Fulcrum Perspectives

An interactive blog sharing the Fulcrum team's policy updates and analysis.

The U.S. Financial Regulatory Week Ahead

It’s World Bank/IMF Week in Washington, There Are Not One But Two Big Fintech Conferences This Week, And Pressure on FDIC Chair Gruenberg To Explain Himself Grows

October 21 - 25, 2024

Washington will be a very busy place this week as finance ministers and central bank chiefs from around the world converge for the annual World Bank/IMF meetings. While burgeoning global debt will be a major focus of the meetings, issues surrounding the stability of the financial markets will be a central theme (We would note it will also be a significant theme of the BRICS Leaders’ Summit in Russia this week, as Russian President Vladimir Putin and other BRICS leaders seek to build an alternative financial system).

Also, this week, not one but two big Fintech Conferences will be held, one in Washington and one in Philadelphia. The one in Washington – the Georgetown University Law Center's Institute of International Economic Law holds its eighth annual Fintech Week Conference – will see speeches by a number of regulators, including Acting Comptroller of the Currency Michael Hsu, CFTC Chairman Rostin Behnam, and CFPB Director Rohit Chopra.

Also this week, Bloomberg is holding its Global Regulatory Forum in New York, where SEC Chair Gary Gensler will speak. He will also speak at SIFMA’s Annual Meeting in New York.

Quickly looking at what happened last week, we would note that while Congress remains out of session until after the November elections, there still was some notable action. House Financial Services Chair Patrick McHenry on Wednesday slammed FDIC Chair Martin Gruenberg for “continued obstruction” of the panel’s investigation into the agency's workplace culture, calling on the bank regulator to schedule a transcribed interview by the end of the day. Gruenberg continues to refuse to cooperate or explain himself.

McHenry – who is retiring from Congress at the end of this session – also sent a letter to the General Accountability Office (GAO) asking for an investigation into the Treasury Department's management of small business ownership data, which it collects under a law intended to fight money laundering.

Also of note, Treasury Secretary Janet Yellen said she believes a bipartisan stablecoin bill currently being negotiated in the House “comes close” to the administration’s goals for regulating digital assets. While we believe there is virtually no chance of the bill being passed by the end of this year, we believe it will be revived early in the new Congress next year.

Below is a listing of all the other significant regulatory-related events this coming week:

U.S. Congressional Hearings

U.S. Senate

· The Senate is in a Pro Forma session and not returning to work until after the election. No work and no hearings are scheduled. They will return to work on November 12.

House of Representatives

· The House is out of session until after the November elections. No business or hearings are scheduled. They will return to work on November 12.

US Regulatory Meetings & Events

Federal Reserve Board and Federal Reserve Banks

· Tuesday & Wednesday, October 22 – 23 – The Federal Reserve Bank of Philadelphia will hold its 8th Annual Fintech Conference in Philadelphia. Among the speakers will be Federal Reserve Board Governor Michelle Bowman, Philadelphia Federal Reserve Bank President Patrick Harker, and a large number of industry leaders.

· Wednesday, October 23, 9:00 a.m. – Federal Reserve Board Governor Michelle W. Bowman gives opening remarks at the Eighth Annual Fintech Conference hosted by the Federal Reserve Bank of Philadelphia, Philadelphia, Pennsylvania.

U.S. Treasury Department

· There are no significant events scheduled at this time.

Department of Commerce

· There are no significant events scheduled at this time.

Securities and Exchange Commission

· Monday, October 21, 10:25 a.m. – SEC Chair Gary Gensler will deliver remarks and participate in a one-on-one conversation with SIFMA President and CEO Kenneth Bentsen at the SIFMA Annual Meeting in New York.

· Tuesday, October 22, 11:00 a.m. – SEC Chair Gary Gensler will speak at the Bloomberg Global Regulatory Forum in New York. A livestream of his remarks will be available. See the conference agenda here.

· Thursday, October 24, 1:00 p.m. – The SEC will hold a Closed Meeting.

Commodities Futures Trading Commission

· Monday, October 21, 2:00 p.m. – CFTC Chairman Rostin Behnam will participate in a fireside chat at SIFMA’s Annual Meeting in New York.

· Tuesday, October 22, 2:05 p.m. – CFTC Chairman Rostin Behnam will give a keynote address at the Bloomberg Global Regulatory Forum in New York.

· Wednesday, October 23, 9:05 a.m. – CFTC Chairman Rostin Behnam will participate in a fireside chat with Congressman Ro Khanna at DC FinTech Week in Washington, D.C.

FINRA

· There are no significant events scheduled at this time.

Federal Deposit Insurance Corporation

· Tuesday, October 22 – Federal Deposit Insurance Corporation Vice Chair Travis Hill will speak at the DC Fintech Week Conference in Washington, D.C.

Office of the Comptroller of the Currency

· Tuesday, October 22, 9:00 a.m. – Acting Comptroller of the Currency Michael J. Hsu will discuss the future of banking with Hyun Song Shin, Economic Adviser and Head of Research at the Bank for International Settlements, during DC Fintech Week in Washington, D.C.

The Consumer Financial Protection Bureau

· Wednesday, October 23 -- Consumer Financial Protection Bureau Director Rohit Chopra delivers remarks at the DC Fintech Week Conference in Washington, D.C.

National Credit Union Administration

· Thursday, October 24, 10:00 a.m. – The NCUA holds a Board Meeting. The agenda will cover an update on cybersecurity and a briefing on New Charter and Field of Memberships.

Federal Trade Commission & Department of Justice Antitrust Division

· There are no significant events scheduled at this time.

Farm Credit Administration

· There are no significant events scheduled at this time.

International Monetary Fund & World Bank

· Friday, October 21 - 26 – The International Monetary Fund and the World Bank Group officially kick off their 2024 Fall Meeting.

North American Securities Administrators Association

· There are no significant events scheduled at this time.

Trade Associations & Think Tank Events

Trade Associations

· Monday, October 21 – SIFMA holds its annual meeting in New York.

· Monday – Friday, October 22 – 25 – The Institute for International Finance Annual Membership meeting takes place in Washington, D.C.

· Tuesday, October 22 – The Institute for International Bankers holds its annual 2024 Anti-Money Laundering Conference in New York.

· Thursday, October 24, 10:00 a.m. – The Bipartisan Policy Center holds a discussion on "Scaling Local Innovations for Achieving Housing Affordability."

Think Tanks and Other Events

· Monday, October 21, 9:00 a.m. – 4:30 p.m. – The Peterson Institute for International Economics holds a conference on "Geopolitics and International Trade and Finance: Knowns and Unknowns."

· Monday, October 21 - The Urban-Brookings Tax Policy Center holds a virtual forum, beginning at 1 p.m., on "Tax Policy, the 2024 Election, and a Look Ahead to 2025."

· Tuesday, October 22 – Day One of The Georgetown University Law Center's Institute of International Economic Law holds its eighth annual Fintech Week Conference begins. Among the speakers today will be Acting Comptroller of the Currency Michael Hsu, Representative French Hill, (R-Ark.), National Security Council Special Adviser for Cybersecurity and Critical Infrastructure Policy Carole House participates in a discussion on "The Geopolitics of Artificial Intelligence," and Federal Deposit Insurance Corporation Vice Chair Travis Hill.

· Tuesday, October 22, 4:00 p.m. – The Brookings Institution will hold an event entitled “Climate, development, and international financial institutions: Perspectives from the Global South.”

· Wednesday, October 23 – Day Two of The Georgetown University Law Center's Institute of International Economic Law Fintech Week Conference. Rep. Ro Khanna, (D-Calif.) and Commodity Futures Trading Commission Chairman Rostin Behnam deliver remarks. Also, New York Department of Financial Services Superintendent Adrienne Harris and Consumer Financial Protection Bureau Director Rohit Chopra delivers remarks.

· Wednesday, October 23 – The Association of Certified Sanctions Specialists holds its sixth annual conference on "Global Sanctions and Export Controls” in Washington, D.C. Among the speakers will be Matthew Axelrod, assistant secretary for export enforcement at the Commerce Department's Bureau of Industry and Security, Scott Anderson, national coordinator for the Commerce Department Bureau of Industry and Security's Disruptive Technology Strike Force, and Molly Braese, chief of staff to the assistant Commerce secretary for export enforcement at the Bureau of Industry and Security.

· Wednesday, October 23, 9:00 a.m. – The Center for Global Development holds a discussion on "Bretton Woods at 80: Priorities for the Next Decade."

