February 13th in Marrakech, Morocco.

· OPEC releases its monthly oil market report.

Americas

Political/Social Events –

· US Vice President JD Vance is expected to visit Azerbaijan.

· The US will host the inaugural Western Hemisphere Chiefs of Defense Conference in Washington.

· Barbados holds elections for their House of Assembly.

Economic & Financial Reports/Events –

· Federal Reserve Board Vice Chair for Supervision Michelle W. Bowman will speak on supervision and regulation at the Keefe, Bruyette & Woods 33rd Annual Winter Financial Services Conference (virtual)

· Kansas City Fed President Jeff Schmid speaks at the Economic Forum of Albuquerque, New Mexico.

· Cleveland Fed President Beth Hammack speaks on leadership at Ohio State University, Columbus, Ohio.

· Chile Monetary Policy Meeting Minutes

· Brazil PPI (December)

· Mexico Industrial Production (December)

· USA MBA Mortgage Market Index (February/06)/ MBA Purchase Index (February/06)/ Non-Farm Payrolls (January)/ Unemployment Rate (January)/ Average Hourly Earnings (January)/ Participation Rate (January)/ Government Payrolls (January)/ Manufacturing Payrolls (January)/ EIA Crude Oil & Gasoline Stocks Change (February)/ Monthly Budget Statement (January)

· Bank on Canada releases summary of deliberations/Canada Building Permits (December)

· Uruguay Industrial Production (December)

· Peru Balance of Trade (December)

· EARNINGS: Cisco, Hilton Worldwide, McDonald’s, Tenet Healthcare, T-Mobile US, Kraft Heinz

Asia

Political/Social Events –

· China is expected to conduct a test launch of its new Long March-10A rocket, slated for use on lunar missions.

Economic & Financial Reports/Events –

· South Korea Unemployment Rate (January)

· Australia Home Loans Q4/ Investment Lending for Homes Q4/ RBA Hauser Speech

· China Inflation Rate (January)/ PPI (January)

· Malaysia Construction Output Q4/ Unemployment Rate (December)

· India M3 Money Supply (January/23)

· EARNINGS: Grab, Commonwealth Bank of Australia

Europe

Political/Social Events –

· NATO Defense Ministers will meet in Brussels to discuss the situation in Ukraine and how to offer greater support. US Defense Secretary Pete Hegseth has indicated he intends to skip the meeting.

· Greek Prime Minister Kyriakos Mitsotakis will meet with Turkish President Recep Tayyip Erdogan in Ankara, Turkey. The meeting will focus on managing bilateral relations and delimiting the exclusive economic zone (EEZ) as well as discussions of the continental shelf and mining.

Economic & Financial Reports/Events –

· European Central Bank Vice President Piero Cipollone participates in a fireside chat at the Frankfurt Digital Finance Conference 2026 in Frankfurt, Germany.

· European Central Bank Board Member Isabel Schnabel gives the Eugen Böhm von Bawerk Lecture at the Austrian Academy of Sciences in Vienna, Austria.

· European Central Bank Board Member Anneli Tuominen gives closing remarks at the Residential Policy Workshop 'AMLA and the reshaping of money laundering supervision in the EU' in Frankfurt, Germany.

· European Central Bank Board Member Claudia Buch gives opening remarks at the Residential Policy Workshop 'AMLA and the reshaping of money laundering supervision in the EU' in Frankfurt, Germany.

· Bank of England’s Executive Director of International James Talbot will give a speech at the London School of Economics on “Climate Change, the Economy, and the Financial System: Perspectives from the Bank of England.)

· Turkey Retail Sales (December)

· Italian Industrial Production (December)

· Hungary Monetary Policy Meeting Minutes

· Russia Balance of Trade (December)/ Business Confidence (January)/ Corporate Profits (November)

· EARNINGS: Commerzbank, Dassault Systemes, TotalEnergies,

Middle East

Political/Social Events –

· Egypt will host the AI Everything Middle East and Africa Summit in Cairo through February 12th.

Economic & Financial Reports/Events –

· Jordan Inflation Rate (January)

Africa

Political/Social Events –

· The 39th Ordinary Summit of the African Union will be held in Addis Ababa, Ethiopia through February 15th. Heads of state will be gathered to discuss security and economic issues.

Economic & Financial Reports/Events –

· South Africa SACCI Business Confidence (December and January)

Thursday, February 12, 2026

Global

· The UN Security Council is scheduled to hold a vote linked to the 1988 Committee. Also, in the morning, the Security Council is scheduled to hold a briefing on the Middle East, followed by consultations on the Middle East (Yemen).

· The International Energy Agency releases its monthly oil market report.

Americas

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Federal Reserve Board Governor Stephen I. Miran will participate in a conversation with Dallas Federal Reserve President Lorie Logan at the Federal Reserve Bank of Dallas Global Perspectives Event, Dallas, Texas.

· Bank of Canada Senior Deputy Governor Carolyn Rogers speaks in Toronto.

