Fulcrum Perspectives

An interactive blog sharing the Fulcrum team's policy updates and analysis.

Recommended Weekend Reads

Understanding Trump’s Latin American Military Buildup, The Secret and Massive Drug Smuggling Routes into the US, Young Adults Are Spending Less Time Together, and The Desperate Search for Safe Havens

October 31 - November 2, 2025

Below are a number of reports and articles we read this past week and found particularly interesting. Hopefully, you will find them interesting and useful as well. Have a great weekend.

The Americas

Understanding Trump’s Military Buildup in Latin America Americas Quarterly Podcast

The recent deployment of the USS Gerald R. Ford, the U.S. Navy’s largest aircraft carrier, has intensified speculation about Washington’s true objectives in the Southern Caribbean. In this episode of the Americas Quarterly Podcast, we examine what’s really behind the Trump administration’s escalating military activity. Is it a hardline campaign against drug cartels, or the opening moves of a broader effort to pressure Venezuelan leader Nicolás Maduro? What do we know about dynamics within the Venezuelan military? And to what extent could this impact Washington’s relations with Colombia and other countries in the region? Our guest is Ryan Berg, director of the Americas Program and head of the Future of Venezuela Initiative at the Center for Strategic and International Studies.

From Posture to Purpose: Rethinking U.S. Strategic Aims in Venezuela FIU Jack D. Gordon Institute for Public Policy

The U.S. military buildup in the Caribbean reflects a strategic confusion between counter-narcotics and regime-change objectives in Venezuela. Current operations project power but lack coherence, risking escalation without achievable outcomes. A sustainable strategy must align U.S. means and ends, favoring intelligence, law enforcement, and targeted financial tools over military coercion. Even limited “surgical strikes” risk hardening regime cohesion, triggering regional instability, fueling migration flows, and creating governance vacuums with grave humanitarian consequences. To avoid these pitfalls while focusing on transnational criminal organizations, Washington should prioritize multilateral law-enforcement cooperation, expand Coast Guard and intelligence capabilities, and strengthen sanctions enforcement targeting the regime’s illicit revenue streams. Aligning coercive, diplomatic, and economic instruments toward realistic, proportional goals offers the only path to sustainable results without deepening Venezuela’s crisis on entangling the United States militarily.

After Argentina’s Midterms, a New Chapter for U.S.-Argentina Relations Center for Strategic and International Studies

Argentina’s midterms may also herald a new era of U.S. relations with the country and Latin America as a whole. In the weeks leading up to the election, the United States announced a major financial assistance package, giving Argentina access to a total of $40 billion in U.S. dollar currency swaps, with $20 billion coming from the U.S. Department of the Treasury’s Exchange Stabilization Fund, and a further $20 billion from banks and sovereign wealth funds. In addition to this, the Trump administration announced plans to purchase Argentine beef, a move that was deeply unpopular with U.S. ranchers but offered a powerful signal of the importance Washington places on its relationship with Buenos Aires

See the Secret Networks Smuggling Drugs to the U.S. From Latin America The Wall Street Journal

These interactive reports and accompanying maps show how demand in America for illegal drugs such as fentanyl and cocaine fuels sophisticated systems for smuggling them in. Traffickers deploy everything from fast-moving fiberglass boats to stealthy “narco-subs” to cargo ships to get their products to users without losing shipments to seizures or couriers to arrest. With decades of experience, according to U.S. counternarcotics officials, the traffickers are usually a step ahead of America and its allies in Latin American and Caribbean waters

Youth and Family Trends and Their Future Impact on the Economy

Cognitive Skills Beyond Childhood The Economic Journal

Data from a British birth cohort followed since 1958 show that cognitive skills early in life predict wages at age 50 better than cognitive skills at age 50. Early cognitive skills likely allow for higher educational attainment or on-the-job learning.