· Wednesday, October 24, 9:00 a.m. – The Peterson Institute for International Economics holds a virtual discussion, beginning at 9 a.m., on "Geneva Report Launch: Much Money, Little Capital, and Few Reforms: The 2023 Banking Turmoil."

· Wednesday, October 24, 11:00 a.m. – The Peterson Institute for International Economics holds a virtual discussion, beginning at 11 a.m., on "Monetary Policy Transmission Across the Euro Area."

· Wednesday, October 24, 1:00 p.m. – The Peterson Institute for International Economics holds a virtual discussion on "Monetary Policy During Periods of Economic Volatility." Adrian Orr, Governor of the Bank of New Zealand, will speak,.

Please let us know if you have any questions or would like to be added to our email distribution list.

The Global Week Ahead

The World Bank/IMF Annual Meetings Convenes in Washington – As Does the Annual BRICS Meeting in Russia, Important Elections Being Held in Eastern Europe, What Happens Next in the Middle East After Sinwar’s Death?

October 20 - 27, 2024

This will be an extremely busy and particularly important week, both geopolitically and for global markets. The World Bank/International Monetary Fund (IMF) meetings are being held in Washington, D.C. this week. As finance ministers and central bank chiefs from around the world converge on Washington to discuss global economic issues, managing growing global debt, which, as the IMF reported this past week, is approaching $100 trillion globally – 93 percent of the global GDP – and is on track to surpass 100 percent of global GDP by 2030). On the sidelines of the meetings, G20 Finance Ministers will also meet in Washington under the chairmanship of Brazil, who is strongly advocating the voice of the “Global South” as a growing economic power.

However, as the World Bank/IMF meetings occur, leaders of the BRICS nations will gather in Russia to meet under the chair of Russian President Vladimir Putin. The meeting – seen by Moscow as something of a victory over Western sanctions and pressure to end its war on Ukraine – will see the presidents or prime ministers of China, India, Turkey, the UAE, Brazil, Iran, Egypt, and more than 24 other countries discussing issues including how to end the dominance of the US dollar and building an alternative financial system. Most observers are not expecting any significant breakthroughs. But it is also likely the BRICS will approve the invitation to up to two dozen new member countries.

Also this week, several important elections are being held in countries Russia is battling to influence and draw into its orbit: Moldova, Bulgaria, and Georgia. Russian efforts have become so brazen—especially in Moldova—that they are offering bribes to vote against the pro-EU/pro-West governments.

We also continue to watch the evolving situation in the Middle East. Israel continues to prepare for a retaliatory military strike against Iran (which could come at any time) while continuing its efforts to destroy Hezbollah’s operations in Southern Lebanon. But the news that Hamas’ political leader, Yahha Sinwar, has been killed by Israeli Forces may prove to be an inflection point in the war in Gaza. At the time of this writing, there are reports trickling in of larger numbers of Hamas fighters surrendering to Israeli Forces.

Looking at the global economic radar screen this week, beyond the World Bank/IMF meetings and BRICS meeting, markets are focused on the release of the Federal Reserve’s Beige Book on Wednesday and the durable goods orders report on Friday. Also, the Bank of Canada meets on interest rates on Wednesday.

In Asia, China will announce its 1-year and 5-year loan prime rates on Monday and any new stimulus plans or details of already announced stimulus plans coming from Beijing. In Japan, the October CPI is out this Friday.

Turning to Europe, the European Central Bank’s consumer expectations survey will be released on Friday, as will Germany’s Ifo survey and France’s, Italy’s, and the U.K.’s consumer confidence reports.

Below is what else we are closely watching happening around the world in the coming week:

Sunday, October 20, 2024

Global

· The BRICS 1st Climate Congress will be held in Sochi, Russia.

Americas

Political/Social Events –

· Today is Revolution Day in Guatemala, celebrating the overthrow of a dictatorship in 1944.

Economic Reports/Events –

· Nothing significant to report.

Asia

Political/Social Events –

· Indonesia’s new president, Prabowa Sunianto, will be sworn into office.

Economic Reports/Events –

· New Zealand Credit Card Spending (September)

· China FDI (YTD) (September)

Europe

Political/Social Events –

· Moldova holds presidential elections and a vote on a constitutional referendum on EU integration. There are substantial fears Russia will seek to disrupt the elections in an attempt to block a yes vote on joining the EU – to the point where Russian operatives are openly offering bribes to Moldovans to vote against joining the EU. Pro-EU President Maya Sandu is likely to receive the most votes in the election, but a runoff is also likely.

Economic Reports/Events –

· Nothing significant to report.

Middle East

Political/Social Events –

· Iraq holds regional elections.

Economic Reports/Events –

· Nothing significant to report.

Africa

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

Monday, October 21, 2024

Global

· UN Secretary-General António Guterres will be in Addis Ababa to take part in the 8th African Union – United Nations annual conference. The high-level discussions will be co-chaired by Moussa Faki Mahamat, the Chairperson of the African Union Commission and the Secretary-General. Later in the day, the Secretary-General will go to the UN Economic Commission for Africa in Addis Ababa, where he will take part in the re-inauguration ceremony of Africa Hall, which is reopening after extensive renovations to transform it into a modern conference center.

· The UN Convention on Biological Diversity (COP16) to the Convention on Biological Diversity (CBD) in Cali, Colombia through November 1.

· The UN Security Council is scheduled to hold a briefing on maintenance of international peace and security: Anticipating the impact of scientific developments on international peace and security. In the afternoon, the Security Council will hold a briefing on Ukraine.

Americas

Political/Social Events –

Economic Reports/Events –

· Kansas City Federal Reserve Bank President Jeffrey Schmid to speak on the economic and monetary policy outlook before hybrid event hosted by the Chartered Financial Analyst Society, Kansas City.

· Dallas Federal Reserve Bank President Lorie Logan to speak and participate in a moderated question-and-answer session before the 2024 SIFMA (Securities Industry and Financial Markets Association) Annual Meeting in New York.

· Minneapolis Federal Reserve Bank President Neel Kashkari to participate in Chippewa Falls Chamber of Commerce town hall.

· USA CB Leading Index (September)

· Colombia Imports/ Balance of Trade (August)

· El Salvador Balance of Trade (September)

· Paraguay Interest Rate Decision

· Brazil BCB Focus Market Readout

· Costa Rica Balance of Trade (September)

Asia

Political/Social Events –

· U.S. and Philippine military forces will participate in the Sama Sama 2024 and Kamandag 8 drills through October 24.

Economic Reports/Events –

· Australia RBA Hauser Speech

· China Loan Prime Rate 1Y & 5Y

· New Zealand Credit Card Spending (September)

· Malaysia GDP Growth Rate Prel Q3

· Taiwan Export Orders (September)

Europe

Political/Social Events –

· Singapore’s International Energy Week begins and runs through October 26. Speakers include industry executives and energy ministers from Tanzania, Cambodia, Laos, Australia and New Zealand, discussing energy security and transition plans.

The EU Agriculture and Fisheries Council meets in Luxembourg through October 22. The ministers will discuss reaching a political agreement on next year’s fishing opportunities in the Baltic Sea.

Economic Reports/Events –

· Germany PPI (September)

· Greece Current Account (August)

· Poland Corporate Sector Wages (September)/ Employment Growth (September)/ Industrial Production (September)/ PPI (September)

· Slovenia PPI (September)

· Slovakia Unemployment Rate (September)

· Turkey Central Government Debt (September)

Middle East

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Kuwait Inflation Rate (September)

· Lebanon Inflation Rate (September)

· Jordan Industrial Production (August)

· Oman Inflation Rate (September)/ M2 Money Supply (August)/ Total Credit (August)

· Israel M1 Money Supply (September)

· Qatar Inflation Rate (September)

Africa

Political/Social Events –

· Mozambique’s opposition politician Venâncio Mondlane, who early vote counts placed second in the country’s October 9 presidential election, called for a countrywide strike today to protest preliminary results he’s already rejected. He urged supporters to “paralyze” the country, according to a video posted to his social media channels including YouTube on Wednesday. Mondlane has repeatedly said he was winning.

Economic Reports/Events –

· Nothing significant to report.

Tuesday, October 22, 2024

Global

· The 16th BRICS Summit begins in Kazan, Russia, and runs through October 24. This is the first time the BRICS has met since expanding the membership to include Iran, the UAE, Saudi Arabia, Egypt, and Ethiopia. In total, leaders from 32 countries are expected to attend. Among the agenda items will be efforts to move away from the dominance of the US dollar further, create an alternative financial infrastructure, and plan for future expansion.