· USA Initial Jobless Claims (February/07)/ Continuing Jobless Claims (January/31)/ Existing Home Sales (January)/ EIA Natural Gas Stocks Change (February/06)/ 15- & 30-Year Mortgage Rate (February/12)/ Fed Balance Sheet (February/11)

· Paraguay Balance of Trade (January)

· Uruguay Interest Rate Decision

· Peru Interest Rate Decision

· EARNINGS: Airbnb, Anheuser-Busch InBev, Applied Materials, Wynn Resorts

Asia

Political/Social Events –

· Bangladesh heads to the polls, with the Bangladesh Nationalist Party tipped to perform well, while Bangladesh Jamaat-e-Islami has emerged as a significant force as voters eye a change from politics as usual. The party led by the students who drove the 2024 protests has failed to build momentum, however, and has become part of a Jamaat-led alliance.

· Singapore Finance Minister Lawrence Wong delivers the 2026 budget statement in Parliament.

Economic & Financial Reports/Events –

· Australia Consumer Inflation Expectations (February)/ RBA Hunter Speech

· Philippines Foreign Direct Investment (November)

· Japan Machine Tool Orders (January)

· India Inflation Rate (January)/ Passenger Vehicles Sales (January)

· EARNINGS: Softbank, Nissan

Europe

Political/Social Events –

· NATO Defense Ministers will meet in Brussels. US Secretary of Defense Pete Hegseth is expected to sip the meeting.

· There will be a meeting of the EU Foreign Affairs Council (Defense) in Brussels. The Council will discuss EU military support to Ukraine, with a focus on cooperation in defense innovation, after an informal exchange of views with the Minister of Defense of Ukraine, Mykhailo Fedorov, who will be present in person.

· There will be an informal meeting at an EU leaders retreat in Alden Biesen castle in Belgium. The focus on the retreat, according to an invitation letter sent by EU President António Costa, is competitiveness and “strengthening the single market in the new geoeconomic context.”

· There will be an informal meeting of the EU Employment and Social Affairs Council through February 13th in Belgium.

Economic & Financial Reports/Events –

· European Central Bank Board Vice President Piero Cipollone gives a lecture at a conference organized by the Commissione Europa of the Accademia Nazionale dei Lincei in Rome, Italy.

· European Central Bank Chief Economist Philip R. Lane gives a speech at The World Ahead 2026 Sofia Gala Dinner in Sofia, Bulgaria.

· European Central Bank Governing Council member Joachim Nagel gives speech on European monetary policy at Euro50 Group

· Great Britain RICS House Price Balance (January)/ GDP Growth Rate Q4/ Business Investment Q4/ Goods Trade Balance (December)/ Balance of Trade (December)/ Construction Orders Q4/ Industrial Production (December)/ Manufacturing Production (December)/ NIESR Monthly GDP Tracker (January)

· Hungary Inflation Rate (January)

· Turkey Inflation Report/ Foreign Exchange Reserves (February/06)

· Poland GDP Growth Rate Q4

· Greece Inflation Rate (January)

· Serbia Interest Rate Decision

· Russia Current Account Q4

· Germany Current Account (December)

· EARNINGS: Hermès, L’Oreal, Mercedes-Benz, Schroders, Siemens, Swisscom, Thyssenkrupp, Unilever, British American Tobacco

Middle East

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Israel Imports/ Exports/ Balance of Trade (January)

Africa

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· South Africa Gold Production (December)/ Mining Production (December)/ Manufacturing Production (December)

· Egypt Interest Rate Decision/ Overnight Lending Rate

Friday, February 13, 2026

Global

· The UN Security Council is scheduled to hold a briefing on the Middle East, followed by consultations on the Middle East (Syria).

· The G7 Foreign Ministers are expected to meet on the sidelines of the Munich Security Conference in Munich, Germany.

Americas

Political/Social Events –

· Brazil’s Rio Carnival opening ceremony is held.

Economic & Financial Reports/Events –

· Brazil Retail Sales (December)

· USA Inflation Rate (January)/ CPI (January)/ Baker Hughes Total Rigs Count (February/13)

· Colombia Consumer Confidence (January)/ Industrial Production (December)/ Retail Sales (December)

· Argentina Leading Indicator (January)

Asia

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Bank of Japan Member of the Policy Board Naoki Tamura gives a speech at the Kanagawa Keizai Doyukai.

· South Korea Import Prices (January)/ Export Prices (January)

· New Zealand Business NZ PMI (January)/ Visitor Arrivals (December)/ Business Inflation Expectations Q1

· China House Price Index (January)

· Malaysia Current Account Q4/ GDP Growth Rate Q4

· India WPI Food Index/ Fuel/ Inflation/ Manufacturing (January)/ Foreign Exchange Reserves (February/06)

· Kazakhstan Unemployment Rate Q4/ GDP (January)

· Indonesia Car Sales (January)

· EARNINGS: Kirin

Europe

Political/Social Events –

· The Munich Security Conference begins in Munich, Germany and runs through February 15th.

· The UK Parliament goes into recess until February 23rd.

Economic & Financial Reports/Events –

· European Central Bank Vice President Luis de Guindos gives a lecture at the Academia Europea Leadership in Barcelona, Spain. Later, he gives remarks and participates in a Q&A at the Círculo de Confianza by Foment de Trebal in Barcelona, Spain.

· Bank of England Chief Economist Huw Pill speaks in a fireside chat at a Santander event in London.