Young Adults Are Spending Less Time With Friends Institute for Family Studies

In post-pandemic America, young adults are spending a record amount of time alone. But even before the pandemic, young adults began spending less time with friends. In 2010, young adults ages 18 to 29 on average spent 12.8 hours a week with friends. By 2019, that number nearly halved, falling to 6.5 hours a week. The pandemic exacerbated this trend with a low point of 4.2 hours a week with friends in 2020. And while we’ve seen a slight increase since, socializing has not nearly recovered. Today, young adults spend just 5 hours a week with friends. Lingering effects of pandemic-era isolation are certainly at play, but the role of technology cannot be ignored.

Mind the Fertility Gap: Why people stopped having babies and how economic freedom can help Institute for Economic Affairs

n a new paper published by the Institute, British women are falling at least 0.4 children short of their own stated family goals, according to fertility data through 2011, with this gap likely widening as fertility now hits record lows of 1.44 while desired family size remains stable at 2.2. New report shows how pro-natal policies that focus on cash incentives, such as baby bonuses, subsidies, and maternity pay, may have some short-term effect but are often found wanting and prohibitively expensive. Evidence shows policies affecting economic freedom, including Labour market, childcare and housing liberalization, can have profound effects on fertility through their impact on work-family compatibility

Geoeconomics & Financial Markets

The Role of Single-Family Rentals in the U.S. Housing Market Federal Reserve Bank of St. Louis

When homeownership and home sales plummeted in 2010 in the wake of the housing market collapse, investors responded by purchasing single-family homes and renting them out to households that could not afford to buy such homes but still desired this type of housing. Subsequently, investor-owned single-family rentals (SFRs) increased as a share of total single-family properties, and they continue to increase as a housing supply shortage and higher mortgage rates make homeownership difficult for many first-time homebuyers. This blog post summarizes economic research that has been done on the role of investor-owned SFRs in the U.S. housing market. Such research has found that the vast majority of SFRs are owned by small-scale investors. Properties owned by large-scale investors tend to increase prices of nearby homes, while ownership by small-scale investors appears to have the opposite effect. Research has also found that investor-owned SFRs expand housing options available to renters but may negatively impact renter welfare in terms of eviction filings4and rent increases.

The Desperate Search for Safe Havens Robin Brooks Substack

Countries with low debt burdens are outperforming ones with lots of debt. The right chart above shows this dynamic. Since Jackson Hole, the Swedish Krona (red line) is the best performing currency against the Dollar, followed by the Norwegian Krone (orange line) and Swiss Franc (black line). The Euro (pink line) is flat against the Dollar, no surprise since it consists mostly of high-debt countries, with Germany’s recent move to soften up its debt brake and pursue big fiscal stimulus a major destabilizer for the region. The Japanese Yen (blue line) is down over two percent against the Dollar, no surprise given that gross government debt is 240 percent of GDP. The fact that Sweden is at the top of the pack makes sense. The Krona is massively undervalued (it’s at the same level against the Euro as during the global financial crisis), while Sweden has also managed to steer clear of endlessly rising debt levels that so bedevil the Euro periphery.

As New Jobs In Finance Dry Up, New York City’s Fiscal Model Is Wilting The Economist

According to the Citizens Budget Commission New York state’s share of American taxpayers reporting more than $1m in income declined from 12.7% in 2010 to 8.7% in 2022. Such people paid $34bn in income tax to the state and city in 2022, a figure that would have been $13bn higher if New York’s share of millionaires had held up. Estimates from Goldman Sachs suggest that fully 10% of households in New York City with incomes of more than $10m established residency elsewhere between 2018 and 2023. As the ultra-rich have headed for the exit, the city’s employment growth has become concentrated in much worse-paid industries than finance. Since the end of 2019, New York has added more than 268,000 jobs in health care and social assistance, particularly home health care. Employment as a whole rose by just 220,000 over the same period, meaning that, if it was not for that industry, overall employment would have shrunk.