The UN Security Council is scheduled to hold a private meeting with ICJ briefing. In the afternoon, a briefing on the United Nations Integrated Office in Haiti (BINUH) is scheduled to be held, followed by consultations.

· G7 Development Ministers meet in Pescara, Italy.

Americas

Political/Social Events –

· Canada's 25% surtax on Chinese steel and aluminum imports will go into effect.

Economic Reports/Events –

· Philadelphia Federal Reserve Bank President Patrick Harker to speak on "Fintech" before the Eighth Annual Fintech Conference hosted by the Federal Reserve Bank of Philadelphia.

· Mexico Economic Activity (August)

· Canada PPI (September)/ Raw Materials Prices (September)

· USA Redbook (October/19)/ Richmond Fed Manufacturing Index (October)/ Richmond Fed Services Revenues Index (October)/ Money Supply (September)/ API Crude Oil Stock Change (October/18)

Asia

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· South Korea PPI (September)

· New Zealand Imports/ Exports/ Balance of Trade (September)

· Indonesia M2 Money Supply (September)

Europe

Political/Social Events –

· The European Parliament will debate and vote on a €35 billion financial assistance package for Ukraine as part of the G7’s support initiative. The package leverages extraordinary profits from frozen Russian assets and aims to address Ukraine’s urgent financing needs in the face of Russia’s brutal war of aggression.

· EU President Ursula von der Leyen will travel to the Western Balkans for meetings with the presidents and prime ministers of Montenegro, Serbia, and Bosnia and Herzegovina regarding further integration with the European Union, including stronger trade ties.

· NATO Secretary General Mark Rutte will travel to Estonia for meetings with Estonian President Alar Karis and Prime Minister Kristen Michal. The next day, he will meet with Minister of Foreign Affairs Margus Tsahkna and then visit the Tapa Army Base, where he will address the troops together with the President of Estonia.

Economic Reports/Events –

· European Central Bank President Christine Lagarde participates in a panel discussion about "The future of cross-border payments: faster safer together – safe and inclusive fast payments across borders" during the IMF/WB Annual Meetings in Washington, D.C. Lagarde will also be interviewed by Bloomberg Television's Francine Lacqua at the IMF.

· Bank of England Governor Andrew Bailey will give the keynote address at the Bloomberg Global Regulatory Forum in New York.

· European Central Bank Board Member Elizabeth McCaul gives the keynote speech at the annual SCION Day 2024 organized by ETH (Eidgenössische Technische Hochschule) in Zürich, Switzerland.

· European Central Bank Board Member Philip R. Lane will give a speech at the Central Banking Seminar of the Federal Reserve Bank of New York in New York. He then will give a speech at Colombia University.

· European Central Bank Board Member Elizabeth McCaul participates in a panel discussion at the Bloomberg's Global Regulatory Forum in New York.

· European Union New Car Registrations (September)

· Great Britain Public Sector Net Borrowing (September)

· Hungary Gross Wage (August)

· Poland Retail Sales (September)

Middle East

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Hong Kong Inflation Rate (September)/ Deposit Interest Rate (October)/ Interest Rate Decision

Africa

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· South Africa Leading Business Cycle Indicator (August)

Wednesday, October 23, 2024

Global

· G20 Finance Ministers and Central Bankers will meet in Washington, D.C. on the sidelines of the IMF/World Bank meetings.

· G20 Trade and Investment Ministers will meet in Brasilia, Brazil through October 25.

· The UN Security Council is scheduled to hold a briefing on the United Nations Multidimensional Integrated Stabilization Mission in the Central African Republic (MINUSCA) followed by consultations. In the afternoon, there will be a briefing on the Middle East followed by consultations (Syria).

Americas

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Federal Reserve Board Governor Michelle Bowman to give opening remarks on second day of the Eighth Annual Fintech Conference hosted by the Federal Reserve Bank of Philadelphia.

· Richmond Federal Reserve Bank President Thomas Barkin to speak on "Recognizing the Impact of Community Colleges" before the 2024 Virginia Education and Workforce Conference.

· USA MBA Purchase Index (October/18)/ Existing Home Sales (September)/ EIA Crude Oil & Gasoline Stocks Change (October/18)/ Fed Beige Book

· Mexico Retail Sales (August)

· Canada BoC Interest Rate Decision/ BoC Monetary Policy Report/ BoC Press Conference to follow.

· Argentina Economic Activity (August)

Asia

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· South Korea Consumer Confidence (October)

· Singapore Inflation Rate (September)

· Taiwan Industrial Production (September)/ Retail Sales (September)

· Thailand Imports/ Exports/ Balance of Trade (September)/ New Car Sales (September)

Europe

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· European Central Bank President Christine Lagarde gives a speech at an "Atlantic Council Front Page" event in Washington, D.C.

· European Central Bank Board Member Piero Cipollone participates in panel "CBDC, cross border payments and the future of money in a deglobalized world" at 'Bretton woods in a new world' conference organized by Reinventing Bretton Woods Committee in Washington, D.C.

· European Central Bank Board Member Philip R. Lane participates in conversation session at 2024 IIF Annual Membership Meeting "Thriving in turbulence: Sustaining growth in a new economic landscape" in Washington, D.C,

· Turkey Consumer Confidence (October)

· Slovenia Consumer Confidence (October)/ Unemployment Rate (August)

· Poland M3 Money Supply (September)

· Euro Area Consumer Confidence Flash (October)

· Russia Industrial Production (September)

Middle East

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Qatar M2 Money Supply (September)/ Total Credit Growth (September)

· Kuwait M2 Money Supply (September)/ Private Bank Lending (September)

Africa

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· South Africa Inflation Rate (September)

Thursday, October 24, 2024

Global

· The UN Security Council is scheduled to hold an open debate on women and peace and security.

· G20 Anti-Corruption Ministers will meet in Natal, Brazil.

Americas

Political/Social Events –

· Montserrat holds legislative elections.

Economic Reports/Events –

· Cleveland Federal Reserve Bank President Beth Hammack to give welcome remarks before the “Inflation: Drivers and Dynamics 2024" event hosted by the Center for Inflation Research at the Federal Reserve Bank of Cleveland and the European Central Bank.

· Brazil IPCA mid-month CPI (October)/ Federal Tax Revenues (September)

· Chile PPI (September)

· Mexico Mid-month Inflation Rate (October)

· Canada New Housing Price Index (September)

· USA Chicago Fed National Activity Index (September)/ Initial Jobless Claims (October/19)/ / S&P Global Manufacturing/ Composite/ Services PMI Flash (October)/ New Home Sales (September)/ EIA Natural Gas Stocks Change (October/18)/ Kansas Fed Manufacturing & Composite Index (October)/ 15 & 30-Year Mortgage Rate (October/23)/ Building Permits Final (September)/ Fed Balance Sheet (October/23)

· Uruguay Unemployment Rate (September)

· Argentina Retail Sales (August)

Asia

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· South Korea Business Confidence (October)/ GDP Growth Rate Adv Q3

· Australia Judo Bank Manufacturing/ Composite/ Services PMI Flash (October)

· Japan Foreign Bond Investment (October/19)/ Jibun Bank Manufacturing/ Composite/ Services PMI Flash (October)

· Singapore URA Property Index Final Q3

· Malaysia Inflation Rate (September)

· India HSBC Manufacturing/ Composite/ Services PMI Flash (October)

· Philippines Budget Balance (September)

· Taiwan Unemployment Rate (September)/ M2 Money Supply (September)

· China PBoC 1-Year MLF Announcement

Europe

Political/Social Events –

· Denmark hosts North Sea Cooperation ministers meeting in The Cooperative consists of Denmark, Belgium, the Netherlands, France, Germany, Norway, Ireland, Luxembourg and the European Commission. Great Britain participates as an observer.

· The European Court of Justice will rule on Intel's fight against a once-record €1.06 billion EU antitrust fine for rebates to laptop makers.

· The EU’s Conference of Presidents (EP President Metsola and political group leaders) will decide on the winner of the 2024 Sakharov Prize for Freedom of Thought. The three shortlisted candidates are (in alphabetical order): Dr Gubad Ibadoghlu, academic and anti-corruption activist in Azerbaijan; María Corina Machado, as leader of the democratic forces in Venezuela and President-elect Edmundo González Urrutia; and "Women Wage Peace" and "Women of the Sun", Israel/Palestine.

Economic Reports/Events –

· Bank of England Governor Andrew Bailey will be a panelist at the G30 39th Annual International Banking Seminar hosted by the Inter-American Bank in Washington, D.C. Later, Bailey will give the Mike Gill Memorial Lecture at the CFTC in Washington.

