If you are interested in having Frank speak at one of your conferences or meetings, please email him at fkelly@fulcrummacro.com. And if you would like to see a sizzle reel of Frank speaking and moderating panels and discussions, we are happy to send one upon request.

Fulcrum Macro Advisors in the Media

Watch, listen to, and read Fulcrum Macro Advisors Founder and Managing Partner Frank Kelly’s latest insights via his presentations, interviews, publications, and other media.

Be sure to follow Frank and Fulcrum Macro Advisors on X, SubStack, LinkedIn, and Instagram. Also, be sure to check out the Fulcrum Macro Advisors YouTube Channel to see Frank's latest presentations, media interviews, and moderated talks.

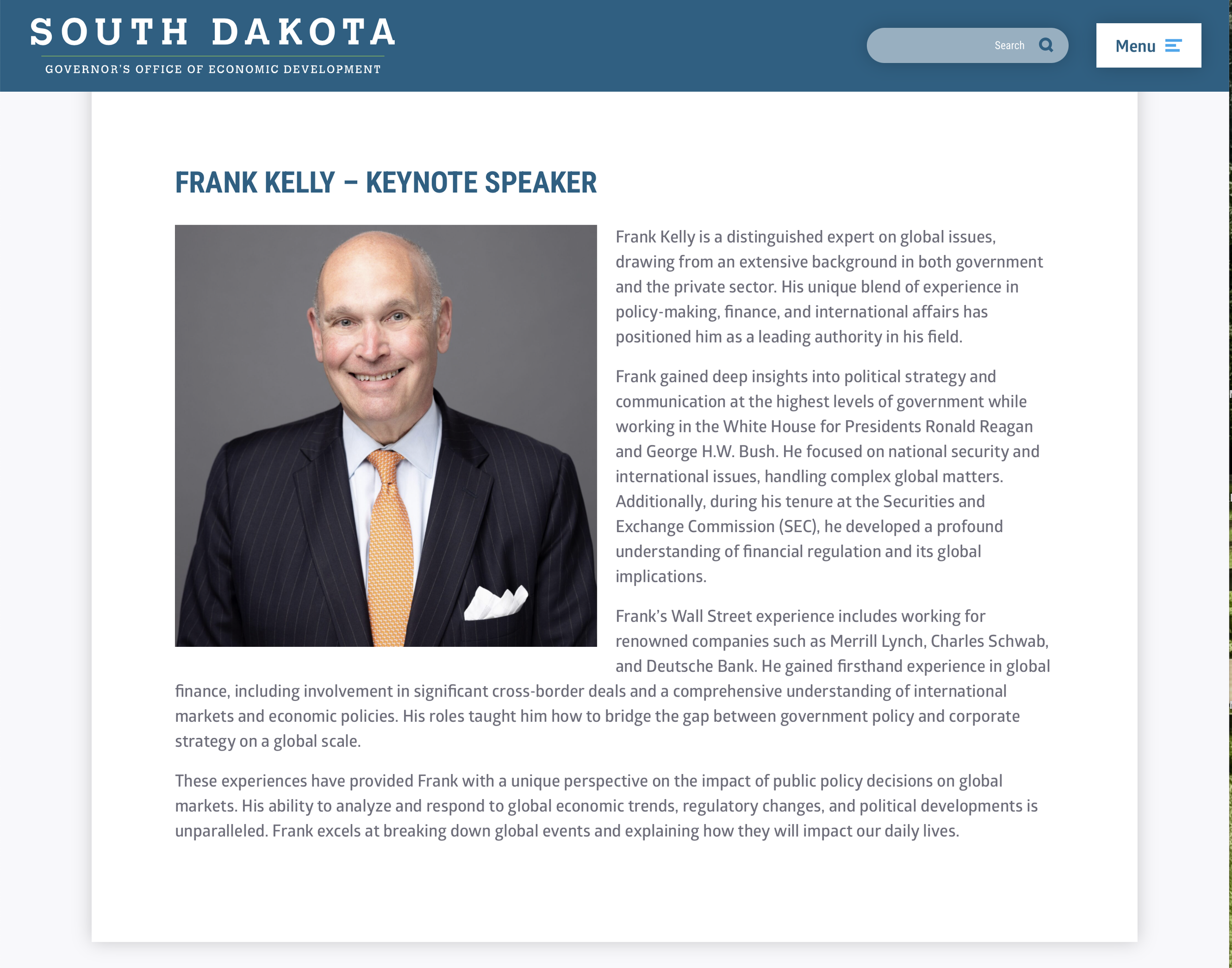

South Dakota 2026 Governors Conference on Economic Development

February 25 - 26, 2026

I am excited and deeply honored to be speaking at the upcoming South Dakota Governor's Economic Development Conference in Pierre on February 25th. South Dakota is a land of great opportunity, matching its spectacular beauty. Mining, oil, natural gas, and agriculture are mainstay businesses - but it is the tech future that is rightly generating tremendous excitement. This is going to be a great event. If you want to attend, it is not too late to register, which you can do by going to this LINK.

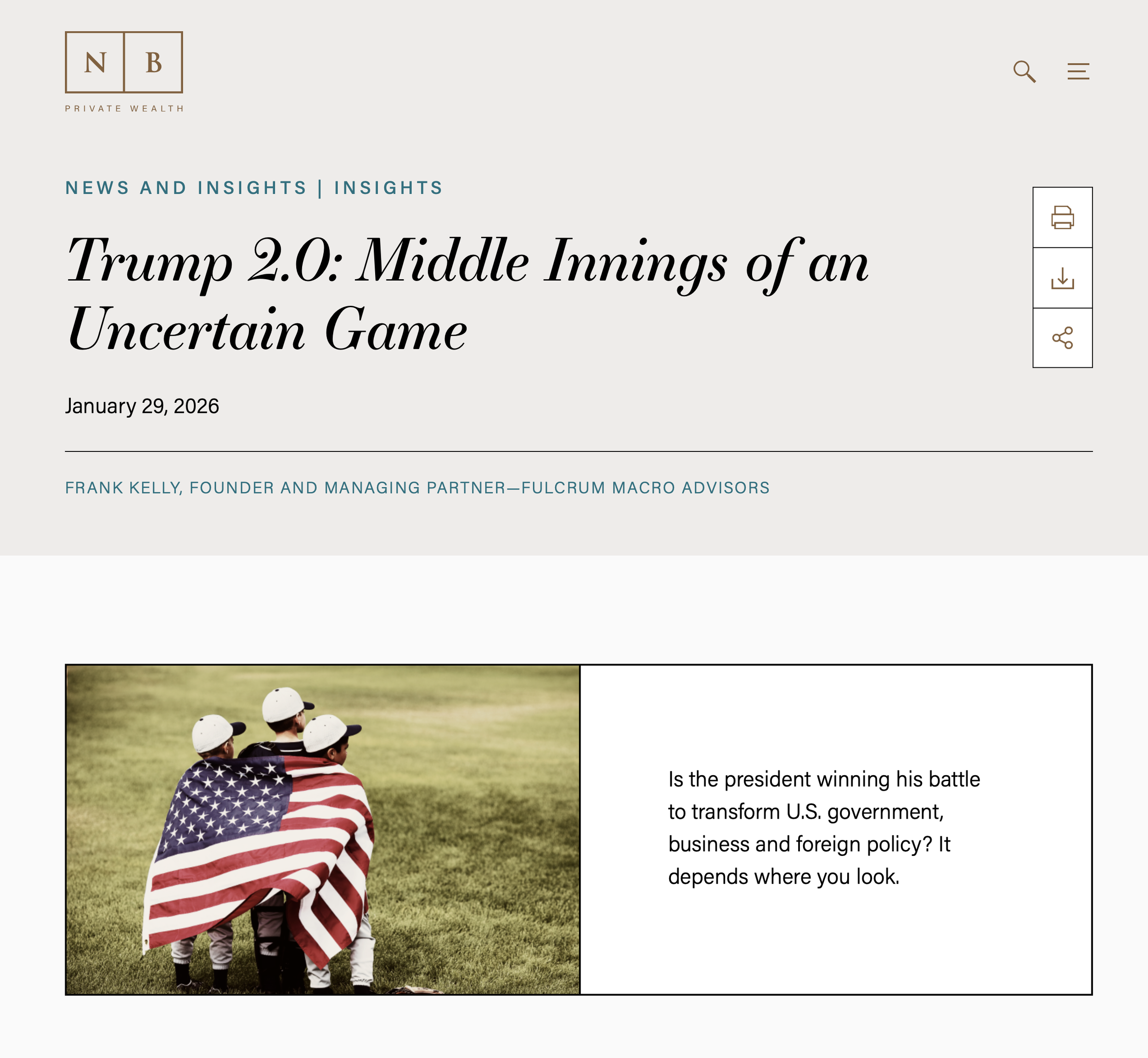

Neuberger Berman Private Bank’s Aspire Magazine

Trump 2.0: Middle Innings of An Uncertain Game

It was a pleasure to be recently interviewed by Neuberger Berman Private Bank’s outstanding magazine, Aspire, about developments in the Trump Administration and how the President’s policies might impact markets.

You can read the full interview here.