Recommended Weekend Reading

Looking at U.S. - China Policy Challenges in Advance of the Xi-Trump Meeting, Will the AI Data Center Boom Threaten the Trump Manufacturing Revival?, and Looking at the Supply Chain Chokepoints in Quantum

October 24 - 26, 2025

Below are a number of reports and articles we read this past week and found particularly interesting. Hopefully, you will find them both interesting and useful. Have a great weekend.

A Look at Major Policy Issues for Both the U.S. and China

China’s Two Economy Problem Semafor

At a glance, China’s export-focused manufacturing sector is buoyant, racing away from the US and other advanced economies in areas including batteries, robotics, and biotechnology. And yet its domestic economy is in deep crisis, suffering from spiraling levels of joblessness, plunging consumer confidence, and falling business investment in the midst of a real estate collapse. To understand China is to believe all these things to be true. It is an economy moving fast and slow at the same time, a tech superpower that creates opportunities for PhD scientists but not its underclass of rural workers, a nation that manufactures a third of everything made in the world but can’t stir demand at home. Its growth model is so lopsided it is unbalancing the global economy. In short, China is at war with itself; taking the long view, the current US-China trade spat is a sideshow.

How China Raced Ahead of the U.S. on Nuclear Power New York Times

While U.S. nuclear construction costs skyrocketed after the 1960s, they fell by half in China during the 2000s and have since stabilized, according to data published recently in Nature. (The only two U.S. reactors built this century, at the Vogtle nuclear plant in Waynesboro, Ga., took 11 years and cost $35 billion.) China’s nuclear companies build only a handful of reactor types, and they do it over and over again. That allows developers to perfect the construction process and is “essential for scaling efficiently,” said Joy Jiang, an energy innovation analyst at the Breakthrough Institute, a pro-nuclear research organization. “It means you can streamline licensing and simplify your supply chain.”

Taiwan Is Not for Sale David Sacks/Foreign Affairs

When U.S. President Donald Trump meets with Chinese leader Xi Jinping in the coming weeks and months—likely starting next week at the Asia-Pacific Economic Cooperation forum in South Korea—the immediate focus will be on how to de-escalate the latest round of export restrictions and tariff threats that the United States and China have wielded against each other. But Trump and Xi are also likely to consider a more ambitious deal to reset bilateral relations, which would seek not only to stabilize economic ties but also to reevaluate geopolitical flash points—above all, Taiwan.

How U.S. Can Outcompete China Daniel Bob/RealClearWorld

Leadership in critical technologies such as artificial intelligence, quantum computing, semiconductors, robotics, advanced materials, biotechnology, and aerospace will determine who leads the world economically and strategically in the decades ahead. These technologies spur productivity gains, provide supply chain resilience, and shape military strength that sustain national security and prosperity.

China Against China Jonathan Czin/Foreign Affairs

Thirteen years after Xi Jinping ascended to the top of China’s leadership hierarchy, observers in Washington remain deeply confused about how to assess his rule. To some, Xi is the second coming of Mao, having accumulated near-total power and bent the state to his will; to others, Xi’s power is so tenuous that he is perpetually at risk of disgruntled elites ousting him in a coup.

Technology, Trade, Immigration, and Geopolitical Power

The Fiscal Impact of Immigration The Manhattan Institute

Using a methodology aligned with the congressional budget window, this report estimates the fiscal, economic, and population effects of immigrants by age, education, and category of admission. It updates previous Manhattan Institute research by incorporating more recent census data, more precise life-expectancy and fertility adjustments, economic and capital stock growth, and the fiscal effects of the descendants of immigrants. This report estimates fiscal impact in nominal dollars over a 10- and 30-year horizon. This report also updates and fixes several assumptions from previous research on the fiscal impact of immigrants, including the calculation method for interest on the debt and correctly adjusting tax credits for inflation. It uses an updated method for accounting for public-goods spending. Overall, the average new immigrant reduces the federal budget deficit and expands the economy, but this is not true of all categories of immigrants. Immigrants without college degrees receive more government benefits than they pay in taxes, even when we consider only their preretirement years. By contrast, immigrants who finished college or obtained an advanced degree contribute millions of dollars more in federal taxes than they receive in government benefits, and they save substantial amounts of interest on the debt while growing the economy.