· European Central Bank Board Member Elizabeth McCaul participates in panel discussion at the 2024 IIF Annual Membership Meeting in Washington D.C.

· European Central Bank Board Member Philip R. Lane gives remarks at a conference entitled "Inflation: Drivers and Dynamics" organized by ECB and FED Cleveland Fed in Cleveland, Ohio.

· France Business Confidence (October)/ Business Climate Indicator (October)/ HCOB Manufacturing/ Composite/ Services PMI Flash (October)

· Germany HCOB Manufacturing/ Composite/ Services PMI Flash (October)

· Euro Area HCOB Manufacturing/ Composite/ Services PMI Flash (October)

· Poland Unemployment Rate (September)

· Great Britain S&P Global Manufacturing/ Composite/ Services PMI Flash (October)/ CBI Business Optimism Index Q4/ CBI Industrial Trends Orders (October)

· Turkey MPC Meeting Summary/ Foreign Exchange Reserves (October/18)

Middle East

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

Africa

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

Friday, October 25, 2024

Global

· Nothing significant to report.

Americas

Political/Social Events –

· Semafor holds its World Economy Summit in Washington through October 25. Among the speakers will be Amos Hochstein, President Biden’s Special Advisor on Energy Security and other senior Administration officials.

Economic Reports/Events –

· Brazil FGV Consumer Confidence (October)

· Canada CFIB Business Barometer (October)/ Retail Sales (August)/ Budget Balance (August)

· USA Durable Goods Orders (September)/ Michigan Consumer Sentiment Final (October)/ Michigan Current Conditions Final (October)/ Baker Hughes Total Rigs Count (October/25)

· Paraguay PPI (September)

Asia

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· New Zealand ANZ Roy Morgan Consumer Confidence (October)

· Japan Tokyo CPI (October)/ Coincident Index Final (August)/ Leading Economic Index Final (August)

· Singapore Unemployment Rate Prel Q3/ Industrial Production (September)

· Malaysia Coincident Index (August)/ Leading Index (August)

· Hong Kong Business Confidence Q4

· India Foreign Exchange Reserves (October 18)

Europe

Political/Social Events –

· German Chancellor Olaf Scholz will visit India through October 27. Accompanying Scholz will be a large number of German CEOs seeking new investment opportunities with India. The German government recently released a white paper entitled “Focus on India” which seeks to lay the groundwork for a stronger partnership with India. Additionally, discussions between Scholz and Indian Prime Minister Narendra Modi will focus on greater defense cooperation.

Economic Reports/Events –

· European Central Bank Board Member Elizabeth McCaul gives a re-recorded speech at a conference entitled "EU Banking Regulation at a Turning Point" organized by Universitá degli Studi di Roma Tor Vergata.

· Great Britain Gfk Consumer Confidence (October)/ CBI Distributive Trades (October)

· Hungary Unemployment Rate (September)

· France Consumer Confidence (October)/ Unemployment Benefit Claims (September)/ Jobseekers Total (September)

· Spain Unemployment Rate Q3/ PPI (September)

· Turkey Business Confidence (October)/ Capacity Utilization (October)

· Euro Area Loans to Companies & Households (September)/ M3 Money Supply (September)

· Germany Ifo Business Climate (October)/ Ifo Current Conditions (October)/ Ifo Expectations (October)

· Italy Business Confidence (October)/ Consumer Confidence (October)

· Slovenia Business Confidence (October)/ Tourist Arrivals (September)

· Greece Total Credit (September)

· Russia Interest Rate Decision/ CBR Press Conference

Middle East

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

Africa

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Zimbabwe Inflation Rate (October)

Saturday, October 26, 2024

Global

· Nothing significant to report.

Americas

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

Asia

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Japan General Elections

Europe

Political/Social Events –

· Georgia will hold parliamentary elections. Much like the elections earlier in the week in Moldova, significant Russian efforts to interfere and influence in the elections are expected. The elections are expected to be decisive in determining if Georgia moves toward possible EU integration or rejects integration for a tighter alliance with Russia. The ruling Georgian Dream Party has accused Western entities of attempting to destabilize the country, while the opposition and Western allies argue that the government is undermining democratic principles. If Georgian Dream wins, it has vowed to ban the main opposition parties, leading to fears of democratic backsliding, while a victory for the opposition could restore Georgia’s pro-Western course.

Economic Reports/Events –

· Nothing significant to report.

Middle East

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

Africa

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

Sunday, October 27, 2024

Global

· Nothing significant to report.

Americas

Political/Social Events –

· Uruguay holds presidential and parliamentary elections. However, the elections are being marred by a controversial $23 billion proposal to overhaul the social security system. If approved, the measure would increase minimum payouts, lower the retirement age and transfer privately managed savings to a government-run trust in what advocates see as a way to share the nation’s resources more equally.

Economic Reports/Events –

· Nothing significant to report.

Asia

Political/Social Events –

· Japan holds snap elections for its the House of Representatives. The ruling Liberal Democratic Party (LDP) is at risk of losing its majority in the lower house, which would mean the LDP would have to rely on a coalition partnership with the Komeito Party– which is currently does to hold power in the upper house. The LDP needs to win 233 seats for an outright majority.

· Uzbekistan holds parliamentary elections.

Economic Reports/Events –

· China Industrial Profits (YTD) (September)

Europe

Political/Social Events –

· Lithuania holds the second round of parliamentary elections.

· Bulgaria will hold snap parliamentary elections. This is the third attempt to form a government since June and the sixth snap elections held in the country since 2021.

· Liechtenstein holds a vote on a referendum on the privatization of Radio Lichtenstein.

Economic Reports/Events –

· Nothing significant to report.

Middle East

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

Africa

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

Recommended Weekend Reads

The Latin American Nations are Best Positioned for Nearshoring, How America’s Gender Gap is Reshaping the Election, and Macroeconomic Limits of China’s Africa Strategy

October 18 - 20, 2024

Please find below our recommended reads from reports and articles we read in the last week. We hope you find these useful and that you have a relaxing weekend. And let us know if you or someone you know wants to be added to our distribution list.

Americas

Solving Latin America’s Food Paradox Americas Quarterly

Latin America has, in many ways, become the world’s breadbasket. Over the past two decades, the value of its agricultural exports rose a whopping 500% to $316 billion in 2022, the last full year data was available. No other region has a larger farming surplus. It is the source of more than 60% of the world’s soybean trade, almost half its corn, and more than a quarter of its beef. Three out of four avocados come from Latin America, as does much of the world’s coffee. At the same time, about 28% of people in Latin America and the Caribbean suffer today from moderate or severe food insecurity, meaning they lack regular access to enough safe and nutritious food for normal health and development. That number is down from its peak during the COVID-19 pandemic but still six percentage points higher than in 2014, according to the United Nations Food and Agriculture Organization (FAO). That means an additional 48 million people are suffering from food insecurity compared to a decade ago. What can be done?

China invites Colombia to Join the Belt and Road Initiative, “Exploring” Free Trade Agreement South China Morning Post

Colombia has confirmed formation of working group to discuss matter and hails ‘great potential’ to lure mainland investment, alarming US officials.