· Germany Wholesale Prices (January)

· Romania Industrial Production (December)

· Turkey Current Account (December)

· Hungary Construction Output (December)/ Industrial Production (December)

· Switzerland Inflation Rate (January)

· Slovakia GDP Growth Rate Q4

· Spain Inflation Rate (January)

· Poland Inflation Rate (January)/ Balance of Trade (December)/ Current Account (December)

· Euro Area Balance of Trade (December)/ Employment Change Q4/ GDP Growth Rate Q4

· Russia Interest Rate Decision/ CBR Press Conference/ Inflation Rate (January)

· Serbia Building Permits (December)

· Ukraine Balance of Trade (September, October, November, and December)

Middle East

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Nothing significant to report.

Africa

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Nothing significant to report.

Saturday, February 14, 2026

Global

· Nothing significant to report.

Americas

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Nothing significant to report.

Asia

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· China New Yuan Loans (January)/ M2 Money Supply (January)/ Outstanding Loan Growth (January)/ Total Social Financing (January)/ Current Account Prel Q4

Europe

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· European Central Bank President Christine Lagarde gives opening remarks at a roundtable discussion on trade dependencies and global supply chains during the Munich Security Conference 2026 in Munich, Germany.

· Romania GDP Growth Rate Q4

Middle East

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Nothing significant to report.

Africa

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Nothing significant to report.

Sunday, February 15, 2026

Global

· Nothing significant to report.

Americas

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Nothing significant to report.

Asia

Political/Social Events –

· The Lunar New Year begins. China begins a weeklong holiday to celebrate the Year of the Horse. Financial markets are closed in Hong Kong, Indonesia, Malaysia, Singapore, South Korea, Taiwan, and Vietnam, and China.

Economic & Financial Reports/Events –

· Nothing significant to report.

Europe

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· European Central Bank President Christine Lagarde participates on a panel discussion on European Competitiveness during the Munich Security Conference 2026 in Munich, Germany.

Middle East

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Saudi Arabia Inflation Rate (January)/ Wholesale Prices (January)

· Israel Inflation Rate (January)

· Jordan Industrial Production (December)

Africa

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Egypt Unemployment Rate Q4

The Global Week Ahead

The US and Iran Begin Talks to Avert a US Military Strike, The US Hosts a Critical Mineral Summit, Japan Holds Elections, and the ECB and Bank of England Meet on Interest Rates

February 1 - 8, 2026

Washington remains frozen and covered in “snowcrete,” but there is a lot going on here in terms of geopolitical activity. First, it appears the US will be meeting with Iranian officials face-to-face this coming Friday in Istanbul to attempt to negotiate over Iran’s nuclear program. Up until this point, there have been no official face-to-face meetings between the two countries, but Iran, seeing the approach of a large US Naval force and President Trump’s demands for talks, relented. The impact on oil/gas markets could be significant if an agreement is ultimately reached.

Also this week, on Wednesday, Secretary of State Marco Rubio is hosting a critical minerals ministerial meeting where a dozen or more foreign ministers will gather to hammer out the details of a draft Critical Minerals and Rare Earth Framework. The proposed Framework would ensure all signatories have access to critical minerals, facilitating greater and freer trade. Among the confirmed attendees are India, South Korea, Australia, the Democratic Republic of the Congo (DRC), Guinea, and Kenya.

Finally, we would note that President Trump is scheduled to meet with Colombian President Gustavo Petro on Wednesday. The aim of the meeting is to de-escalate tensions after Trump snatched Venezuelan President Nicholas Maduro and began to bicker with Petro over drug interdiction policy. A positive outcome of the meeting would further solidify Trump's policy of greater US engagement and influence in the Hemisphere.

Turning to Asia, on Sunday, Japan heads to the voting booth after Prime Minister Sanae Takaichi called snap elections. Polls suggest Takaichi’s Liberal Democratic Party (LDP) could score a landslide victory (estimates put it at more than 233 of the total 465 seats), giving her a strong hand to push forward with her “proactive” fiscal policy focused on bigger spending and tax cuts.

Looking at the global economic and financial radar screen this week, the big events are in Frankfurt and London, respectively, as the European Central Bank and the Bank of England meet to consider further interest rate cuts. Both are expected to hold off on any further rate cuts.

In the US, the major economic releases this week include the jobs report on Friday. This follows the JOLTS report (Tuesday) and the ADP report (Wednesday). Also, out this week are the ISM indices on Monday (manufacturing) and Wednesday (services), and the University of Michigan consumer survey on Friday.

In Europe, the January CPIs for France, Germany, Italy, and Spain are out this week. Germany releases factor order and industrial production figures this week. And we will also see retail sales and trade figures for most major Eurozone countries.

In Asia this week, the Reserve Bank of Australia meets to decide on interest rates. China releases January PMIs on Saturday, and in Japan, the Bank of Japan releases its summary of recent interest rate deliberations.

Below is the rest of our detailed report of the major geopolitical and geoeconomic events in the coming week:

Sunday, February 1, 2026

Global

· The OPEC+ monthly meeting will be held virtually.

· The UK assumes the chair of the UN Security Council for the month of February.

· The Arctic Frontiers Conference is held in Tromso, Norway.

· The International Submarine Cable Resilience Summit begins in Porto, Portugal.

Americas

Political/Social Events –

· Costa Rica holds presidential and parliamentary elections.

Economic & Financial Reports/Events –

· Nothing significant to report.

Asia

Political/Social Events –

· In India, Prime Minister Narendra Modi presents the country's annual budget for the fiscal year starting in April, with the focus likely to be on fields such as infrastructure development, green energy and steps to boost export competitiveness amid U.S. President Donald Trump's punishing 50% tariffs on Indian goods.