AI Data Center Boom Threatens Trump’s Manufacturing Revival Bloomberg

The AI boom is coming to America’s industrial heartland, which speaks to how the economy is being transformed—even propped up—by a surge in investment in software, chipmaking and data centers. But the Lordstown plant’s reinvention raises the question: Is the exuberance around the technology that Trump has enthusiastically endorsed getting in the way of his goal of making America great again at churning out things like gasoline-powered cars, steel and furniture? Access to capital, power and people is key to the success of any construction or manufacturing project—and right now AI is gobbling up all three.

The Supply Chain Chokepoints in Quantum War on the Rocks

As quantum technologies move from proof-of-concept to deployment, supply chain resilience becomes just as critical as qubit coherence times. Resilience includes redundancy, domestic capacity, and timely alternatives when foreign manufacturers face disruptions or reprioritize their customers. Expertise and capital are key to driving technological innovation, but mean little if a company or research lab does not have access to the necessary inputs and reliable supply chains. Lack of access to one aspect of the supply chain can grind further research and development to a standstill, a red flag for investors and potential researchers. If the United States is to remain on the leading edge of quantum technologies, ensuring companies, government labs, and academic projects can consistently access critical supplies is a prerequisite.

Recommended Weekend Reads

Listen to Venezuelan Opposition Leader Machado Learn She Has Won the Nobel Peace Prize, Preparing for Putin’s Death, How Ukraine has Crippled Russia’s Oil Lifeline, Where Could Reshoring Manufacturers Find Workers?

October 10 - 12, 2025

Each week, we gather up the best research and reports we have read in the past week and pass them on to you. Below is this week’s curated collection. We hope you find them interesting and informative, and that you have a great weekend.

Latin America

“Oh my God… I have no words.” Listen to the emotional moment this year’s laureate, Maria Corina Machado, leader of the Venezuelan democracy movement, finds out she has been awarded the Nobel Peace Prize. Kristian Berg Harpviken, Director of the Norwegian Nobel Institute, shared the news with her directly before it was announced to the world.

Escalation Against the Maduro Regime in Venezuela: Puerto Rico’s Emerging Role in U.S. Power Projection Center for Strategic & International Studies

The United States is overseeing a seismic reordering of defense priorities and assets to the Western Hemisphere. At the time of this writing, four destroyers, one cruiser, one nuclear-powered attack submarine, one landing helicopter dock, two amphibious vessels, and one special operations platform, alongside a host of enablers and support vessels, are present in the Caribbean. In total, more than 10 percent of all deployed U.S. naval assets are currently located in the SOUTHCOM area of responsibility. These forces are more than a mere show of force; since the first warships entered the region in August, the U.S. military has conducted at least four lethal strikes against alleged drug trafficking boats in international waters, killing at least 21. The next phase of operations could witness strikes within Venezuelan territorial waters or even on land. Reportedly, the Trump administration has already drawn up strike packages for such contingencies, which are currently being reviewed by the president. Meanwhile, President Donald Trump has notified Congress of his determination that the United States is involved in a “non-international armed conflict” against drug trafficking groups now designated as foreign terrorist organizations, suggesting that the tempo of operations will only increase in the coming weeks.