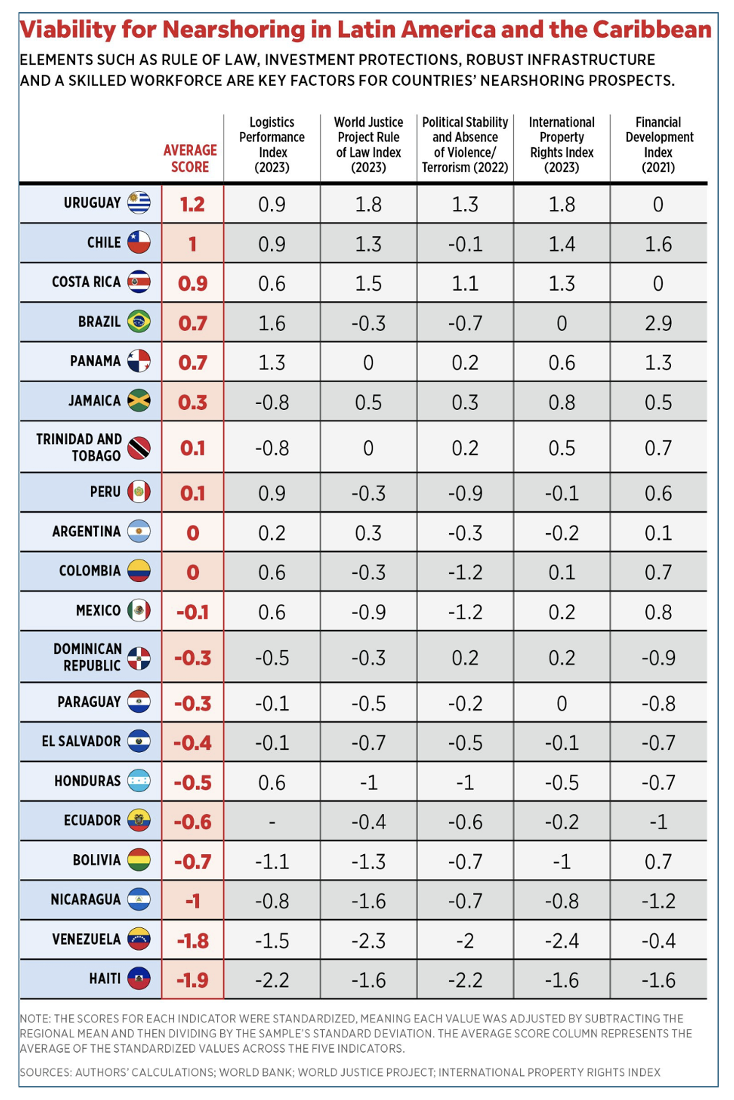

Which Latin American Countries are Best Positioned for Nearshoring? Brian Winter/Editor-in-Chief of Americas Quarterly

Winter posted a fascinating tweet showing a chart prepared by former Chilean Finance Minister Felipe Larraín showing which countries in Latin America are best positioned for nearshoring.

The U.S. Elections

The Politics of Progress and Privilege: How America’s Gender Gap Is Reshaping the 2024 Election American Enterprises Institute’s Survey Center on American Life

The United States is experiencing a tumultuous shift in how Americans recognize traditional gender hierarchies. Women still feel there is a significant need to address gender inequality, whereas many men are more ambiguous on the matter. Gen Z is particularly sensitive to the reassessment of these norms, with young men and women increasingly stratified along party lines. Young women are more likely to support Democratic candidates, take liberal policy stances, and believe that a more concerted effort is needed to ensure equality between the sexes. Young men, comparatively, have sorted in the opposite manner. With Gen Z increasingly at odds in their politics and social identities, the common ground between American men and women is diminishing rapidly.

China

Renminbi dilemma for Chinese authorities Mark Sobel/ OMFIF

China’s economy is being rocked by enormous headwinds – excess leverage, local government debt, housing sector woes, de/disinflation, contracting manufacturing and weak service sector growth. The authorities have announced measures to reduce interest rates, spur housing and boost equity prices. However, the fiscal pronouncements made over the past weekend – though apparently not directly aimed at boosting consumption –were lacking in details, terms and amounts. Together, these efforts, while helping to limit downside risks to the economy, are so far unlikely to restore confidence and significantly strengthen activity. Amid weak domestic demand and low confidence, how then might Chinese authorities view the renminbi?

U.S. – China Relations for the 2030s: Toward a Realistic Scenario for Coexistence Carnegie Endowment for International Peace

It has become difficult to imagine how Washington and Beijing might turn their relationship, which is so crucial to the future of world order, toward calmer waters. If there is to be any hope of doing so, however, a group of some of the leading policy experts on US China relations offer, via individual essays, a realistic vision of what those calmer waters might look like.

Value-added and Value Lost: The Macroeconomic Limits of China’s Africa Strategy European Council on Foreign Relations

China’s overcapacity has hit Europe’s economies hard, but it is also damaging Africa’s. With both continents suffering, Africa and Europe can make common cause in confronting this mutual challenge.

Geoeconomics

Immigration and Macroeconomy After 2024 Stan Veuger/Wendy Edelberg/Cecilia Esterline/Tara Watson

Few issues have dominated the US political debate in recent years like immigration. The starting point for our analysis is the creation of a “high immigration” and a “low immigration” scenario for each presidential candidate. These scenarios reflect a combination of the historical record under the Trump administration and the Biden-Harris administration, announced and inferred immigration policies, as well as our judgment of likely developments. They are constructed from the ground up, starting by predicting inflows from specific visa categories, border and parole policy, and entries without inspection. We also predict removals, reflecting both the candidates’ visions and logistical constraints as well as other factors that affect outflows. We provide two scenarios for each candidate given the considerable uncertainty about policy actions as well as responses by migrants.

Challenging the deglobalization narrative: Global flows have remained resilient through successive shocks Journal of International Business Policy

Abstract: We challenge the popular narrative that the world has entered a period of deglobalization, arguing that deglobalization is still a risk rather than a current reality. Drawing upon the DHL Global Connectedness Index, we show that international flows have not decreased relative to domestic activity, there is not an ongoing shift from global to regional business, and geopolitically driven shifts in international flows still primarily involve countries at the center of present conflicts. We propose policy and research implications, warning that misperceptions of deglobalization could themselves contribute to costly reductions in international openness.

The Great Transfer-mation: How American communities became reliant on income from government Economic Innovation Group

This interactive research report shows how transfers’ share of Americans’ total personal income has more than doubled over the past 50 years, from 8.2% in 1970 to 17.6% in 2022. They are the third largest source of Americans’ personal income, after income from work and investments. The average American received $11,500 in income from government transfers in 2022, compared to $40,500 in income derived from work and $12,900 from investments. Today, most U.S. counties depend on a level of government transfer income that was once reserved only for the most distressed places.

The Global Week Ahead

The Tense Wait for Israel’s Military Response to Iran’s Attack Continues, the European Council Gathers on Ukraine and Middle East Policy, Biden Goes to Germany, and the ECB Meets on Rates

October 13 - 20, 2024

With less than a month until the US elections, the world tensely awaits Israel's promised military response to Iran's recent missile attack as Israeli military forces continue to intensify their attacks on Hezbollah forces in Southern Lebanon. It remains unclear if Israel will attack Iranian nuclear facilities or oil production and shipping facilities or, military sites, or critical infrastructure facilities – or some variation of all of these.

The situation in the Middle East and Ukraine will be the focus of EU leaders this week as the European Council meets in Brussels. Of note, the leaders will discuss and debate further military aid to Ukraine and allowing Ukraine to use NATO/EU weapons to strike Russian positions and troops inside Russia – something Russian President Vladimir Putin has angrily threatened the West would be seen as a significant escalation crossing one of his "red lines."

The EU leaders will also discuss the recently released competitiveness reports written by former European Central Bank President Mario Draghi and how best to implement the report's sweeping recommendations. They will also discuss ongoing trade tensions with China.

Later in the week, President Biden will visit Germany for meetings with German Chancellor Scholz. Biden was scheduled to visit last week but had to cancel due to Hurricane Milton hitting Florida.

Looking at the global economic radar screen for the coming week, markets are preparing for the IMF/World Bank meetings beginning on October 21st. Until then, markets are focused on US retail sales and industrial production figures released this week as indicators of where the Federal Reserve will go with rates when it meets in November.

Moving to Asia, markets remain intensely focused on China following the extraordinary efforts to stabilize the economy. Beijing releases inflation figures and important trade balance numbers this week. Elsewhere, Japan releases CPI figures.

In Europe, the European Central Bank meets on interest rates, and markets anticipate a 25-basis point cut. The UK releases inflation data, and Germany sees the release of the ZEW survey, which will better clarify how the country's economy is doing in the face of a spate of negative data.

Below are the other major political and economic events we are watching this coming week:

Sunday, October 13, 2024

Global

· The World Health Summit begins in Berlin.

Americas

Political/Social Events –

· President Biden was scheduled to travel to Angola for meetings through October 15 with Angolan President João Lourenço to discuss increased trade and climate collaboration. However, the trip was cancelled due to Hurricane Herman hitting Florida.

· The XVI Conference of Defense Ministers of the Americas takes through October 16 I Mendoza, Argentina.

Economic Reports/Events –

· Nothing significant to report.

Asia

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· China PPI (September)/ Inflation Rate (September)/ Imports/ Exports/ Balance of Trade (September)/ New Yuan Loans (September)/ M2 Money Supply (September)/ Outstanding Loan Growth (September)/ Total Social Financing (September)

Europe

Political/Social Events –

· Lithuania holds legislative elections.

Economic Reports/Events –

· Nothing significant to report.

Middle East

Political/Social Events –

· Iran’s Foreign Minister Abbas Araghchi meets with senior Iraqi leaders in Baghdad. Araghchi has been traveling throughout the region this past week meeting with leaders in Lebanon, Saudi Arabia, and the UAE in an effort to gather support and in advance of an expected Israeli attack on Iran.