Economic & Financial Reports/Events –

· South Korea Imports/ Exports/ Balance of Trade (January)

· India Union Budget 2026

Europe

Political/Social Events –

· The second round of Russia-Ukraine peace talks is scheduled to begin in Abu Dhabi, United Arab Emirates.

Economic & Financial Reports/Events –

· Nothing significant to report.

Middle East

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Saudi Arabia GDP Growth Rate Q4

Africa

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Nothing significant to report.

Monday, February 2, 2026

Global

· Nothing significant to report.

Americas

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Atlanta Federal Reserve Bank President Raphael Bostic participates in moderated conversation on monetary policy before the Atlanta Rotary Club.

· Chile IMACEC Economic Activity (December)

· Brazil S&P Global Manufacturing PMI (January)/ BCB Focus Market Readout

· Canada S&P Global Manufacturing PMI (January)

· USA S&P Global Manufacturing PMI (January)/ ISM Manufacturing PMI (January)/ ISM Manufacturing Employment (January)/ ISM Manufacturing New Orders (January)/ ISM Manufacturing Prices (January)/ Loan Officer Survey/ Treasury Refunding Financing Estimates

· Colombia Davivienda Manufacturing PMI (January)

· Peru Inflation Rate (January)

· Argentina Tax Revenue (January)

· EARNINGS: Palantir, Disney, Tysons Food

Asia

Political/Social Events –

· The travel period for China's Spring Festival celebrations will commence and last through March 13th.

Economic & Financial Reports/Events –

· Australia S&P Global Manufacturing PMI (January)/ ANZ-Indeed Job Ads (January)/ TD-MI Inflation Gauge (January)/ Commodity Prices (January)

· Bank of Japan releases its Summary of Opinions/ S&P Global Manufacturing PMI (January)

· Indonesia S&P Global Manufacturing PMI (January)/ Imports/ Exports/ Balance of Trade (December)/ Inflation Rate (January)/ Tourist Arrivals (December)

· Malaysia S&P Global Manufacturing PMI (January)

· Philippines S&P Global Manufacturing PMI (January)

· South Korea S&P Global Manufacturing PMI (January)

· Taiwan S&P Global Manufacturing PMI (January)

· Vietnam S&P Global Manufacturing PMI (January)

· China RatingDog Manufacturing PMI (January)

· India HSBC Manufacturing PMI (January)

· Singapore Business Confidence Q4/ SIPMM Manufacturing PMI (January)

· Kazakhstan Inflation Rate (January)

· EARNINGS: Central Japan Railway, East Japan Railway

Europe

Political/Social Events –

· The Oslo Security Conference is held through February 3rd in Oslo, Norway.

· French Prime Minister Sebastien Lecornu will face his third and last set of no-confidence votes in the National Assembly over his decision to pass the 2026 budget without a parliamentary vote.

· There will be an informal meeting of EU Competitiveness Ministers (Internal Market and Industry), through February 3rd in Brussels.

Economic & Financial Reports/Events –

· Bank of England Deputy Governor for Financial Stability Sarah Breeden gives a speech entitled “Talking ‘bout Next Generation” at the City & Financial Payments Regulation and Innovation Summit 2026 in London.

· Russia S&P Global Manufacturing PMI (January)

· Germany Retail Sales (December)/ HCOB Manufacturing PMI (January)

· Turkey Istanbul Chamber of Industry Manufacturing PMI (January)

· Switzerland Retail Sales (December)/ procure.ch Manufacturing PMI (January)

· Hungary HALPIM Manufacturing PMI (January)

· Poland S&P Global Manufacturing PMI (January)

· Spain HCOB Manufacturing PMI (January)/ New Car Sales (January)

· Italy HCOB Manufacturing PMI (January)

· France HCOB Manufacturing PMI (January)

· Euro Area HCOB Manufacturing PMI (January)

· Greece S&P Global Manufacturing PMI (January)

· Great Britain S&P Global Manufacturing PMI (January)/ BoE Breeden Speech/ BoE Jackson Speech/ Nationwide Housing Prices (January)

· Serbia GDP Growth Rate Q4

· EARNINGS: Julius Baer

Middle East

Political/Social Events –

· The Saudi Capital Markets Forum begins in New York and runs through February 3rd. The country formally is opening its markets to foreign investors today.

· The Rafah border crossing between Egypt and Gaza is scheduled to open.

Economic & Financial Reports/Events –

· Nothing significant to report.

Africa

Political/Social Events –

· The Africa Data Centres Association hosts a conference on cloud and data centers in Tunis through February 3rd.

·

Economic & Financial Reports/Events –

· Nigeria Stanbic IBTC Bank Nigeria PMI (January)

· South Africa ABSA Manufacturing PMI (January)/ M2 Money Supply (December)

· Egypt M2 Money Supply (December)

Tuesday, February 3, 2026

Global

· The World Governments Summit begins in Dubai and runs through February 5th. International Monetary Fund Managing Director Kristalina Georgieva is among the speakers.

Americas

Political/Social Events –

· Colombian President Gustavo Petro is expected to meet with President Donald Trump in Washington, D.C.

· Netflix Inc. Co-Chief Executive Officer Ted Sarandos will testify before the US Senate’s antitrust subcommittee on Tuesday, taking the stage to assuage politicians’ concern about his company’s $82.7 billion deal for Warner Bros. and HBO.