J Black Financial Group Webinar

Geopolitics: A View From Washington

January 15, 2026 - It was a great pleasure speaking with John Black, Founder and CEO of the J Black Group, a Northwestern Mutual-affiliated boutique wealth management firm that specializes in liquidity event planning and comprehensive wealth management, about the extraordinarily vibrant and at times bewildering geopolitical landscape. John asked great questions, piercing the political fog to identify the precise issues impacting financial markets and investors. The discussion was tremendous fun, and John and his team run a superb operation!

DWS Analysis and 2026 Outlook Webinar

January 6, 2026 - Delighted to join the brilliant DWS Chief Investment Officer David Bianco and DWS Head of Fixed Income George Catrambone to discuss all the major geopolitical and geoeconomic events and issues of 2026!

Hope you can join us!

Capitol Account

Experts' Take: What's in Store for Financial Regulation This Year

Friday, January 9, 2026 - I was delighted to be interviewed by the pre-eminent financial services regulatory publication, Capitol Account, in Washington, DC, to share my views on the major financial services-related issues in 2026. You can read my views below.

If you are interested in financial regulation and all the politics around it, this is a must-read publication and well worth the subscription.

International Economy Magazine

With EU-Bonds, Is Europe Playing With Fire?

I was pleased and honored to be asked by International Economy Magazine to contribute to a feature on the European Union’s use of EU Bonds.

The topic reached a new plateau of discussion earlier this year when France’s Finance Minister Eric Lombard warned that his country might be forced to turn to the IMF for a bailout amid growing fiscal troubles and a dysfunctional government. Of course, bailing out advanced industrialized countries like France is not practical, considering the IMF’s overall resources.

But this also raised the question of whether European officials are considering an entirely new approach to fiscal/debt policy management and liquidity?

The first steps to this change in approach, some would argue, came earlier this year when Germany altered its constitution to remove its fiscal debt brake (debt not to exceed 60 percent of GDP). Many officials warned that this change could give the green light to other, financially less stable European countries that want to increase their already bloated budgets.

Taking it a step further in understanding what is potentially in play, other questions quickly arise, including:

Is the next step in this new policy the beginning of even more widespread use of EU bonds? The European Commission is pushing for further issuance of EU bonds in the name of the European Union. The volume of outstanding EU Bonds has already reached €650 billion. Yet, from a legal standpoint, EU bonds do not fall within the category of government bonds, principally because the European Union is not permitted to incur its own debt and has only limited scope to raise its own revenues. The EU member states bear responsibility jointly and severally, meaning one or more member states can be held responsible for the amount of a bond issue if other, financially weaker members cannot meet their obligations.

What could be the consequences of these controversial changes? Will these moves enhance the liquidity of European financial markets, which could be particularly useful at a time when European governments are rearming militarily? Note that the European high command also hopes to “professionalize” Europe’s capital markets by having Eurex Futures launch EU-Bond futures.

And most importantly, is this new approach involving EU bonds and other changes a welcome development or a controversial gimmick that could jeopardize the credibility of European financial markets? After all, it is still undecided whether such bonds used in this way contradict the “no-bailout” clause of Article 125 of the EU treaty. Are these wise moves, or are European policymakers playing with fire?

I took a shot at addressing these questions in a short essay alongside a distinguished group of economists and political analysts. You can read all the pieces HERE at The International Economy Magazine Website. Otherwise, my piece is below:

The European Union needs to move forward and quickly on utilizing EU-Bonds

FRANCIS J. KELLY

Founder & Managing Partner, Fulcrum Macro Advisors

The question of whether the European Union can and should pursue greater reliance on EU Bonds is particularly timely, as the EU truly grapples with taking the steps necessary for a more robust common defense and greater competitive capabilities. To date, there is clearly an appetite among financial markets for them as well. Indeed, a new €175 billion double-tranche was issued on October 8, bringing the overall market size to more than €650 billion. I would argue that the successful placement alone answers the question of whether EU bonds are good for liquidity in European financial markets.

However, to the broader question of the European Union more robustly using EU-Bonds (and settling the questions and challenges around the EU Treaty’s Article 25), it really can only be answered after other, more challenging questions are first answered regarding EU leadership. First, are EU leaders truly committed to making the structural changes needed to meet the challenges Mario Draghi outlined in his competitiveness report? And second, who within the European Union is capable of successfully championing the expanded use of EU-Bonds?

Arguably, the answers to those two questions are “yes, sort of” and “no one,” respectively. At the time of this writ- ing, the “Big Three” of the EU power structure—European Commission President Ursula von der Leyen, French President Emmanuel Macron, and German Chancellor Friedrich Merz—are besieged by weak economic outlook reports and growing domestic political challenges (or in the case of von der Leyen, two more no-confidence votes from the EU Parliament—the second round of the year).

Meanwhile, Chancellor Merz—who wisely achieved relief from the debt brake—is now grappling with anemic growth projections for 2026, anticipated to come in around 0.2 percent, with industrial production having dropped to 2005 levels. At the same time, the far-right AfD party’s poll numbers are rising to new heights. Fortunately, the economic outlook is likely to change mid-year 2026, with significantly healthier growth projections for 2027 and beyond.

As for President Macron and France, it seems only a matter of time before new parliamentary elections are called, with a serious risk that Marine Le Pen’s National Rally Party will finally break through and win a parlia- mentary majority—an event that will have massive fiscal and market ramifications for France, which will bleed over to the rest of the European Union.

So, for the near term, it would appear nearly impossible for Merz, Macron, or von der Leyen to lead the charge for greater use of EU-Bonds, meaning the best hope may be the emergence of a broader coalition of EU leaders making the case for a more robust EU bond market.

But the bottom line is that the European Union needs to move forward quickly on using EU bonds more broadly. The global competitive gap is growing by the day. And Russia is proving to be increasingly aggressive and volatile toward EU/NATO nations. All current political and economic challenges aside, the European Union will only lose by not pursuing a broader EU-Bond marketplace.

Nebraska Bankers’ Association Bank Investment & Economic Outlook Conference

Lincoln, Nebraska

November 7, 2025 - I was delighted to have the opportunity to speak at the Nebraska Bankers’ Association’s Annual Bank Investment & Economic Conference. I was supposed to speak in person, but due to the federal government’s shutdown and the reduction in air travel (and air traffic controllers increasingly calling in “sick”, my flight to Lincoln was cancelled. The Bebrask Bankers - being smart, nibble, and very understanding - arranged for me to speak virtually.

Trump's trade policy was top of mind for the attendees, as farmers in the Midwest are being hit hard by China’s retaliatory policy of refusing to buy US agricultural products. As importantly, the current state of play is Big Tech scrambling to move operations—especially data centers—into the region (and Nebraska being a big beneficiary of the move).

A great conversation and further proof of how the supposed “flyover states” are in fact the new “fly to states.” Thank you for having me, Nebraska Bankers Association, and for your understanding of the airline mess!

Northwestern Mutual

Wealth & Investment Management Summit

February 3 - 5, 2025

February 5, 2025 - My great friends at Northwestern Mutual kindly invited me to join them virtually at their annual Wealth & Investment Management Summit being held in Milwaukee, Wisconsin. The meeting brings together the firm’s top 250 financial advisors to discuss the latest on business strategy, market trends, and economic and geopolitical issues.

As you can see from the accompanying photographs, we had a great time discussing the many geopolitical and US political issues challenging investors everywhere. Thank you, Northwestern Mutual, for letting me a part of yourwonderful confderence!

From left to right, NDRIO Chief Investment Officer Scott Anderson, me, NDRIO Executive Director Jodi Smith, and DWS Managing Director Kevin Sheehan. And that’s the mighty Missouri River in the background!

North Dakota State Investment Board’s Investing with Intent Seminar

Bismarck, North Dakota

October 23, 2025 - I had the delightful opportunity to take part in this outstanding seminar in a fireside chat setting overlooking the mighty Missouri River. North Dakota is a beautiful place—the state's vast splendor is staggering. I had the privilege of driving across a good portion of the state and seeing true natural wonders everywhere.

Our conversation was outstanding and focused on how the current geopolitical outlook and the future of US competitiveness are, in large part, found in North Dakota—a state rich in energy resources and, as they are increasingly discovered by the day, critical minerals essential to technological advances.

I'm deeply grateful to the NDRIO for inviting me to participate. It was an incredibly rewarding trip!

CFA Society of Mexico Breakfast Talk and DWS Roadshow in Mexico City, Mexico

October 15 - 17, 2025 - We had an excellent series of meetings with the leading pension plans and banks in Mexico City this week. My thanks to my friends at DWS for arranging a superb and highly enlightening series of meetings and opportunities for me to speak, including to the CFA Society of Mexico.

NeuGroup US Regional Finance & Treasury Leaders 2025 H2 Pilot Meeting

October 8, 2025 - A fascinating and highly interactive session with an outstanding group of Fortune 500 corporate treasurers at the Deutsche Bank Center in New York today.

The topics were about as wide-ranging as you can imagine: Russia/Ukraine, the future of US-Canada trade, the selection of the next Federal Reserve Board chair, and the SEC’s move to twice-a-year reporting and away from quarterly reporting. etc.

Thank you, NeuGroup, for having me join you today. Really fantastic time!