Economic Reports/Events –

· Israel Consumer Confidence (September)

Africa

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

Monday, October 14, 2024

Global

· OPEC releases its monthly report.

· The UN Security Council is scheduled to meet for consultations on 1559 report (regarding the security situation in Lebanon).

· The Nobel Prize for Economics winner is announced.

Americas

Political/Social Events –

· Canada celebrates Thanksgiving. Financial markets are closed.

· Today is Columbus Day in the US. Stock markets remain open while bond markets and some banks observe the day and are closed.

Economic Reports/Events –

· Federal Reserve Board Governor Christopher Waller speaks on the economic outlook before the "A 50-Year Retrospective on The Shadow Open Market Committee and Its Role in Monetary Policy" conference hosted by Stanford University.

· Minneapolis Federal Reserve Bank President Neel Kashkari to participate in panel discussion at the Central Bank of Argentina's Money and Banking Conference:" Fiscal Deficits, Monetary Policy and Inflation” in Argentina. Later, he participates in lecture/fireside chat," The Current State of U.S. Monetary Policy," hosted by the Department of Economics at Torcuato di Tella University in Buenos Aires.

· Brazil IBC-BR Economic Activity (August)/ BCB Focus Market Readout

· Mexico Consumer Confidence (September)

· Uruguay Industrial Production (August)

· Paraguay Balance of Trade (September)

Asia

Political/Social Events –

· Chinese Premier Li Qiang will visit Vietnam through October 14 and sign a railway deal. It is the first official visit to Vietnam by a Chinese premier in 11 years.

· U.S. and Philippine military forces will participate in the Sama Sama 2024 and Kamandag 8 drills through October 24.

· Malaysia's parliament will convene and likely pass the Mufti Bill, which would empower religious figures to make edicts without parliamentary oversight.

· Today is Health and Sports Day in Japan. Financial markets are closed.

Economic Reports/Events –

· New Zealand Composite & Services NZ PCI (September)/ Electronic Retail Card Spending (September)

· Singapore GDP Growth Rate Adv Q3

· India WPI Food Index (September)/ WPI Fuel (September)/ WPI Inflation (September)/ WPI Manufacturing (September)/ Inflation Rate (September)

· South Korea Export Prices (September)/ Import Prices (September)

· China Vehicle Sales (September)/ PBoC 1-Year MLF Announcement

Europe

Political/Social Events –

· UK Foreign Minister Foreign Secretary Lammy travels to Beijing and Shanghai, China for meetings.

· NATO Secretary General Mark Rutte will visit Supreme Headquarters Allied Powers Europe (SHAPE) and then he will travel to Germany. At SHAPE, Rutte will meet with Supreme Allied Commander Europe (SACEUR), General Christopher Cavoli, and other senior officers. In the afternoon, NATO Secretary General will travel to Wiesbaden, where he will meet the German Minister of Defence, Boris Pistorius, and visit the site of NATO’s Security Assistance and Training – Ukraine (NSATU) command.

· The EU Foreign Affairs Council will meet in Luxembourg. Ministers will discuss the situation in Ukraine and the Middle East.

· The EU Environment Council will meet in Luxembourg. The agenda includes approving the conclusions on preparations for the COP29 Meetings, the UN Convention on Biodiversity, and the Global Plastics Treaty.

· NATO holds “Steadfast Noon” nuclear preparedness drills in the North Sea.

· The 10th Annual Berlin Process Summit takes place in Berlin, Germany. The event brings together representatives from Western Balkans and EU countries.

· The EU-Kazakhstan Cooperation Council meets in Luxembourg. The meeting will focus on It will then exchange views on political, economic and trade matters and cooperation (including internal reforms, rule of law and human rights, efforts to address sanction circumvention, cooperation facility, critical raw materials and sustainable connectivity). The delegations will also touch on regional and international developments and cooperation, Global Gateway Team Europe Initiatives and security.

Economic Reports/Events –

· The UK International Investment Summit, hosted by the UK Government, takes place in London. The aim of the Summit is to show “the UK is the best place in the world to do business.” However, the summit comes two weeks before Prime Minister Keir Starmer releases his new budget, which is expected to call for significantly higher taxes on corporations and wealthy individuals. On Thursday, P&O Ferries – which was prepared to roll-out a $1.4 billion port expansion in the UK as the showpiece of the conference, announced they were pulling out of the deal after Deputy Prime Minister Angela Rayner and Transport Minister Louise Haigh called the firm “rogue operators” and were boycotting using the firm.

· Bank of England Member of the Monetary Policy Committee Swati Dhingra will speak on a panel at the Reserve Bank of India’s 90th Anniversary High-Level Conference in New Delhi, India.

· Ireland Construction PMI (September)

· Romania Industrial Production (August)/ Current Account (August)

· Switzerland Producer & Import Prices (September)

· Great Britain BoE Dhingra Speech

· Poland Balance of Trade (August)/ Current Account (August)

· Turkey Auto Production (September)/ Auto Sales (September)

Middle East

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Israel Imports/ Exports/ Balance of Trade (September)

· Jordan Inflation Rate (September)

Africa

Political/Social Events –

· The Nigerian Economic Summit will be held in Abuja. Nigeria’s finance minister Wale Edun and central bank governor Yemi Cardoso will be among the speakers.

Economic Reports/Events –

· Angola Wholesale Prices (September)/ Inflation Rate (September)

Tuesday, October 15, 2024

Global

· The G7 Tech and Digital Ministers meet in Cernobbio, Italy.

· The UN Security Council is scheduled to hold a briefing on the Middle East, followed by consultations (Yemen). In the afternoon, it is scheduled to hold a briefing on Colombia followed by consultations

· The World Trade Organization (WTO) General Council meets in Geneva, Switzerland

· The OECD’s Forum on Green Finance and Investment 2024 takes place in Paris, France.

Americas

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Federal Reserve Board Governor Adriana Kugler gives remarks virtually entitled “Career Opportunities and Diversity in Economics” at the Exploring Careers in Economics event hosted by the Federal Reserve.

· San Francisco Federal Reserve Bank President Mary Daly speaks and participates in moderated conversation at event hosted by the New York University Stern School of Business in New York.

· Atlanta Federal Reserve Bank President Raphael Bostic to participate in moderated conversation on the economic outlook and impact on small business with the Gathering Spot.

· Canada Inflation Rate (September)/ CPI Median (September)/ Wholesale Sales Final (August)

· USA NY Empire State Manufacturing Index (October)/ Redbook (October/12)/ Consumer Inflation Expectations (September)/ NOPA Crush Report

· Colombia Industrial Production (August)/ Retail Sales (August)

· Peru GDP Growth Rate (August)

Asia

Political/Social Events –

· The Shanghai Cooperation Organization meets in Islamabad, Pakistan. The agenda will focus on combating terrorism, enhancing security cooperation among states, and promoting economic collaboration through trade and investment initiatives.

· Japanese political parties officially kick off campaigning in advance of the October 27 general election.

Economic Reports/Events –

· Indonesia Imports/ Exports/ Balance of Trade (September)

· Japan Capacity Utilization (August)/ Industrial Production Final (August)/ BoJ Adachi Speech

· India Imports/ Exports/ Balance of Trade (September)

· Kazakhstan GDP (September)

· Sri Lanka Manufacturing PMI (September)/ Services PMI (September)

· New Zealand Global Dairy Trade Price Index (October/15)

Europe

Political/Social Events –

· The EU General Affairs Council will meet in Luxembourg. Ministers will discuss EU-Swiss relations, and the fight against antisemitism.

· The EU Transport, Telecommunications, and Energy Council (Energy) will meet in Luxembourg. They will discuss energy prices, and the state of the energy union and REPowerEU.

· The Second Accession Conference with Albania will meet in Luxembourg.

·

Economic Reports/Events –

· Germany Wholesale Prices (September)/ ZEW Current Conditions (October)

· Great Britain Unemployment Rate (August)/ Employment Change (August)/ Claimant Count Change (September)/ HMRC Payrolls Change (September)

· Hungary Construction Output (August)/ Industrial Production Final (August)

· France Inflation Rate Final (September)/ IEA Oil Market Report

· Slovakia Inflation Rate (September)

· Spain Inflation Rate Final (September)

· Euro Area ECB Bank Lending Survey/ ZEW Economic Sentiment Index (October)/ Industrial Production (August)

· Poland Inflation Rate Final (September)

· Ireland Balance of Trade (August)

· Serbia Building Permits (August)

· Turkey Budget Balance (September)

Middle East

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Israel GDP Growth Annualized 3rd Est Q2/ Inflation Rate (September)

· Saudi Arabia Inflation Rate (September)/ Wholesale Prices (September)

Africa

Political/Social Events –

· The Africa Cyber Defense Forum, organized by the African Telecommunications Union, will take place in Kigali, Rwanda.