Economic & Financial Reports/Events –

· Richmond Federal Reserve Bank President Thomas Barkin speaks before the SC First Steps “Early Advantage: Foundations for South Carolina's Economic Vitality" event.

· Federal Reserve Vice Chair for Supervision Michelle Bowman takes part in a moderated conversation at the WSJ Invest Live event in New York

· Brazil IPC-Fipe Inflation (January)/ BCB Copom Meeting Minutes/ Industrial Production (December)

· USA LMI Logistics Managers Index (January)/Redbook (January/31)/ JOLTs Job Openings (December)/ JOLTs Job Quits (December)/ RCM/TIPP Economic Optimism Index (February)/ API Crude Oil Stock Change (January/30)

· Mexico Business Confidence (January)/ S&P Global Manufacturing PMI (January)/ Foreign Exchange Reserves (December)

· Colombia Exports (December)

· Paraguay Inflation Rate (January)

· EARNINGS: Amgen, Emerson Electric, Clorox, PepsiCo, Paypal, Pfizer, Prudential Financial, Willis Towers Watson, LATAM Airlines, Merck

Asia

Political/Social Events –

· The Singapore Airshow begins and runs through Sunday. More than 1000 aerospace and defense companies from 50 countries will participate.

· The Chinese Communist Party and Taiwan's Kuomintang party will recommence party-to-party talks, suspended in 2016, in China through February 4th.

· The Indonesia Economic Summit, hosted by the Indonesia Business Council, holds a two-day annual event in Jakarta, inviting global business leaders and policymakers to discuss industry challenges for the development of Southeast Asia's largest economy.

Economic & Financial Reports/Events –

· New Zealand Building Permits (December)/ Global Dairy Trade Price Index (February/03)

· South Korea Inflation Rate (January)

· Japan Monetary Base

· The Reserve Bank of Australia meets on Interest Rates and holds Press Conference/Australia Building Permits (December)/ Private House Approvals (December)

· Taiwan Consumer Confidence (January)

· Hong Kong Retail Sales (December)

· Pakistan Inflation Rate (January)/ Wholesale Prices (January)

· India RBI Market Borrowing Auctions

· EARNINGS: Nintendo, West Japan Railway, Mitsubishi Electronic

Europe

Political/Social Events –

· There will be an informal video conference among EU Housing Ministers.

Economic & Financial Reports/Events –

· European Central Bank Board Member Patrick Montagner gives a keynote speech at the Afore Consulting 10th Annual FinTech and Regulation Conference in Brussels, Belgium.

· Ireland AIB Manufacturing PMI (January)

· Romania PPI (December)

· Turkey Inflation Rate (January)/ PPI (January)/ Imports/ Exports/ Balance of Trade (January)

· France Inflation Rate (January)/ Budget Balance (December)/ New Car Registrations (January)

· Spain Unemployment Change (January)/ Tourist Arrivals (December)

· Italy New Car Registrations (January)

· EARNINGS: Publicis Groupe

Middle East

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Saudi Arabia Riyad Bank PMI (January)

· Jordan PPI (December)

Africa

Political/Social Events –

· Today is Mozambican Heroes Day, a national holiday.

· Solar energy executives gather in Nairobi for the Intersolar Africa business summit.

Economic & Financial Reports/Events –

· Egypt S&P Global PMI (January)

· Ghana Inflation Rate (January)

Wednesday, February 4, 2026

Global

· Nothing significant to report.

Americas

Political/Social Events –

· Secretary of State Marco Rubio hosts a Critical Minerals Ministerial in Washington DC with multiple foreign ministers attending. The State Department is circulating a draft Critical Minerals and Rare Earth Framework for attending countries to sign.

· Treasury Secretary Scott Bessent will testify before the House Financial Services Committee to present “The Financial Stability Oversight Council’s Annual Report to Congress.”

· The New START Treaty expires. The US and Russia treaty helped restrict the proliferation of nuclear weapons.

· “The Muppet Show” returns being shown on ABC and Disney+. American culture is saved.

Economic & Financial Reports/Events –

· Federal Reserve Board Governor Lisa D. Cook gives a speech on monetary policy and the economic outlook at the Economic Club of Miami, Miami, Florida.

· USA MBA 30-Year Mortgage Rate (January/30)/ MBA Mortgage Market Index (January/30)/ MBA Mortgage Refinance Index (January/30)/ MBA Purchase Index (January/30)/ ADP Employment Change (January)/ Treasury Refunding Announcement/ S&P Global Composite & Services PMI (January)/ ISM Services PMI (January)/ ISM Services Business Activity (January)/ ISM Services Employment (January)/ ISM Services New Orders (January)/ ISM Services Prices (January)/ EIA Crude Oil & Gasoline Stocks Change (January/30)/ Total Vehicle Sales (January)

· Brazil S&P Global Composite & Services PMI (January)

· Canada S&P Global Composite & Services PMI (January)

· Uruguay Inflation Rate (January)

· Colombia Monetary Policy Meeting Minutes

· EARNINGS: Alphabet, Boston Scientific, Eli Lilly, Fox Corp, Johnson Controls McKesson, Stanley Black & Decker, Qualcomm, T Rowe Price, Uber

Asia

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Reserve Bank of Australia Assistant Governor Brad Jones holds a fireside chat at the Investment Magazine 2026 Chair Forum.