The HealthTech Community Hospital Leadership Conference

Lexington, Kentucky

September 8, 2025 - I was given a very unique opportunity today: To speak to a select group of community hospital executives about what is going on in Washington and the world, how it is impacting healthcare overall, the challenges of technology, and why the global race for technological dominance is directly impacting their work.

It was an excellent discussion, and the issues ranged from trade to elections to healthcare policy - especially the future of Medicaid. These folks are deeply dedicated to providing the best, most humane care possible to their rural communities - they are true heroes. And I have to be candid: It was a challenge for me to get ready for this talk, but one I am deeply grateful for having the chance to engage in. Thank you, HealthTech, for having me. You can access my presentation below.

National Credit Union Managers Association’s Fall Conference

Quebec, Canada

August 30 - September 3, 2025

What a magnificent city to have the honor and pleasure to speak in! The NCUMA held its annual fall conference in Quebec at the historic and stunning Fairmont Le Château Frontenac. Gathering close to 200 leaders from credit unions in the United States and Canada (Fun Fact: The very first credit union was started in Quebec in 1901 - the "La Caisse Populaire de Lévis").

This was a special event: we conducted two 90-minute presentations, each with a 15-minute break in the middle. The first session focused on geopolitics, global demographic trends, and the geoeconomic outlook. Then, in the second session, we discussed what we had covered in the first session, “home” to America, and how it is all directly impacting our communities and small businesses - all of which credit unions serve as the financial lifeblood to each and every one of them.

It is an unusually long presentation, but we had to cover a lot, and I have to say, it was a lot of fun to prepare. You can access the entire presentation below. A huge thank you to Kathy Budd and the NCUMA team for inviting me and letting me be part of this outstanding conference!

Federal Home Loan Bank Board - Indianapolis Investor Symposium

Indianapolis, Indiana

August 21, 2025 - It was again a great pleasure and honor to speak at the Federal Home Loan Bank Board - Indianapolis Investor Symposium, this time in the booming town of Indianapolis! A tremendous group of folks who asked brilliant questions, especially regarding how the geopolitical and geoeconomic issues we are seeing now are hitting Indiana and the greater Midwest, all of which led to some fantastic discussions. Thank you, FHLB-I, for having in your wonderful hometown and letting meet your many investors. Once again, I learned a great deal about what is going on in the heart of America’s economy. You can access my full presentation HERE.

Federal Home Loan Bank of Indianapolis Investor Symposium

Lansing, Michigan

August 12, 2025 - It was an honor and a pleasure to be asked back to speak at the Federal Home Loan Bank Board of Indianapolis Investor Symposium in Lansing, Michigan. The FHLBI does an extraordinary job of reaching out to all its investors in its geographic region, bringing timely and smart industry updates and market insights.

It was great to be in Lansing (home of the Michigan State University Trojans!) and to spend time interacting with the attendees. I have to say, when you go to an FHLBI event and listen to the questions and insights of their investors, it is like listening to the heartbeat of the American economy. I walk out of every one of these sessions a lot smarter than when I walked in. Thank you for having me!

And thank you to our super-star summer intern, Samantha Valentino, for your great work helping to prepare my presentation!

Counselors of Real Estate Geopolitical Chess: Succeeding in an Uncertain World

July 16, 2025 - I was asked back by my friends at the Counselors of Real Estate to join them for a lunchtime session to discuss both the geopolitical outlook and the U.S. political and regulatory outlook, as well as how they are impacting commercial real estate. From the recently passed One Big Beautiful Bill Act, which has significant tax implications for real estate, to tariffs and the impending surge of foreign direct investment into the U.S., much of it focused on data centers to support AI, there is not be more going on than right now. It was a great time, brilliantly hosted by David Levy. Take a listen. I hope you find it informative and enjoyable!

Northwestern Mutual/McGill Junge Group 2nd Quarter 2025 Market Commentary Featuring Frank Kelly

My great friend, Ed McGill, was kind enough to invite me to join him and Jason Kirchhoff, McGill Junge’s Director of Investments and all around renaissance man to discuss the state of the markets, how the ongoing tariff wars and other geopolitical events are impacting investment decisions, and what we should be thinking of in the coming year. A really great time with both Ed and Jason. I hope you find it interesting and useful!

The International Economy Magazine

Is Germany Without the Debt Brake on the Right Track?

June 2025 Edition - I was delighted to contribute to International Economy Magazine on " Is Germany Without the Debt Brake on the Right Track?" You can read my contribution HERE, along with the excellent assessments of other economic luminaries far smarter than I am.

My sense is that, between Russia’s aggression against Ukraine and ominous threats against the rest of Eastern Europe and President Trump’s lukewarm (at best) commitment to the defense of Europe, we are going to see a significant economic and military turnaround in Europe. In essence, Trump will - perhaps unintentionally, perhaps intentionally — “Make Europe Great Again” as a global economic bloc while building up its military to world-class standards. And it will be Germany leading the way. Berlin made that intention perfectly clear earlier this year with an initial down payment of €100 billion for defense and infrastructure, most of which will be tech-based, resulting in enormous commercial spin-off benefits. Germany says it will take them 10 years to build up their military - I am betting it will be closer to five years, and with it will come the birth of German tech giants that will increasingly compete with US tech giants. Only time will tell, but one thing is certain: The economic and political status quo is over, and a new dawn is breaking over Europe that will likely be quite positive for investors and for democracy overall.

DWS Xtrackers Webinar:

What to Expect from the White House?

June 10, 2025 — I’m very much looking forward to this webinar with my old friends John O’Connor and Stefan Marx (I’ve known and worked with Stefan for more than 20 years now!).

Lots to cover from what President Trump is planning next with tariffs as Congress battles to get his “One Big Beautiful Bill” enacted into law to Ukraine and Germany’s transformation under their new Chancellor, Friedrich Merz. And of course, what is going on in China and the rest of Asia. It’s going to be a packed hour! Hope you can join us!

KingsRock Advisory Morning Meeting

June 9, 2025 - It was great fun to join the KingsRock Morning Meeting to talk with former Trump Deputy National Security Advisor K.T. McFarland to dicuss the geopoltical issues impacting markets now and what we are likely to see in the coming weeks and months - the status of the Russian War on Ukraine, the status of the Iranian nuclear talks, US-China trade talks, and the upcoming G7 Leaders meeting in Canada. K.T. is a highly seasoned professional, having served as an aide in the Nixon, Reagan, and Trump Administrations, and brings brilliant insights to every conversation.

KingsRock was founded by my old friend and colleague, Hakan Wohlen. He’s done a fantastic job building up KingsRock from scratch into a successful and very smart boutique investment banking firm.

Central Iowa Business Conference 2025

Meadows Event Center - Altoona, Iowa

May 22, 2025 - Traveling to Iowa has become one of my favorite things to do. The state is beautiful, and its people embody the very best of Midwest values: kind, hardworking, practical, and keenly intelligent. Therefore, having the wonderful opportunity to speak at the Central Iowa Business Conference 2025 sponsored by the Urbandale Chamber of Commerce was a truly special event for me.

Iowa is undergoing a rapid transformation, and much of it is evident in central Iowa. Big Tech has discovered all those virtues I mentioned above and is building tech centers, data centers, and R&D facilities at a stunning pace. I’m told that Microsoft runs all the “Call of Duty” and “Minecraft” game activities globally at their data centers just outside of Des Moines. When you consider that, on average, 204.33 million people play Minecraft around the world monthly and, at its daily peak, 55.7 million daily, that gives you some insight into the capacity of the data centers in Des Moines.

Being able to speak with more than 300 entrepreneurs who are building businesses that support much of the tech sector, as well as the overall growing population of Iowa, was a tremendous opportunity to learn as much as share what I’m seeing geopolitically and economically. Thank you, Urbandale Chamber, for bringing me out. The pleasure was truly all mine!

The Iowa Manufacturing Podcast: “From Classrooms to Cartels: How Policy, Education, & Energy Shape Global Well-Being”

May 26, 2025 - I was delighted to be a guest on the Iowa Manufacturing Podcast this past week to talk all things geopolitical and economic and their direct impact on Iowa’s growing manufacturing and services industries.

Also on the podcast, just before my interview was Dr. Ian Roberts, the Superintendent of Des Moines Public Schools. As you can see from his impressive bio below, he has a vast array of responsibilities critical to the economic and societal success of not just Des Moines, but all of Iowa. His interview is fascinating and well worth listening to.

You can listen to the Podcast via this LINK or the link below. Or you can listen via Apple Podcasts, Spotify, iHeartRadio, or Amazon Music. Thank you for having me!

LED: Leadership with Ed McGill

What a thrill and honor to be a guest on the LED: Leadership with Ed McGill podcast. Ed is a brilliant and incredibly successful financial advisor in Des Moines, Iowa. McGill-Junge Wealth Management, part of the Northwestern Mutual Private Client Group, is a large operation. Ed is dedicated to serving clients in ways we rarely see today - authentic leadership. And with that in mind, Ed understands that leadership is a talent that needs to be nurtured and encouraged for the betterment of society and the world.

Please take a listen, and I hope you find it helpful and inspiring!