Economic Reports/Events –

· South Africa SACCI Business Confidence (August)/ SACCI Business Confidence (September)

· Nigeria Food Inflation (September)/ Inflation Rate (September)

Wednesday, October 16, 2024

Global

· The UN Security Council is scheduled to meet for consultations on the United Nations Mission for the Referendum in Western Sahara (MINURSO). In the afternoon, there will be a TCC meeting on United Nations Multidimensional Integrated Stabilization Mission in the Central African Republic (MINUSCA).

· The International Energy Agency (IEA) releases its World Energy Outlook 2024 Report.

Americas

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· USA MBA Mortgage Market Index (October/11)/ Export Prices (September)/ Import Prices (September)/ API Crude Oil Stock Change (October/11)

· Canada Housing Starts (September)/ Manufacturing Sales Final (August)/ New Motor Vehicle Sales (August)

Asia

Political/Social Events –

· Hong Kong’s Chief Executive John Lee will deliver his 3rd annual policy address. Lee is expected to focus on the economy after further curbing dissent earlier this year with the imposition of a local national security law known as Article 23.

Economic Reports/Events –

· Bank of Japan Member of the Policy Board Seiji Adachi gives a speech to business leaders in Kagawa, Japan.

· New Zealand Inflation Rate Q3

· Australia RBA Hunter Speech/ Westpac Leading Index (September)

· South Korea Unemployment Rate (September)

· Japan Machinery Orders (August)

· Philippines Interest Rate Decision/ Cash Remittances (August)

· Thailand Interest Rate Decision

· Indonesia Loan Growth (October)/ Interest Rate Decision/ Lending & Deposit Facility Rate (October)

· India M3 Money Supply (October/04)

Europe

Political/Social Events –

· The EU-Gulf Cooperation Council Summit is held in Brussels. The summit will be co-chaired by the President of the European Council, Charles Michel, and the Emir of Qatar, H.H. Sheikh Tamim bin Hamad Al Thani, as the rotating President of the GCC. The summit is an opportunity for the EU to develop a closer partnership with the GCC and its member states (the United Arab Emirates, the Kingdom of Bahrain, the Kingdom of Saudi Arabia, the Sultanate of Oman, the State of Qatar, and the State of Kuwait).

· The 76th Frankfurt Book Fair takes place through October 20 in Frankfurt, Germany.

Economic Reports/Events –

· European Central Bank President Christine Lagarde gives a speech at the official dinner of Banka Slovenije in Ljubljana, Slovenia.

· European Central Bank Board Member Claudia Buch gives a speech at Bocconi University in Milan, Italy.

· Great Britain Inflation Rate (September)/ PPI Input & Output (September)/ Retail Price Index (September)

· Italy Inflation Rate Final (September)

· Ireland Residential Property Prices (August)

· Euro Area ECB Buch Speech/ ECB President Lagarde Speech/ European Council

· Poland Core Inflation Rate (September)

· Belarus Industrial Production (September)

· Russia PPI (September)

Middle East

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Qatar Inflation Rate (September)

Africa

Political/Social Events –

· Kenya’s Senate will debate whether to dismiss Deputy President Rigathi Gachagua after the National Assembly voted to impeach him. Gachagua has denied all 11 charges against him, which include enriching himself and stirring ethnic hatred.

Economic Reports/Events –

· South Africa Retail Sales (August)

Thursday, October 17, 2024

Global

· G7 Defense Ministers meet in Napoli, Italy.

· The BRICS Business Forum and Business Council meets in Moscow, Russia. Russian President Vladimir Putin will speak at the Forum.

· IMF Managing Director Kristalina Georgieva will give a speech on the outlook for the global economy and policy priorities in advance of the IMF/World Bank meetings the following week in Washington, D.C.

Americas

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Chicago Federal Reserve Bank President Austan Goolsbee gives welcome remarks before the Fifth Annual Exploring Career Pathways in Economics and Related Fields Conference.

· Canada Foreign Securities Purchases (August)

· USA Initial Jobless Claims (October/12)/ Philadelphia Fed Manufacturing Index (October)/ Continuing Jobless Claims (October/05)/ Philly Fed Business Conditions (October)/ Philly Fed CAPEX Index (October)/ Industrial Production (September)/ Capacity Utilization (September)/ Manufacturing Production (September)/ Business Inventories (August)/ NAHB Housing Market Index (October)/ EIA Natural Gas & Crude Oil & Gasoline Stocks Change (October/11)/ 15- & 30-Year Mortgage Rate (October/16)/ Net Long-term TIC Flows (August)/ Foreign Bond Investment (August)/ Overall Net Capital Flows (August)/ Fed Balance Sheet (October/16)

· Brazil Business Confidence (October)

· Paraguay Consumer Confidence (September)

· Chile Interest Rate Decision

Asia

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Japan Imports/ Exports/ Balance of Trade (September)/ Tertiary Industry Index (August)

· Australia Employment Change (September)/ RBA Bulletin/ Unemployment Rate (September)/ Participation Rate (September)

· Singapore Non-Oil Exports (September)/ Balance of Trade (September)

· India Passenger Vehicles Sales (September)

· Kazakhstan Industrial Production (September)

Europe

Political/Social Events –

· The European Council will meet in Brussels. EU leaders will discuss Ukraine, the Middle East, competitiveness, migration, and general foreign affairs.

· There will be an informal meeting of EU trade ministers through October 18 in Budapest, Hungary.

· France and Ukraine will hold a Nuclear Safety Conference in Paris, France.

Economic Reports/Events –

· The European Central Bank meets to discuss and set interest rates. A press conference will follow.

· European Central Bank Board Member Elizabeth McCaul gives speaks via video message on "Supervisory expectations on public cloud usage by European Central Bank (ECB)" at KPMG Cloud Conference 2024 "Profitable Scaling: The Cloud Journey accelerates" in Frankfurt, Germany. Later, she participates on a panel discussion at the “Financial and Regulatory Outlook Conference 2024: A New Age of Finance” organized by Oliver Wyman in Rome, Italy.

· Euro Area Balance of Trade (August)/ Inflation Rate Final (September)/ CPI Final (September)/ Core Inflation Rate Final (September)

· Switzerland Balance of Trade (September)

· Slovakia Harmonized Inflation Rate (September)

· Italy Balance of Trade (August)

· Turkey TCMB Interest Rate Decision/ Overnight Borrowing & Lending Rate (October)/ Foreign Exchange Reserves (October/11)

· Great Britain BoE Woods Speech

· Belarus GDP (September)

Middle East

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Oman M2 Money Supply (August)/ Total Credit (August)

Africa

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Egypt Interest Rate Decision/ Overnight Lending Rate

· Angola Foreign Exchange Reserves (September)/ M3 Money Supply (September)

Friday, October 18, 2024

Global

· The UN Security Council is expected to vote on a draft resolution on Haiti sanctions.

Americas

Political/Social Events –

· President Joe Biden will visit Germany. He had been scheduled to visit last week but had to cancel due to Hurricane Milton. The previously scheduled visit was going to be a formal state visit – something no US President has enjoyed in over 40 years. This visit is now being downgraded to a simple one-day visit. Additionally, there was going to be a meeting of NATO leaders chaired by Biden at Ramstein Air Base to discuss the situation in Ukraine. That meeting will not be rescheduled for this visit.

Economic Reports/Events –

· Federal Reserve Board Governor Christopher J. Waller gives remarks entitled “Decentralized Finance” at the Nineteenth Annual Vienna Macroeconomics Workshop in Vienna, Austria.

· USA Building Permits Prel (September)/ Housing Starts (September)/ Housing Starts (September)/Baker Hughes Total Rigs Count (October/18)

· Colombia ISE Economic Activity (August)

· Argentina Balance of Trade (September)/ Leading Indicator (September)

Asia

Political/Social Events –

· The APEC Finance Ministerial Meeting is held in Lima, Peru.

· ASEAN’s AIPA General Assembly meets in Vientiane.

· Malaysia’s Prime Minister Anwar Ibrahim will present the annual budget.