· New Zealand Employment Change Q4/ Unemployment Rate Q4/ Labour Costs Index Q4/ Participation Rate Q4

· Australia Ai Group Industry Index (January)/ Ai Group Construction Index (January)/ Ai Group Manufacturing Index (January)/ S&P Global Composite & Services PMI (January)/ RBA Jones Speech

· Hong Kong S&P Global PMI (January)

· Japan S&P Global Composite & Services PMI (January)

· Singapore S&P Global PMI (January)

· China RatingDog Composite & Services PMI (January)

· India HSBC Composite & Services PMI (January)/ M3 Money Supply (January/23)

· EARNINGS: Sumitomo, Panasonic

Europe

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· European Central Bank Board President Christine Lagarde participates in an informal dinner and exchange of views with Maroš Šefčovič, Commissioner for Trade and Economic Security as well as Interinstitutional Relations and Transparency, in Frankfurt, Germany.

· Russia S&P Global Composite & Services PMI (January)

· Spain HCOB Composite & Services PMI (January)

· Italy HCOB Composite & Services PMI (January)/ Inflation Rate (January)

· France HCOB Composite & Services PMI (January)

· Germany HCOB Composite & Services PMI (January)

· Euro Area HCOB Composite & Services PMI (January)/ Inflation Rate (January)/ CPI Flash (January)/ PPI (December)

· Slovenia Balance of Trade (December)

· Great Britain DMP 1Y CPI Expectations (January)/ DMP 3M Output Price Expectations (January)/ S&P Global Composite & Services PMI (January)

· Poland Interest Rate Decision (February)

· EARNINGS: UBS, Credit Agricole, Handelsbanken, Santander, Watches of Switzerland

Middle East

Political/Social Events –

· There is nothing significant to report.

Economic & Financial Reports/Events –

· United Arab Emirates S&P Global PMI (January)

· Israel Tourist Arrivals (January)

Africa

Political/Social Events –

· Today is Angola Liberation Day, a national holiday.

Economic & Financial Reports/Events –

· South Africa S&P Global PMI (January)

· Egypt Foreign Exchange Reserves (January)

Thursday, February 5, 2026

Global

· Global Supply Chain Pressure Index (January)

Americas

Political/Social Events –

· Treasury Secretary Scott Bessent will testify before the Senate Banking Committee to present “The Financial Stability Oversight Council’s Annual Report to Congress.”

Economic & Financial Reports/Events –

· Atlanta Federal Reserve Bank President Raphael Bostic participates in moderated conversation and Q&A on monetary policy and navigating the economic environment after graduation at event hosted by the Clark Atlanta University School of Business.

· Bank of Canada Governor Tiff Macklem speaks in Toronto.

· Mexican Central Bank Interest Rate Decision/Mexico Gross Fixed Investment (November)

· USA Challenger Job Cuts (January)/ Initial Jobless Claims (January/31)/ EIA Natural Gas Stocks Change (January/30)/ 15- & 30-Year Mortgage Rate (February/05)/ Fed Balance Sheet (February/04)

· Brazil Balance of Trade (January)

· Colombia PPI (January)

· Costa Rica Unemployment Rate Q4

· EARNINGS: Amazon, Allstate, Bristol Myers Squibb, Cardinal Health, Cigna, Compass, ConocoPhillips, KKR, Hershey, MetLife, News Corp, Thomson Reuter

Asia

Political/Social Events –

· The Malaysia Economic Forum begins in Kuala Lumpur. The forum will feature Prime Minister Anwar Ibrahim, Siri founder and former Chief Technology Officer Tom Gruber, and senior figures from the private sector, including banking and capital market leaders.

· The ASEAN Treasury Forum takes place in Manila, Philippines through February 6th.

· The 17th East Asia Conference on Competition Law and Policy, a two-day event hosted by Asian Development Bank Institute, begins in Tokyo.

Economic & Financial Reports/Events –

· South Korea Foreign Exchange Reserves (January)

· Japan Foreign Bond Investment (January/31)/ Stock Investment by Foreigners (January/31)

· Australia Imports/ Exports/ Balance of Trade (December)

· Philippines Inflation Rate (January)

· Indonesia Full Year GDP Growth 2025/ GDP Growth Rate Q4

· Singapore Retail Sales (December)

· Taiwan Inflation Rate (January)/ Foreign Exchange Reserves (January)

· Sri Lanka Tourist Arrivals (January)

· EARNINGS: Nippon Steel, Suzuki, Motor, Sony

Europe

Political/Social Events –

· There will be in informal meeting of EU Environmental Ministers through February 6th in Brussels.

· Today is Liberation Day San Marino.

Economic & Financial Reports/Events –

· European Central Bank Interest Rate Decision/ Marginal Lending Rate/ ECB Press Conference

· Bank of England Interest Rate Decision

· Ireland AIB Services PMI (January)/ Unemployment Rate (January)

· Germany Factory Orders (December)/ HCOB Construction PMI (January)

· Romania Retail Sales (December)

· Hungary Retail Sales (December)

· France Industrial Production (December)/ HCOB Construction PMI (January)

· Slovakia Retail Sales (December)

· Euro Area HCOB Construction PMI (January)/ Retail Sales (December)

· Italy HCOB Construction PMI (January)/ Retail Sales (December)

· Great Britain New Car Sales (January)/ S&P Global Construction PMI (January)

· Turkey Foreign Exchange Reserves (January/30)

· Russia Vehicle Sales (January)

· EARNINGS: BNP, Vodafone, BBVA, Maersk, Shell

Middle East

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Israel Business Confidence (January)

Africa

Political/Social Events –

· Today is Burundi Unity Day, a national holiday.