DWS’s 2025 Americas Real Estate Client Conference

Scottsdale, Arizona

May 7 - 9, 2025 - RREEF has proven over and over again to be the preeminent brand in commercial real estate asset management. As part of DWS, it has been an honor and a joy to work with all the folks who do such a superlative job in one of the most competitive and challenging market segments out there.

I was delighted to speak at the conference in a fireside chat with JJ Wilczewski, DWS’s Global Head of Institutional Investments, about how the markets are fairing in such turbulent geopolitical storms. Thank you for having me - it was a fantastic time!

J. P. Morgan Investor Seminar

IMF/World Bank Spring Meetings 2025

Washington, D.C.

April 22, 2025 - It was once again my great pleasure to be part of J.P. Morgan’s annual IMF/World Bank Investor Seminar in Washington, D.C.

JPM puts together a powerhouse event that spans two full days and brings together the biggest and most powerful names in finance and politics to address the issues facing markets today. I was delighted to join Charles Meyers, Chair and Founder of Signum Global Advisors, Daniel Silverberg of Capstone, and Elizabeth Herman of JPM’s Government Relations team on a panel brilliantly moderated by Amy Ho of JPM’s Strategic Research team.

Thank you, Joyce Chang and the whole JPM team, for having me again! It was a great time!

From left to right, JPM’s Elizabeth Herman, Capstone’s Daniel Silverberg, Signum’s Charles Meyers, JPM’s Amy Ho, and Frank Kelly.

Neuberger Berman Private Wealth Magazine

Aspire - Spring Edition

I was honored to be interviewed for Neuberger Berman’s Private Bank’s spring edition of their magazine, Aspire. You can read the full interview HERE.

DWS Webinar on Tariffs & the Markets

April 9, 2025—It was great to join my friend George Catrambone, Head of Fixed Income for DWS in the Americas, to discuss the rapidly changing tariff environment. This constantly changing scenario is driving markets wild, but hopefully, we brought some clarity to what markets can expect and when.

If you want to hear the replay, contact your DWS representative or go to DWS’s website.

DWS Roundtable and Reception

Chicago, Illinois

April 2, 2025

It was a fantastic time joining DWS CEO Stefan Hoops and John Vojticek, DWS’s Global Head of Liquid Real Assets, at this roundtable hosted by JJ Wilczewski in Chicago in April. We covered the globe of issues - Trump’s new tariffs (which were being announced as we talked!), global market reactions, where there is opportunity for investors, and how to best prepare for the wild world ahead of us.

From left to right, JJ Wiczewski, DWS Global Head of Institutional, me, DWS CEO Stefan Hoops, and DWS Head of Liquid Real Assets John Vojitcek.

Pitcairn Palm Beach Markets & Policy Luncheon

April 1, 2025—It was an honor and a great pleasure to join the massive brain trust of Pitcairn, one of the world’s leading private wealth management firms, in Palm Beach, Florida, this past week.

The event was held at the beautiful Brazilian Court Hotel on a beautiful Florida day. Our panel was made up of Pitcairn’s Chief Global Strategist Rick Pitcairn, Chief Financial Officer Nathan Sonneberg, Managing Director for Wealth Strategies Jennifer Proper, and myself.

Special thanks to my brilliant friend, Jay Goetschius, Managing Director and head of Pitcairn’s Florida operations for making this wonderful event a reality!

Charlotte ETF Roundtable: Election Outcome & the Markets

March 27, 2025 — Delighted to have been a part of the Charlotte, North Carolina, ETF Roundtable. ETFs are a critical component of the financial markets. A wonderful conversation in the spectacular (and very fun) InTown Golf Club in Charlotte!

Federal Home Loan Bank of Indianapolis Elite Member Conference

Palm Beach, Florida

February 24, 2025 - What a great treat to have the opportunity to speak at the FHLB-I Elite Member Conference again at the beautiful Breakers Hotel in Palm Beach!

Talking and hearing from top leaders who are working with the FHLB-I is incredible. I hear about the many issues and opportunities they are seeing in the US and in their region. Sharing my thoughts on geopolitical and national political and regulatory trends and issues was a great honor. Thank you for having me!

CFA Society Austin Annual Dinner 2025

AT&T Hotel and Conference Center

February 20, 2025

I was honored and delighted to be the keynote speaker at the 2025 Annual CFA Society of Austin Annual Dinner in Austin, Texas!

As DWS’s Senior Political Strategist, speaking to more than 400 incredibly engaged and energized CFAs was great - a tremendous discussion covering a wide range of issues. I’ve got my presentation below if you want to see it. Thank you again, CFA Society of Austin!

J.P. Morgan Strategic Research Webinar:

Trump’s Second Act: Regime Change and What Lies Ahead

February 6, 2025 - I was delighted to join again with Joyce Chang, J.P. Morgan’s Chair of Global Research, and my friends Charles Myers and Dan Silverberg to discuss “ Trump’s Second Act: Regime Change and What Lies Ahead.”

More than 1,500 institutional investors joined us to hear a lively discussion as we delved into everything on the Trump radar screen: Tariffs, taxes, budget, the Middle East and Trump’s Gaza plan, Ukraine, and China policy. We also went through Trump’s unexpected focus on Latin America and the implications for markets. A tremendously fun event!

SSI Securities Gateway to Vietnam Exclusive Call

“Trump & Tariffs”

February 6, 2025 - It was my great privilege to participate in the SSI Securities video call for clients to discuss what markets should expect from the new Trump Administration, especially concerning his use of tariffs.

I was especially honored to share the stage with Pham Luu Hung, Chief Economist of SSI Securities, and Eva Huan Yi, Chief Economist for Huatia Securities (China).

Incredibly, we had more than 166,000 viewers for our call! My old friend, Tom Nguyen, did a superb job hosting the call and helping us drill down into the risks and opportunities for investors and what the future of the U.S.-Vietnamese relationship will be. You can access the SSI report below to read a summary of the call.

There was also a great new report in Vietnam’s leading financial publication, The Investor Magazine, of the call. A screenshot of my comments and a link to the story are to the left.

Federal Home Loan Bank’s 2025 System Sales & Marketing Conference

San Antonio, Texas

February 4, 2025 - It was my great pleasure to speak at the FHLBanks 2025 Sales & Marketing Conference in San Antonio. What a great group of folks! The questions were superb and we had a wonderful conversation on a host of issues ranging from tax policy to geopolitics. Thank you, FHLB, for having me!

You can see my presentation below.

Capital Account

The Outlook for Financial Regulation as Trump Takes Office

January 18, 2025

I was delighted to be interviewed by Washington’s best financial reporter, Rob Schmidt, for his overview of how the new Trump Administration will impact financial regulation and Wall Street in general. Below are excerpts from my interview. I cannot recommend Rob’s publication enough - it is the pinnacle of excellent, cutting-edge reporting and the one place to go to understand the intersection of Wall Street and Washington.

Northwestern Mutual/McGill Junge Wealth Management

“Ask the Experts: Global Economic Outlook 2025 Webinar”

December 17, 2025 - I was delighted to once again join my dear friend, Ed McGill, in discussing the state of the global economy and the geopolitical outlook in 2025, what we might expect from the incoming Trump Administration in its first 100 days, and what sectors will likely most be impacted, and how investors can best prepare.

Thank you, Ed, for having me back! Ed’s team is a powerhouse wealth management firm, managing billions for investors all around the U.S. On top of all that, Ed and his partner, Ross Junge, have assembled a team of super-stars. An amazing operation!

UBS Trending

What Might Trump’s First 100 Days Look Like?

On behalf of DWS, I was delighted to be a guest on UBS Trending, the outstanding and highly informative interview program hosted by the great Anthony Pastore. We discussed what the first 100 days of the Trump Administration might look like and how this is more like Trump 4.0 instead of Trump 2.0 - meaning, President Trump has used the last four years to learn, study, and prepare for this term in office. But, he is also moving at a rate of speed like no other newly elected president because he fully understands he is also a Lame Duck. You can watch the full interview below. Thank you, UBS, for having me, and thank you, DWS, for arranging this tremendously fun interview!

THE LINK TO THE INTERVIEW IS HERE.

Macro Hive: Frank Kelly on Why Everyone Underestimates Trump

December 5, 2024 — It was terrific fun to be invited by my old colleague and friend, Bilal Hafeez, on his Macro Hive Podcast. In this wide-ranging discussion, we discussed Reagan vs. Trump, Why Trump won the 2024 election, It is Trump 4.0, not Trump 2.0!, Views on cabinet picks from Bessent to Hegseth, Thoughts on DOGE and Musk, Tax policy, US vs. Europe/China/Mexico/Canada, Likely policy on Ukraine, Middle East, and China. And we finished it off by talking about my favorite books: Animal Farm (Orwell), Gates of Fire (Pressfield), Rise Of Theodore Roosevelt (Morris)

Bilal has built Macro Hive into a powerhouse boutique research firm based in London. He did all this after a very distinguished career on Wall Street and other major markets around the world. His resume is amazing: He was Global Head of International Fixed Income Strategy at Nomura between 2016 and 2019 and held various senior roles at Deutsche Bank between 2002 and 201,5, including Head of Multi-Asset Research, Advisor to the CEO, Head of Asia Research in Singapore, and Global Head of Foreign Exchange Research. Bilal started his career at JP Morgan in 1998 and was rated the #1 market strategist by Euromoney and Institutional Investor between 2004 and 2013.