Economic Reports/Events –

· Hong Kong Unemployment Rate (September)

· India Bank Loan Growth (October/04)/ Deposit Growth (October/04)/ Foreign Exchange Reserves (October/11)

· Sri Lanka Unemployment Rate Q2

· Japan Inflation Rate (September)/ Foreign Bond Investment (October/12)/ Stock Investment by Foreigners (October/12)

· China House Price Index (September)/ GDP Growth Rate Q3/ Industrial Production (September)/ Retail Sales (September)/ Fixed Asset Investment (YTD) (September)/ Unemployment Rate (September)/ Industrial Capacity Utilization Q3/ NBS Press Conference

· Malaysia GDP Growth Rate Prel Q3/ Imports/ Exports/ Balance of Trade (September)

Europe

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Great Britain Retail Sales (September)/ Retail Sales ex Fuel (September)

· Euro Area Current Account (August)/ Construction Output (August)

· Spain Balance of Trade (August)/ Consumer Confidence (September)

· Italy Construction Output (August)/ Current Account (August)

· Serbia Current Account (August)

· Slovakia Current Account (August)

· Ukraine Balance of Trade (July) / Balance of Trade (August)

Middle East

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Israel M1 Money Supply (September)

Africa

Political/Social Events –

· The IMF’s executive board will meet for the first review of Ethiopia’s $3.4 billion financing program.

Economic Reports/Events –

· South Africa Inflation Rate (September)/ Building Permits (August)

· Ghana PPI (September)

· Ethiopia Inflation Rate (September)

Saturday, October 19, 2024

Global

· Nothing significant to report.

Americas

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

Asia

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

Europe

Political/Social Events –

· German Chancellor Olaf Scholz meets with Turkish President Tayyip Erdogan in Istanbul, Turkey. The two leaders will discuss Ukraine and the Middle East.

Economic Reports/Events –

· Nothing significant to report.

Middle East

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

Africa

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

Sunday, October 20, 2024

Global

· The BRICS 1st Climate Congress will be held in Sochi, Russia.

Americas

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

Asia

Political/Social Events –

· Indonesia’s new president, Prabowa Sunianto, will be sworn into office.

Economic Reports/Events –

· New Zealand Credit Card Spending (September)

· China FDI (YTD) (September)

Europe

Political/Social Events –

· Moldova holds presidential elections and a vote on a constitutional referendum on EU integration. There are substantial fears Russia will seek to disrupt the elections in an attempt to block a yes vote on joining the EU.

Economic Reports/Events –

· Nothing significant to report.

Middle East

Political/Social Events –

· Iraq holds regional elections.

Economic Reports/Events –

· Nothing significant to report.

Africa

Political/Social Events –

· Nothing significant to report.

Economic Reports/Events –

· Nothing significant to report.

U.S. Financial Regulatory Week Ahead

Washington Gets Ready for IMF/World Bank Week, The FDIC’s Look at the Resolution of Systemically Important Banks, and HUD Looks at the Mortgage Market and Access to Capital

October 14 - 18, 2024

It is going to be another relatively quiet week in Washington across the board – Congress remains out of session until after the elections, and regulators are quietly preparing for the annual International Monetary Fund/World Bank weeklong meetings that begin on October 21st. With finance ministers, central bankers, and other major regulatory officials converging on Washington for back-to-back meetings, speeches, and events, there will likely be a lot to watch and report (which we will detail in next week’s report).

We would note that that The Federal Deposit Insurance Corporation holds a meeting of the FDIC Systemic Resolution Advisory Committee to discuss the resolution of systemically important financial companies. This continues to be a moving target for bank regulators as banks and Congressional Republicans push back on expanding the definitions for “systemically important.”

Also, this coming week, the Department of Housing and Urban Development is partnering with Ginnie Mae to host a conference looking at the mortgage market and access to capital. With the housing market nationally struggling with still too-high interest rates and a shortage of housing inventory – an issue that has become a hot-button issue on the presidential and congressional campaign trails – this will be a particularly interesting event. In addition to this, House Financial Services Committee Ranking Democrat Representative Maxine Waters (D-CA) said in an interview last week that if Democrats win control of the House in November and she becomes Committee chair again, her number one priority issue will be housing.

Last week, regulators, lobbyists, and everyone else who follows the banking sector were jarred to see TD Bank hit with a $3 billion fine and agreed to asset caps after submitting a guilty plea for money laundering by drug traffickers. As the 10th largest bank in the U.S., the size and impact of the penalties are pretty significant.

Also last week, the digital asset exchange Crypto.com sued the Securities and Exchange Commission after learning they are the target of potential charges by the agency. Crypto argued in their lawsuit that the SEC has no authority over their business or the crypto business overall, saying the agency is acting under “an unlawful de factor rule.” This will be a very interesting case, especially in light of the Supreme Court’s Chevron decision earlier this year clipping the wings of aggressive regulatory actions.

Finally, and perhaps most impactful to markets, the Federal Trade Commission and the Department of Justice’s Antitrust Division jointly released their final version of Hart-Scott-Rodino rules (e.g., new rules dealing with mergers and acquisitions). One aspect of the rules that private equity and other acquisition firms took note of is how the regulators want to look at how Big Tech firms and private equity are acquiring large amounts of smaller companies in a bid to snuff out oncoming competition potentially.

Below is a listing of all the other significant regulatory-related events this coming week:

U.S. Congressional Hearings

U.S. Senate

· The Senate is in Pro Forma session and not returning to work until after the election. No work and no hearings are scheduled. They will return to work on November 12.

House of Representatives

· The House is out of session until after the November elections. No business or hearings are scheduled. They will return to work on November 12.

US Regulatory Meetings & Events

Federal Reserve Board and Federal Reserve Banks

· Tuesday, October 15, 1:00 p.m. – Federal Reserve Board Governor Adriana Kugler gives remarks virtually entitled “Career Opportunities and Diversity in Economics” at the Exploring Careers in Economics event hosted by the Federal Reserve.

· Friday, October 18, 12:10 p.m. (Vienna, Austria) – Federal Reserve Board Governor Christopher J. Waller gives remarks entitled “Decentralized Finance” at the Nineteenth Annual Vienna Macroeconomics Workshop in Vienna, Austria.

U.S. Treasury Department

· There are no significant events scheduled at this time.

Department of Commerce

· There are no significant events scheduled at this time.

Department of Housing and Urban Development

· Tuesday, October 15, 8:30 a.m. – HUD and Ginnie Mae will host a strategic summit on "Mortgage Market Resilience and Access to Credit." Participants include am Valverde, acting president of Ginnie Mae; Daniel Hornung, special assistant to the president for economic policy at the National Economic Council; Julia Gordon, assistant HUD secretary for housing and Federal Housing Administration commissioner; Bob Broeksmit, president/CEO of the Mortgage Bankers Association; David Dworkin, president/CEO of the National Housing Conference; Ted Tozer, fellow in the Housing Finance Policy Center at the Urban Institute and former Ginnie Mae President.

Securities and Exchange Commission

· Tuesday, October 15, 2:00 p.m. – 6:00 p.m. – SIFMA will hold its annual Private Credit Forum. SEC Commissioner Hester Pierce will deliver remarks.

· Thursday, October 17, 2:00 p.m. – The SEC will hold a Closed Meeting.

Commodities Futures Trading Commission

· Tuesday, October 15, 6:00 p.m. – CFTC Commissioner Christy Goldsmith Romero will receive the Pioneer Award from the Asian Pacific American Bar Association (APABA) of Washington, D.C. at the Annual Gala.

· Wednesday, October 16, 9:00 a.m. – 1:00 p.m. – The CFTC’s The Commodity Futures Trading Commission’s Division of Clearing and Risk will hold a public roundtable Oct. 16 from 9:00 a.m. to 1:00 p.m., to discuss existing, new, and emerging issues in clearing. The roundtable will be held in the Conference Center at CFTC's headquarters at Three Lafayette Centre, 1155 21st Street N.W., Washington, D.C.

· Wednesday, October 16, 11:00 a.m. – CFTC Commissioner Caroline D. Pham will speak on a keynote fireside chat at FIX Trading Community’s Americas Trading Conference 2024 in New York.

Federal Deposit Insurance Corporation

· Tuesday, October 15, 9:00 a.m. – The Federal Deposit Insurance Corporation holds a meeting of the FDIC Systemic Resolution Advisory Committee to discuss the resolution of systemically important financial companies.

Office of the Comptroller of the Currency

· There are no significant events scheduled at this time.

The Consumer Financial Protection Bureau

· There are no significant events scheduled at this time.

FINRA

· There are no significant events scheduled at this time.

National Credit Union Administration

· There are no significant events scheduled at this time.

Federal Trade Commission & Department of Justice Antitrust Division