· The RiseUp Summit, focused on startups, meets at the Grand Egyptian Museum in Cairo

Economic & Financial Reports/Events –

· Nothing significant to report.

Friday, February 6, 2026

Global

· The 2026 Winter Olympics begin in Milan and Cortina d’Ampezzo, Italy and runs through February 22nd.

· FAO Food Price Index (January)

Americas

Political/Social Events –

· The US is tentatively scheduled to hold talks with Iranian officials in Istanbul on Iran’s nuclear program.

Economic & Financial Reports/Events –

· Federal Reserve Board Vice Chair Philip N. Jefferson gives a speech on the economic outlook and supply-side inflation dynamics at a conference entitled: Supply-Side Factors and Inflation: What Have We Learned? Being hosted by The Brookings Institution, Washington, D.C.

· Chile Inflation Rate (January)

· Mexico Consumer Confidence (January)

· Canada Unemployment Rate (January)/ Employment Change (January)/ Participation Rate (January)/ Ivey PMI s.a (January)

· USA Non-Farm Payrolls (January)/ Unemployment Rate (January)/ Average Hourly Earnings (January)/ Participation Rate (January)/ Government Payrolls (January)/ Manufacturing Payrolls (January)/ U-6 Unemployment Rate (January)/ Used Car Prices (January)/ Michigan Consumer Sentiment (February)/ Michigan Consumer Expectations (February)/ Michigan Current Conditions (February)/ Michigan Inflation Expectations (February)/ Baker Hughes Total Rigs Count (February/06)/ Consumer Credit Change (December)

· Costa Rica Inflation Rate (January)

· Argentina Industrial Production (December)

· Colombia Cement Production (December)/ Inflation Rate (January)

· El Salvador Inflation Rate (January)

Asia

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Bank of Japan Member of the Policy Board Kazuyuki Masu gives a speech before local leaders in Ehime, Japan.

· South Korea Current Account (December)

· Japan Household Spending (December)/ Foreign Exchange Reserves (January)/ BoJ Masu Speech/ Coincident Index (December)/ Leading Economic Index (December)

· Philippines Unemployment Rate (December)/ Industrial Production (December)/ Foreign Exchange Reserves (January)

· Vietnam Balance of Trade (January)/ Foreign Direct Investment (January)/ Industrial Production (January)/ Inflation Rate (January)/ Retail Sales (January)/ Tourist Arrivals (January)

· Indonesia Foreign Exchange Reserves (January)/ Property Price Index Q4

· India RBI Interest Rate Decision/ Cash Reserve Ratio/ Bank Loan Growth (January/23)/ Deposit Growth (January/23)/ Foreign Exchange Reserves (January/30)

· Hong Kong Foreign Exchange Reserves (January)

· Kazakhstan PPI (January)

· Pakistan Balance of Trade (January)

· EARNINGS: Toyota

Europe

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· European Central Bank Board Vice President Piero Cipollone gives a speech on the digital euro at an event organized by MEP Michalis Hadjipantela in Cyprus.

· European Central Bank Governing Council Member ECB Martin Kocher speaks at the Club of Business Journalists in Vienna, Austria.

· Bank of England Chief Economist Huw Pill speaks at the National MC Agency Briefing.

· Euro Area ECB Cipollone Speech/ ECB Survey of Professional Forecasters

· Germany Imports/ Exports/ Balance of Trade (December)/ Industrial Production (December)/ New Car Registrations (January)

· Great Britain Halifax House Price Index (January)/ BBA Mortgage Rate (January)

· Hungary Industrial Production (December)

· France Imports/ Exports/ Balance of Trade (December)/ Current Account (December)/ Foreign Exchange Reserves (January)

· Slovakia Balance of Trade (December)

· Spain Industrial Production (December)

· Switzerland Unemployment Rate (January)/ Foreign Exchange Reserves (January)

· Greece Balance of Trade (December)

· Poland Foreign Exchange Reserves (January)

· Russia Foreign Exchange Reserves (January)/ GDP (December)/ Unemployment Rate (December)/ Industrial Production (December)/ Real Wage Growth (November)/ Retail Sales (December)

· Turkey Treasury Cash Balance (January)

· Ukraine Foreign Exchange Reserves (January)

· EARNINGS: Societe Generale, Skanska

Middle East

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Israel Foreign Exchange Reserves (January)

Africa

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· South Africa Foreign Exchange Reserves (January)

Saturday, February 7, 2026

Global

· Nothing significant to report.

Americas

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Nothing significant to report.

Asia

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· China Foreign Exchange Reserves (January)

Europe

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Nothing significant to report.

Middle East

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Nothing significant to report.

Africa

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Nothing significant to report.

Sunday, February 8, 2026

Global

· Nothing significant to report.

Americas

Political/Social Events –

· NASA may launch a three American astronauts and a Canadian from the Kennedy Space Center in Cape Canaveral, Florida. This would be the first crewed lunar voyage in over 50 years. The 10-day flight around the moon and back will mark the second mission of Artemis, the successor to the Apollo programmed the cold war era. A moon landing is the goal of the next Artemis mission

· Super Bowl LX will be played in Santa Clara, California.