You can watch the full interview below. Thank you, Bilal! It was a true honor and really fun talking with you!

Handelssblatt

Paul Atkins: The future chief is the crypto industry’s preferred candidate

December 5, 2024 - I was honored and delighted to be interviewed by Handelsblatt, one of Germahy’s largest newspapers, on the nomination of my old and great friend, Paul Atkins, as the new Chairman of the U.S. Securities and Exhange Commission.

As I told the reporter:

“He is considered a prudent and smart regulator. “He is very thorough and careful and looks at regulatory risks from every angle,” says Frank Kelly, founder of the consulting firm Fulcrum Macro Advisors, who knows him well. “

Congratulations, Paul! you are going to be an outstanding SEC Chair!

You can read the full article HERE.

The FLAR XXXVIII Conference of Central Banks and Official Institutions

Cartagena, Colombia

November 20 - 22, 2024

FLAR (Fondo Latinoamericano De Reservas)—the central bank of Latin America’s central banks—brings together the central bank chiefs and senior staff of Latin America’s central banks. It was a tremendous honor to once again have the opportunity to address this distinguished group in Cartagena.

My presentation starts at the 56-minute mark via the link below. We held a panel discussion after my talk, which was fun and covered a lot of issues.

The conference is one of the more thought-provoking and exciting events, illuminating everything happening in the Hemisphere now and in the future. Thank you for having me back, FLAR, and thank you, DWS, for once again arranging for me to speak!

From left to right: DWS’ Aiviel Sanchez, Ana María Rodríguez, Stella Gonzales Vigil, Mary Wallace, and myself at the DWS Rep Office Reception held at the J.W. Marriott in Bogáta on November 19, 2024.

Opening of the DWS Rep Office in Colombia

November 19, 2024 — It was my great pleasure and honor to visit Colombia last week for meetings in Bogáta and Cartenga, all arranged by DWS. Having the opportunity to meet with the leadership of the nation’s pensions funds, bank insurance fund, and other financial leaders was both timely and fascinating. Colombia is emerging as a major hub for technology in the region. Foreign investors are increasingly looking to Colombia as a superb choice to invest for the long term.

While there, I was honored to speak at the DWS Rep Office opening reception. DWS is expanding its operations throughout the region, particularly in Colombia. Colombian investors are deeply focused on geopolitical developments, particularly between the US and China and the upcoming review of the USMCA. There was a lot to discuss with the attendees, and I suspect there will be even more to cover in the months to come.

Handelsblatt: Donald Trump Appoints Howard Lutnick as Secretary of Commerce

November 19, 2024 - I was pleased to be interviewed by Handelsblatt (one of Germany’s most prominent newspapers) about the implications of President-elect Trump’s nomination of Cantor Fitzgerald CEO Howard Lutnick as Commerce Secretary. Below is a translation of the article:

The future US President Donald Trump wants to make his billionaire advisor Howard Lutnick Secretary of Commerce. Trump announced this on Tuesday on his platform Truth SocialAs Commerce Secretary, he would play a key role in implementing Trump's plans to increase and enforce tariffs.

In an additional role, Lutnick will be "directly" responsible for the position of US Trade Representative, Trump explained. He left open what this structure will look like in practice. Normally, the Secretary of Commerce and the Trade Representative (USTR = United States Trade Representative) are two separate positions in the US government. Either way, Lutnick will take on a key role in the future trade policy of the USA .

Lutnick will lead a sprawling agency involved in financing new computer chip factories, imposing trade restrictions, publishing economic data and even monitoring the weather. It's also a position where connections to corporate executives and the business community are crucial.

The personnel decision comes as a surprise. Lutnick, CEO of the New York investment bank Cantor Fitzgerald, was originally considered for the position of Treasury Secretary. The eccentric banker was a major donor during the election campaign and is leading Trump's transition team, which is preparing for his return to the White House.

Recently, however, there has been some resentment around Lutnick . Trump is annoyed with him and has the feeling that Lutnick is trying to influence the personnel debates in his favor, US media reported unanimously on Monday. Trump's adviser Elon Musk would have liked to see Lutnick as finance minister, as he said on his short message service X. But Trump is now looking for other candidates.

Howard Lutnick supports higher tariffs

The US president-elect is putting the investment banker in a central role to shape the economic policy of the future government. Lutnick would lead a department that focuses on issues such as economic growth and tariffs.

The billionaire has been a strong advocate for Trump's comprehensive tariff policy , which provides for import tariffs on all imports into the USA. They are intended to motivate foreign companies to produce more in the USA and to create jobs and investments locally.

Howard Lutnick at an event with Donald Trump.Photo: AP

However, he has a more nuanced view of the tariffs than Trump, as Lutnick said in September on the US stock exchange channel CNBCexplained. The USA earns "quite a lot of money" from tariffs. At the same time, they are primarily a means of negotiating with other countries.

Countries that impose higher tariffs on imports from the USA would have to prepare for tough discussions. "But if we don't produce certain things in the USA, it makes no sense to impose import tariffs on them," said the 63-year-old.

As Secretary of Commerce, Howard Lutnick would potentially have a lot of influence.

With his long experience in the financial world, he would be particularly well suited for the post of Secretary of Commerce, believes Frank Kelly, founder of the consulting firm Fulcrum Macro Advisors. The investment bank Cantor Fitzgerald, headed by Lutnick, specializes in bond markets and is also very active in Europe.

"So Lutnick probably has a much better understanding of the economies in the various European countries, their political leadership and the issues that need to be discussed with the United States," Kelly said. Lutnick could therefore have even more influence as Commerce Secretary than in the Treasury Department.

If Donald Trump has his way, investment banker and billionaire Howard Lutnick will become the next United States Secretary of Commerce. This will cement the image of a tough China stance by the next US administration.

The US Department of Commerce is a hodgepodge of agencies, from economic development to economic sanctions and tariffs. During Trump's first term in office, it had relatively little influence because then-Secretary Wilbur Ross was skeptical about punitive tariffs - which were then implemented under the leadership of the National Security Council in the White House and then-Trade Representative Robert Lighthizer.

However, the ministry's influence in the coming administration could grow again, for example when it comes to reversing Joe Biden's industrial policy.

Long experience on Wall Street

Lutnick is a colorful figure on Wall Street. He started at Cantor Fitzgerald in 1983, straight out of college, and quickly developed a close relationship with the boutique investment bank's founder, Bernard Cantor. He was promoted to CEO in 1991.

Lutnick has also advised the future president on crypto issues. Cantor Fitzgerald manages funds from the controversial cryptocurrency Tether and has a keen interest in crypto-friendly regulation. The investment banker accompanied the president during his appearance at a Bitcoin conference in Nashville in the summer.

American Council on Life Insurance Senior Investment Managers Seminar 2024

Santa Barbara, California

November 11, 2024 — I loved being in beautiful Santa Barbara today to speak at the ACLI Senior Investment Managers Seminar! There is so much going on this week, with the G20 Leaders meeting in Brazil, the COP26 meeting in Azerbaijan, the APEC Summit in Peru, and President Biden hosting President-elect Trump at the White House for lunch on Wednesday. What a sea change we are going through!

The Clearing House Annual Conference 2024

I Will Be Moderating An All-Star Panel Entitled:

“The Votes Are In: Reviewing the 2024 Election Cycle, Outcomes, and the Road Ahead

November 13, 2024 — I had the greatest time moderating this All-Star panel of John Heilemann, Mark McKinnon, and Jennifer Palmieri at the Clearing House Annual Conference 2024 in New York. It turned out to be national newsmaking event, too, when I asked Jen Palmieri why Vice President Kamala Harris decided not to appear on the Joe Rogan podcast. Jen served as a senior advisor to the Harris campaign.

She told us that she favored Harris appearing on the show - one that would hit tens of millions of listeners who tend to be highly independent thinkers (Note: When former President Trump appeared, he had more than 40 million viewers just on the Youtube channel alone). So why not do it? Because a large segment of the campaign staff - all extremely Progressive in their views - strongly objected to Harris appearing on a show with Rogan, who they claimed was a racist, misogynist, and homophobic (extraordinary and, as far as I’m concerned, completely false charges). It ended up hurting Harris quite significantly during the campaign.

Again, it was a great event. Thank you, Clearing House, for asking me to moderate this great event!

You can find out more about the conference HERE.

From left to right, Frank Kelly, John Heilmann, Jen Palmieri, and Mark McKinnon

SSI Securities (Vietnam):

Post U.S. Election - Impact and Implications for Vietnam

November 12, 2024 - I’m excited to join my old friend, Tom Nguyen, again to talk about the implications of last week’s U.S. elections on Vietnam and the greater Indo-Pacific Region. This is going to be both an honor and great fun to talking to hundreds of Vietnam’s business leaders and entrepreneurs. Thank you, Tom, for having me join!

Nebraska Bankers Association’s

Bank Investment & Economic Outlook Conference

Lincoln, Nebraska

November 7, 2024 - I had a fantastic time speaking at the Nebraska Bankers Association’s Annual Bank Investment & Economic Outlook Conference. If you really want to understand the pulse of the heartland of America, talk to the bankers - local folks dedicated to supporting the work and families in their community. There are no better economists or political analysts in America, as far as I’m concerned. So, it was a true honor and privilege to join with them today to talk about the U.S. economy, the political outlook, geopolitics, and the opportunities this brings to the banks of Nebraska and their clients.

The RIA Channel and Xtrackers by DWS Presents:

American Post-Election: Where Do We Go From Here

November 6, 2024 — The RIA Channel taped a talk featuring my friend, J. H. Whitney Investment Management Chairman and CEO John O’Connor, and myself discussing the investment implications of the US elections and geopolitical risk for the new Trump Administration. The excellent DWS head of Xtrackers Sales in the US, Amanda Rebello, moderated the session, which offers CE credits for financial professionals.

You can watch the video of the discussion HERE.

Fortune Magazine: American voters were asked about the economy. The overwhelming answer shows why they picked Trump over Harris

November 6, 2024 - The election (for the most part) is over. Several states are still counting presidential and congressional votes. However, the decision has been made, and President Trump is returning to the White House with a stunning reversal of fortunes. I was happy to talk with Fortune Magazine Reporter Paolo Confino about why the election was such a surprise and why voters were not feeling the economic upturn we have begun to see in recent reports. The full story is below:

*****

In the 2024 election, voters made their decision based on what political strategists long considered to be the central issue of every presidential campaign: the economy.

Exit polls on Tuesday showed a stark partisan divide. Some two-thirds (67%) of voters said the condition of the economy was “not good/poor,” and only 32% thought the economy was “excellent/good.” Among those who viewed the economy negatively, 69% were Republicans and 29% were Democrats, according to the same poll. Only 8% of those with a positive outlook on the economy were Republican while a whopping 91% of people who felt the economy was doing well were Democrats.

Those numbers presaged an insurmountable hurdle for the incumbent Democratic Party. And it appears Vice President Kamala Harris couldn’t outrun the negative sentiment.

The actual state of economic play is more complex. Inflation has come down to 2.4% from a high of 9% in June 2022. But that means prices are growing more slowly, not that they’re low.

“[President-elect Donald] Trump is expected to be largely inheriting a pretty decent economy, with one exception, while inflation rates have fallen back down to earth, price levels are still pretty high,” Glenmede vice president of investment strategy Michael Reynolds said. “And that’s ultimately what matters for households.”

Essentially, Americans are still feeling financial pressure in their daily lives. The U.S. recovery from the pandemic-era economic slump outpaced the rest of the world. But that was little solace for voters struggling with high costs of living, a housing shortage, and a general sense of economic malaise.

Broad macroeconomic trends, even if they’re positive, are far removed from people’s everyday lives, according to Frank Kelly, senior political strategist at the investment firm DWS. “The average mom and pop isn’t looking at the Bureau of Labor Statistics report, right?,” he said.

Any macroeconomic gains were entirely overshadowed by voters’ feelings about the dollars and cents in their own personal budgets. In exit polls voters fretted over the cost of virtually every household staple from food in their pantry to gas in their trucks to the price of their medications. An AP poll of 120,000 voters found that roughly nine in 10 were “very” or “somewhat” concerned about grocery prices, and eight in 10 were worried about the cost of medical care and gas.

Trump succeeded in convincing voters concerned about the economy that he was best suited to fix their problems because he spoke plainly, Kelly said. “He sounded as if you were in a Lions Club meeting or a Knights of Columbus meeting and somebody was talking about the economy,” Kelly said. “He really spoke to the common man in his language.”

The economy ranked as a top issue among key voting groups that Trump won away from Harris. Among all Hispanic voters, 70% judged the economy as “poor,” according to a Washington Post exit poll. The same poll showed that Hispanic voters prioritized the economy more so than the overall electorate. Some 40% of Hispanics said the economy was their most important issue; two-thirds of that subset voted for Trump.

Latinos banked on Trump to improve the economy

Trump made major inroads with Hispanic voters during this election cycle. Last election President Joe Biden won Hispanic voters 65-32 against Trump. In 2024 the Trump campaign saw a 25 point swing among Hispanics, which amounted to just a 53-45 win for Harris.

The economy was a top issue in the 2020 election as well, in large part because the pandemic was still raging across the country. Yet despite that, four years ago there was a larger share of the electorate with a positive view of the economy. In 2020, there was an even split between those who thought the economy was strong, and those who thought the opposite, according to CNN exit polls from both elections. One thing that did hold true across elections was that voters with an unfavorable view of the economy punished the incumbent party. In 2020, Biden won voters with a negative view of the economy by 63 points. Harris lost them by 40.

However, the feeling of dissatisfaction wasn’t just limited to the economy. It seemingly touched all aspects of American life, as voters registered dramatic levels of disappointment in the direction of the country.

Forty-three percent of voters said they were dissatisfied with the direction of the country, according to an NBC News exit poll. In that same poll, 29% opted for an even harsher assessment of the country, reporting they were “angry” at where the U.S. was headed. For some Americans their aggravation required cataclysmic change to the status quo. About 30% of voters wanted total upheaval in how the U.S. is run, according to the AP poll.

Handelsblatt: How is Wall Street Preparing for Post-Election Turmoil

No one knows when the election results will be known. Wall Street is preparing for increased volatility. Bonds, dollar trades, and cryptocurrencies are the particular focus.

November 5, 2024 - I was delighted to again be quoted again in Handelsblatt, Germany’s largest business newspaper, on what is causing volatility in the bond markets in advance of today’s elections. My views were (translated from the German):

“Frank Kelly, founder of consulting firm Fulcrum Macro Advisors, points to two early indicators that provide insight into the bond market movement in advance of the next Fed interest rate meeting. The first is growing geopolitical risk. We are all waiting to see what Israel does to Iran (especially since Hezbollah sent a drone attacking Netanyahu’s home - which brought it to a new level with Iran), plus the BRICS meeting that has just started, etc. And, secondly, general nervousness about the overall election - could Republicans not only win the Senate but hold onto the House as new polling data suggest movement down ballot?”

Left to right: Liz Herman, Joyce Change, Bob Cusack, Matt Lapinski, and Frank Kelly

J.P. Morgan Investor Seminar

IMF/World Bank Annual Meeting 2024

October 23, 2024 - Being back at the J.P. Morgan Annual IMF/World Bank Client Seminar as a speaker and panelist was a real thrill! The ever-fantastic (legendary) Joyce Chang ran the conference and moderated our panel, “Final Countdown: Thoughts Before Election Day.” Sitting on a stage with the Hill Editor Bob Cusack, Matt Lapinski, CEO of Crossroads Strategies, and Liz Herman from JPM’s Government Affairs Team was awesome - I think I learned more from them than just about anyone else on the elections and what it means for markets and legislation. Thank you, Joyce, for having me!

Mid-Atlantic Bank Executive Conference

Middleburg, Virginia

November 3, 2024 - I was thrilled to have the opportunity to speak at the Mid-Atlantic Bank Executive Conference, sponsored by the Virginia Bankers Association, the Maryland Bankers Association, the West Virginia Bankers Association, and the Pennsylvania Bankers Association. The event was held at the beautiful Salamander Resort in Middleburg, Virginia. Being in Middleburg in the falls is a very special event, being one of the most beautiful areas in the mid-Atlantic area with horse farms all about the area. Thank you for having me at this great event!

The Counselors of Real Estate Global Seminar:

The Risky World of Geopolitics

October 30, 2024 — I was delighted to have the chance to speak to more than 200 leading commercial real estate investors from around the world on the role geopolitics is having in shaping the commercial real estate space. From the economic and social upheaval in China to the growing risks of expanded war in Ukraine and the Middle East, global investors are increasingly looking to the U.S. as a safe-haven for investing. Moreover, Washington’s growing focus on U.S. national economic security led Congress to pass the CHIPS Act, the Infrastructure bill, and the Inflation Reduction Act — all a boon to the commercial real estate sector as well as an overall ongoing massive fiscal stimulus for the U.S. economy over the coming four to six years.

Thank you for having me join you, CRE. It was a fantastic conversation and I really enjoyed it! You can watch the discussion below.

Handelsblatt:

Interest Rate Concerns Are Back - And Are Stopping the Stock Market Rally

Bond Yields in the US have risen sharply within a month. This is also because a scenario that investors have not yet considered could become a reality in the US.

October 24, 2024 - I was happy to get the chance to discuss what is going on in the bond markets and how they are being influenced by geopolitics, uncertainty about the next Fed meeting, and the upcoming U.S. elections with Handelsblatt, Germany’s largest business newspaper.

“Frank Kelly, managing director of the consulting firm Fulcrum Macro Advisors in Washington, cites the following reasons for the development: 1) movement in advance of the next Fed interest rate meeting, 2) geopolitical risk: Waiting to see what Israel does to Iran (especially since Hezbollah sent a drone attacking Netanyahu’s home - that brought it to a new level with Iran) plus the BRICS meeting that has just started etc. and 3) nervousness about the overall election - could Republicans not only win the Senate but hold onto the House as new polling data suggest movement down ballot?”

You can read the full interview HERE.