Economic & Financial Reports/Events –

· Nothing significant to report.

Asia

Political/Social Events –

· Japan holds lower house elections. Prime Minister Sanae Takaichi called for snap elections to solidify her party’s position. More than 1,200 candidates are competing for 465 seats.

· Thailand holds general elections for its 500 seat lower house. This is the first election since 2023.

Economic & Financial Reports/Events –

· Nothing significant to report.

Europe

Political/Social Events –

· Portugal holds second round election votes for president.

Economic & Financial Reports/Events –

· Bank of England Governor Andrew Bailey gives a speech at the IMF/Saudi Ministry of Finance 2nd AlUla Conference for Emerging Market Economies in Saudi Arabia.

Middle East

Political/Social Events –

· The World Defense Show begins in Riyadh, Saudi Arabia through February 12th.

Economic & Financial Reports/Events –

· Nothing significant to report.

Africa

Political/Social Events –

· Nothing significant to report.

Economic & Financial Reports/Events –

· Nothing significant to report.

The Financial Regulatory Week Ahead

FSOC Presents Its Annual Report to Congress, What Sort of Government Shutdown Will We Get?, Federal and State Regulators Battle Over Real Estate Escrow Accounts

February 2 - 6, 2026

Washington is still buried under frozen snow – known here as “snowcrete” because it is like chiseling concrete to clear it away. A number of schools remain closed (having been closed all last week, too), but the wheels of Congress and regulators continue to turn.

The big event of the week will be Treasury Secretary Scott Bessent testifying before the House Financial Services Committee and the Senate Banking Committee to present the Financial Stability Oversight Council (FSOC) 's annual report.

Both hearings look to be pretty wide open in terms of issues to discussed but we suspect a heavy focus of questioning will be on the Trump Administration’s evisceration of the Consumer Financial Protection Bureau (CFPB) and what the Administration intends to do with it going forward along with reform of the Federal Reserve (now that President Trump has nominated Kevin Warsh to be the next chair and Bessent has repeatedly said the Fed needs to reformed), and the future bank regulatory framework.

Looking at last week, we noted an unusual fight emerging between federal and state regulators over real estate escrow accounts. The fight comes at a sensitive time, as the cost of buying a new home has emerged as a serious political issue in this year’s midterm elections. The disagreement revolves around the interest paid on escrow accounts used by mortgage holders to pay expenses such as taxes and insurance. More than a dozen states require banks pay interest on escrow accounts.

However, the Office of the Comptroller of the Currency (OCC) recently proposed a rule that would allow nationally chartered banks under its supervision to pay no interest and charge fees to escrow account holders.

Elsewhere, we continue to track legislation introduced by Senators Roger Marshall (R-KS) and Dick Durbin (D-IL) to crack down on credit card swipe fees. Despite President Trump’s endorsement, we are seeing little progress in the Senate for the legislation and little appetite among senators to get in the middle of this long and messy fight.

Finally, Congress is in another shutdown, which they hope to fix either today or Tuesday, when the House votes on a continuing resolution to keep the government funded. A deal was struck last week, but not in time for the House to vote on it. But in our view, this might have become more complicated over the weekend, when Democrats won the traditionally Democratic 18th district in a special election to replace the recently deceased Representative Sylvester Turner (D-TX).

While it was not a surprising outcome, it means Republicans now have a one-seat majority in the House. For House Speaker Michael Johnson (R-LA), his life has become considerably more difficult because the odds of one Republican defecting to strike some sort of deal over something complete. So, brace for more drama in the House this week – and the rest of the year as this number is going to go back and forth from a one seat to two seat majority numerous times.

Below is the full report on financial regulatory-related events this week. Please let us know if you have any questions.

U.S. Congressional Hearings

U.S. Senate

· Tuesday, February 3, 10:00 a.m. – The Senate Judiciary Committee holds a hearing entitled “The Truth Revealed: Hidden Facts Regarding Nazis and Swiss Banks." Testifying will be:

Neil Barofsky, Independent ombudsperson and partner at Jenner & Block LLP, New York, N.Y.

Barbara Levi, Group general counsel for UBS Group AG and member of the Group Executive Board of UBS Group AG, Zurich, Switzerland

Rabbi Abraham Cooper, Associate dean and director of global social action at the Simon Wiesenthal Center, Los Angeles, Calif.

Robert Karofsky, Co-president for Global Wealth Management, president of UBS Americas and member of the Group Executive Board of UBS Group AG, New York, N.Y.

· Tuesday, February 3, 2:30 p.m. – The Senate Judiciary Committee’s Subcommittee on Antitrust, Competition Policy, and Consumer Rights holds a hearings entitled “Examining the Competitive Impact of the Proposed Netflix-Warner Brothers Transaction.”

· Thursday, February 5, 10:00 a.m. – The Senate Banking Committee will hold a hearing entitled “The Financial Stability Oversight Council’s Annual Report to Congress.” Treasury Secretary Scott Bessent will testify.

House of Representatives

· Wednesday, February 4, 10:00 a.m. – The House Financial Service Committee will hold a hearing on the Annual Report of the Financial Stability Oversight Council. Treasury Secretary Scott Bessent will testify. You can find the Committee’s Memorandum on the hearing HERE.