DWS CIO View Special Report:

November Surprises: What to Expect, As We Head Into the Homestretch of Another U.S. Electoral Nailbiter

October 29, 2024 - DWS published their Special U.S. Election Report today. I was thrilled to be asked to contribute to DWS Chief Investment Officer Bjorn Jesich’s special report on next week’s election and its likely impact on markets globally. Bjorn is one of the very best CIOs I’ve ever met, and he sees markets globally and locally with incredible perspective and precision. You can access the full report HERE. I hope you find it helpful.

“Voters may have been eager to learn more about Harris, and excited by her candidacy, but it’s unrealistic to expect all of that interest will translate into votes, said Frank Kelly, senior political strategist at the investment firm DWS.

“At this point, this is where independents look at their tribal roots, and they head back to the tribe,” said Frank Kelly, senior political strategist at the investment firm DWS. “So you either don’t vote or you go back to where you came from and a lot of people just end up doing that.”

Fortune Magazine: Donald Trump is eking ahead in the polls as the "excitement’s over’ for Kamala Harris

Fortune Magazine interviewed me today to get my sense of how the presidential election is going with two weeks left in the race. Below is the interview, or you can read the piece online HERE.

****

Donald Trump is eking ahead in the polls as the ‘excitement is over’ for Kamal Harris

by Paolo Confino - October 22, 2024

Former President Donald Trump is pulling ahead in the polls as the presidential election enters its home stretch. A number of news outlets and election forecasters showed Trump overtaking Vice President Kamala Harris.

The race still remains a virtual dead heat, coming down to fine margins in just a few swing states. However, in the campaign’s closing weeks the former president has pulled ahead, perhaps presaging a dramatic return to the White House. The state of the race represents a return to normalcy as Republican-leaning voters that had previously entertained the possibility of crossing political lines and voting for Harris return home in the lead-up to Election Day.

Voters may have been eager to learn more about Harris, and excited by her candidacy, but it’s unrealistic to expect all of that interest will translate into votes, said Frank Kelly, senior political strategist at the investment firm DWS.

“At this point, this is where independents look at their tribal roots, and they head back to the tribe,” said Frank Kelly, senior political strategist at the investment firm DWS. “So you either don’t vote or you go back to where you came from and a lot of people just end up doing that.”

For Harris, the major change in the race is that she is no longer gaining momentum, with gaining being the operative word. “Excitement’s over,” Kelly said.

The vice president surged in the polls after her dramatic entry into the race in July on the back of a rejuvenated Democratic Party and a raft of positive press coverage. In September, after her only televised debate with Trump, Harris was widely considered to have won—and she got a further bump in the polls.

“In some ways, it’s almost like a recalibration,” Kelly said. “She shot ahead because of the excitement, and the ‘vibe,’ and he’s been clawing back that space.”

The Harris campaign has always maintained it expected the race to be extremely close to the point of being tied, while the Trump campaign regularly referred to Harris’s previous leads in the polls as a honeymoon phase that would peter out. FiveThirtyEight gives Trump a 52% chance of winning the election, whereas just a few weeks ago it gave Harris a 58% chance of winning.

That said, the flip-flopping may be more indicative of the state of the race than who actually leads it.

“It’s two sides settling down for long trench warfare, and they’re fighting over dozens of votes, as opposed to tens of thousands of votes,” Kelly said.

The race will come down to the slightest of margins among undecided voters in just a few swing states. Any change in those margins and the race could be altered dramatically. Of the seven swing states still in play—Michigan, Wisconsin, Pennsylvania, Nevada, Arizona, Georgia, and North Carolina—all are within two points, according to FiveThirtyEight.

Nevada, Pennsylvania, and Michigan are all even, according to FiveThirtyEight. In Wisconsin, Harris is up one point against Trump, while Trump is ahead by a point in North Carolina and two points in Georgia and Arizona. Trump’s lead in Georgia appears to be widening to four points, according to a poll of likely voters from the Atlanta Journal-Constitution and the University of Georgia released Tuesday.

Because of the Electoral College, small movements in the polls in swing states can have large ripple effects for the outcome of the election. In a worrying sign for Harris, her polling results in swing states are all declining. In addition to the Georgia poll, Harris’s lead is slipping in the other swing states, according to ABC News. In no swing state, even where she leads, has Harris’s polling lead increased. That means the outcome of swing states could come down to each campaign’s ability to turn out voters in each of the swing states.

The Georgia poll that showed Harris slipping, like many others, found the 2024 election had an unusually high number of voters that were still open to switching their votes. Eight percent of likely voters in the Georgia poll were still undecided, while nationally that number was even higher, with 10% of saying they might still change their minds, according to an NBC poll.

In the closing weeks, Harris seems set on trying to win at least some of these voters to her side. Earlier this week, Harris campaigned with former Republican member of Congress Liz Cheney, who has been an outspoken critic of Trump following the events of Jan. 6, 2021.

Research from the Democratic-aligned research group Blueprint (founded by LinkedIn cofounder Reid Hoffman) found the most convincing closing argument against Trump was that he lacked support from his own Republican cabinet officials, a message that the Harris campaign and its newfound Republican surrogates have been hammering home over the past few days.

“People really need to stop and think about how completely unprecedented that is,” Cheney said during a campaign stop with Harris.

While the outcome of the election remains a toss-up, Americans do sense the magnitude of this election in ways they haven’t before. Americans have shrugged off much of the disillusionment they feel for politics and politicians of either party, at least temporarily. An NBC News poll found 62% of registered voters believe this election will make a “great deal of difference” in their lives.

SMBC Virtual Fireside Chat with SMBC Chief US Economist Joseph Lavorgna

October 24, 2024 - 10:00 a.m. EST

this is going to be a wild one! I am so delighted to be joining my dear old friend, Joe Lavogna, to discuss the upcoming U.S. Elections and how they will shape the markets. Joe is the Chief US Economist for the esteemed Japanese bank SMBC. He and I have been friends for over 25 years, and he’s one of the best Wall Street Economists. I hope you can join us for this call, which will be lively (if you know Joe and me) and fun!

McGill Junge Wealth Management’s “Ask the Experts" Webinar

October 24, 2024 - 12:00 p.m. CT

I was delighted to speak with my great friend, Ed McGill. about the global economic and political outlook. Ed and his partner, Ross Junge, run one of the most successful, innovative, and client-focused wealth management operations I’ve ever seen. Brilliant and laser-focused but also with the genuine culture of a long-time trusted family doctor, McGill Junge has built a large practice by any standard in beautiful Des Moines, Iowa.

You can watch the interview below:

SumZero & Alpha Sense:

Election 2024: Political Impacts on Investment Strategies

October 22 - 2:00 p.m. EST

October 22, 2024 - I greatly enjoyed speaking with my old friend, Griff Marie and Charley Grant from AlphaSense to discuss the 2024 elections and their market implications. So many sectors will likely be impacted, and we'll try to break it down for you. You can watch the entire interview below.

Live Abundantly: Joy & Meaning for those with Down Syndrome

Pelham, New York

October 17, 2024 — I am constantly speaking somewhere about policy, elections, politics, geopolitics, geoeconomic trends, and other issues. But this is where my heart lies, joyfully taken when my late son, Brendan, was born in 1997. Brendan had Down Syndrome, and in his short 15 years of life, he changed the world. Despite battling Leukemia three times and going through a brutal bone marrow transplant - beating it each time. Ultimately, we lost him as his poor little body had taken too much of a beating of chemotherapy and battling this dreadful disease.

Brendan became friends with St. Pope John Paul II when he - all on his own and with no suggestion from his parents or siblings—wanted his “Make-A-Wish” to be meeting the Pope. That story has been told in four separate books and numerous news articles.

Brendan is only one example of how people with Down Syndrome transform all those they meet and know. But the story does not stop there - they had a champion, a giant of science who is now close to being declared a saint by the Catholic Church: Dr. Jerome Lejeune, MD. A friend and confidant of John Paul II, a brilliant researcher who first identified the genetic make-up of Down Syndrome and then went on to transform the treatment of those with Down’s as well as other special needs.

To say it is an honor to speak at the Dignity of Life Committee event is, quite honestly, a massive understatement. I will be there bursting with pride at having the chance to talk about Dr. Lejeune and my Brendan. Thank you, my friends, for having me.

National Council of Real Estate Investment Fiduciaries (NCREIF)

Fall Conference 2024

Hollywood, Florida

October 14, 2024 - What a great event in Hollywood, Florida, at the NCREIF 2024 Conference. With all that is going on globally, with all that is going on in the markets - especially in the commercial real estate markets - we had a fantastic and very lively discussion. We covered the upcoming US elections, federal tax law being re-written in 2025 and 2026, and the strong fiscal tailwinds of the CHIPS Act, IRA, and Infrastructure laws coming in the coming year! Here is the full agenda (HERE).

Thank you, NCREIF, for letting me a part of the wonderful event!

State of Wisconsin Investment Board Regular Meeting of the Board of Trustees Fireside Chat on Elections and Geopolitics

Delavan, Wisconsin

October 15, 2024 — I am delighted to have the opportunity to participate in a fireside chat at the upcoming SWIB Board of Trustees meeting. SWIB is one of the most brilliantly well-run retirement systems in America. This is a real honor and I’m very much looking forward to it!

NeuGroup’s 2024 Conference for Large and Mid-Cap Treasurers

New York, New York

October 8 & 9, 2024 - The NeuGroup is the most trusted thought leader and respected advocate for corporate finance and treasury practitioners. I was delighted and honored to speak at their Large Cap and Mid-Cap Treasurers Conference in New York, representing some of the biggest Fortune 100 companies in America. We discussed how geopolitical and geoeconomic risks and opportunities are driving a good deal of the US election themes and how they will likely play out in the November vote and in Congress in 2025.

Thank you, DWS, for arranging it, and thank you for having me, NeuGroup!

S&P Global Market Intelligence Insurance IN/sights Symposium 2024

New York, New York October 8, 2024

October 8, 2024 - I was delighted to have had the opportunity to participate in a fantastic S&P Global Market Intelligence Conference on the insurance sector. We had a great conversation on how the elections could impact the economy, inflation, markets, and the insurance industry as a whole. Ben Herzon’s superb analysis of Vice President Harris’s and former President Trump’s economic agendas set the stage for a lively discussion masterfully hosted by S&P’s Haily Ross. Jerry Theodorou also brought a level of expertise in the insurance sector at both the federal and state levels which is unmatched. Outstanding analysis by both Jerry and Ben. It was an honor to sit on this powerhouse panel. Thank you for having me, S&P Global!

Conversation with Dynamic Advisor Solutions and J.H. Whitney Asset Management: Washington Analysis and Geopolitical Landscape Review

October 4, 2024—On behalf of DWS and their fantastic Xtrackers team, I had a great conversation with my friend John O'Connor, led by Kostya Etus of Dynamic Advisor Solutions, regarding the U.S. Elections and geopolitical landscape and its impact on the financial markets. John is one of the most intelligent, insightful folks I know when it comes to geopolitical risk and finance. It is a great honor and pleasure to share a stage with him!

Ventura County Employees’ Retirement Association Board of Retirement Board Retreat & Business Meeting

September 30, 2024 — This was a very special event for me. VCERA’s chief investment officer is Dan Gallagher. Several years ago, after listening to one of my DWS bi-weekly client calls, Dan put together the fact that we are cousins who have not seen each other for nearly 50 years. He invited me out last year to address his board, and I’m guessing it well enough that he decided to have me back again this year! And who doesn’t love to go to beautiful Ventura and present three blocks from the beach?

It was a wonderful time and a great discussion with the VCERA Board. We covered the many geopolitical factors that impact global markets - particularly fixed income in the US and abroad. We also focused on the coming fiscal tailwinds from the massive amount of unspent federal CHIPS Act, infrastructure, and IRA funding.

You can watch my presentation HERE (as well as the rest of the board meeting).

DWS Insurance Asset Management Conference

Charleston, South Carolina

September 23, 2024 — I was delighted to have the opportunity to address this gathering of CEOs and Chief Investment Officers of some of the biggest insurance firms globally. It was a fantastic conversation about the multiple geopolitical challenges today and the many implications of the U.S. elections on the markets. Will Harris win, or will Trump pull off a come-back? Which party will control the Senate, and is there a real chance that the filibuster will be removed if Democrats sweep the White House, House of Representatives, and Senate? What does this mean for tax policy? Health care policy? And where are we going on with the U.S.-China policy, and what exactly is going on inside China today economically, socially, and politically? We covered all of this and much more. Thank you for having me, DWS! You can see my full presentation HERE.

Wisconsin Bankers Association Management Conference

Green Bay, Wisconsin

September 24, 2024 - I was delighted to present to the Wisconsin Bankers Association at their Annual Management Conference in beautiful Green Bay at the Oneida Hotel and Casino.

It was a great conversation with C-Suite bank executives, discussing the US elections (Wisconsin is a must-win state for both former President Trump and Vice President Harris) and how geopolitics are driving tremendous opportunity here in the US. We focused a good part of the talk on the coming tailwinds from massive spending on the CHIPS Act, the Infrastructure bill, and the Inflation Reduction Act - all of which have barely yet to tap the massive funding appropriated by Congress.

Thank you for having me, WBA! Green Bay is a beautiful town!

SSI Securities Corporation (Vietnam’s Leading Investment Bank) Client Call:

The U.S. Election and Vietnam

Thursday, September 19, 2024 - I was delighted to participate in SSI Securities's inaugural “Gateway to Vietnam” client call entitled “The US election and Vietnam.” Hosted by my dear friend, Thomas Nguyen, this is the first time SSI has hosted a virtual call for institutional and corporate clients - and we had nearly 1,000 participants!

In 2025, two historic anniversaries will be remembered in US-Vietnamese relations: It will be 50 years since the end of the Vietnamese War and 30 years since the US established diplomatic relations with Vietnam. Over the last 30 years, the relationship has taken off, with Vietnam becoming a major trade partner of the US. Increasingly, the US and Vietnam are serving as strategic partners to ensure a safe and secure environment in the greater Indo-Asian region. In 2023, Vietnam and the US established a “Comprehensive Strategic Relationship” - the highest diplomatic relationship Vietnam can have with another country.

Vietnam is a tremendous success story. The nation’s economy has experienced a meteoric rise over the last 30+ years. Its GDP has grown sixfold, the poverty rate has been slashed from 14 percent to 2 percent, and the middle class has grown massively. Trade with the US reached $115 billion in 2022 and continues to grow.

We will be watching closely as Vietnam develops into a major semiconductor manufacturer and a major supplier of critical minerals and other rare earth elements in the years to come.

The future of US-Vietnamese relations is bright. It was great fun to work with my old friend, Tom, again and to participate in this superb call.

I had a great conversation with Bloomberg Columnist John Authers (who is also Bloomberg’s senior editor for Markets) Thursday about former President Donald Trump’s tariff proposal and its potential impact on domestic prices, geopolitics, and the elections. Below is an excerpt of what I had to say. You can read the full interview and Authers’ column HERE.

Fortune Magazine: The US Dollar is Weakening Because Some Investors Think Kamala Harris Will Win

August 21, 2024 - Fortune Magazine interviewed me about the “Trump Trade” - is it fading because markets are starting to factor in a likely Kamala Harris victory in November.

The story's genesis is a Macquarie research note suggesting, “The current weakness of the US dollar can be attributed to the unwinding of the “Trump Trade,” which had been built on the premise of more inflation and higher interest rates in the US, which would support the USD.

I took the opposite side of this view. Here is what I had to say:

“Backing off from the Trump trade seems to indicate that at least some investors are losing faith in Trump’s chances come November. However, with several months to go until the election, any outcome is far from a foregone conclusion. Especially in a race such as this year’s that was so recently upended, according to Frank Kelly, senior political strategist at investment firm DWS. “July was Trump’s month, August was Harris’ month, and September is going to be an all-out brawl,” he said.

Throughout the early days of her campaign, Harris has been relatively vague on policy. However, she’s started rolling out more of them over the last week. So far, her economic views include advocating for regulations against excessive price increases on consumer goods, building more housing stock, and eliminating taxes on tips (an idea first introduced by Trump).

The Harris campaign has telegraphed that will change over the coming weeks. The ongoing Democratic National Convention could serve as a starting point for a broader policy rollout. Kelly, the political strategist, thinks once that happens the election campaign will move into its next phase. “Now they’ll start battering each other with policy issues rather than it being personal,” he said.

You can read the full article HERE.

Reuters: As Democrats gather, investors gauge market impact from a Harris administration

August 21, 2024 - Reuters interviewed me to understand Vice President Harris’s economic and regulatory policy views. My thoughts:

“She seems to be on track to be more aggressive than the Biden Administration on a lot of these consumer issues that go right to the market,” said Frank Kelly, senior political strategist at investment firm DWS Group, citing Harris’ recent economic proposals and her record as a U.S Senator and California Attorney General.

You can read the full interview HERE.

Reuters: Trump’s bitcoin stockpile plan stirs debate

August 6, 2024 - Reuter’s reporters Medha Singh and Lisa Mattackal wrote a brilliant piece on the intersection of Bitcoin and the presidential elections, taking a deep dive into former President Donald Trump’s proposal to create a federal Bitcoin stockpile.

I was delighted to be interviewed for the commentary. My assessment was this is a much more complicated issue than many may understand. I pointed out that this could end up being like the Strategic Petroleum Reserve, where both the President and Congress have varying amounts of control.

Indeed, over the years, Congress has regularly “raided’ the SPR, forcing the sale a portions of it to use the proceeds to help fund budget proposals (much like Congress raiding the Social Security program over the years, too).

You can read the full commentary and more on my assessment of the proposal HERE.

Business Insider: 3 Election Trades to Boost your Portfolio Regardless of a Harris or Trump Win

August 4, 2024 — Markets are struggling to understand the potential implications of the November Presidential elections and which sectors are safest and which are no-goes. Business Insider wrote a piece interviewing DWS Chief Investment Officer David Bianco, Amanda Rebello, Head of DWS’ Xtrackers ETF Sales, and me.

As I told BI, I “believe that the Big Tech-friendly policies Biden spearheaded, such as the CHIPS Act, are here to stay. "The CHIPS Act, in particular, was bipartisan…”

I went on to point out that with continued government support coming from across the aisle in Congress and hefty AI capital expenditures, the Big Tech and AI investment theme is a durable one this election season.