Understanding Trump’s Shift on Brazil Americas Quarterly

Donald Trump’s Brazil strategy was not working. Instead of helping former President Jair Bolsonaro avoid prison or be allowed to run again in 2026, a barrage of U.S. tariffs and sanctions was having the opposite effect—hastening Bolsonaro’s conviction while boosting the popularity of his rival, President Luiz Inácio Lula da Silva. Brazil’s economy seemed to handle the strains surprisingly well, while a procession of business leaders to the White House in recent weeks warned of risks to U.S. inflation from coffee, beef, and other goods. So the U.S. president did what he has on other occasions: He listened. And then he changed course. Trump’s brief encounter with Lula at the United Nations, after which he proclaimed they had “excellent chemistry,” was not a chance meeting. And then they had a phone call. What comes next?

Russia

Preparing for Putin’s Death The Rand Corporation

Vladimir Putin is the longest-serving Russian ruler since Joseph Stalin. He turns 73 on Oct. 7, old for a Russian, but even if he is fanatical about his health, he cannot continue indefinitely. It is essential to consider who might succeed him. This is a challenging task—under Putin's rule, the Russian political system has, once again, become an authoritarian dictatorship bearing some of the features of a personality cult. Under these conditions, Putin has not, as far as we can tell, been publicly grooming a successor, presumably because his personal authority would begin to ebb to them, and because they would become a target for others who fear losing their influence.

How Russia Recovered Dara Massicot/Foreign Affairs

The story of Russia’s invasion of Ukraine has been one of upset expectations and wild swings in performance. At the start of the war, most of NATO saw Russia as an unstoppable behemoth, poised to quickly defeat Ukraine. Instead, Russia’s forces were halted in their tracks and pushed back. Then, outside observers decided the Russian military was rotten, perhaps one counterattack away from collapse. That also proved incorrect—Ukrainian offensives failed, and Moscow resumed its slow advance. Now, plenty of people look beyond Russia to understand the state of the battlefield, blaming Kyiv’s troubles on insufficient external backing instead. What many policymakers and strategists have missed is the extent to which Moscow has learned from its failures and adapted its strategy and approach to war, in Ukraine and beyond. Today, the military is institutionalizing its knowledge, realigning its defense manufacturers and research organizations to support wartime needs, and pairing tech startups with state resources.

Ukraine’s Drone War Is Crippling Russia’s Oil Lifeline National Security Journal

Ukraine’s expanding long-range drone fleet has knocked nearly 40% of Russia’s oil refineries offline. According to an analysis by BeefeaterFella, with refined fuels yielding far higher margins than crude, Russia could be losing $3–6 billion annually in revenue, while shortages, rationing, and black markets spread at home. Since January, 21 of Russia’s 38 major refineries have been struck, with successful Ukrainian attacks already 48% higher than in all of 2024, according to the BBC. The cascading effects are being felt far from the battlefield. Owners of small petrol stations in Siberia told Russian media they were forced to close due to supply shortfalls, with one manager in Novosibirsk comparing the crisis to the hyperinflation of post-Soviet Russia.

Trade, Tariffs, and Reshoring of Manufacturing

Where Could Reshoring Manufacturers Find Workers? Federal Reserve Bank of Cleveland

The announcement of new tariffs this year has reignited the discussion of whether the United States can expand its manufacturing employment by millions of workers. Reversing decades of manufacturing job losses is one explicit goal of the new higher tariffs. This District Data Brief presents measures of employment and demographics as context around the current and potential employment in US manufacturing. Raising manufacturing employment by 4 to 6 million workers would constitute a large increase relative to current levels. However, an increase of this scale would not be large relative to the global growth of manufacturing employment in recent decades, the current US labor force size, or the number of US adults not engaged in high-paying work

SORCE Insights: Tariff-Related Uncertainty and Pass-Through to Pricing The Federal Reserve Bank of Cleveland

In the Survey of Regional Conditions and Expectations (SORCE) fielded in June 2025, the Cleveland Fed asked respondents a set of special questions about the impact of tariffs and tariff-related uncertainty on costs, selling prices, staffing, and capital expenditure plans. Most respondents (64 percent) said that they were incurring costs caused by uncertainty over tariff rates, the direct expenses of paying tariffs, or both. Of these respondents, 68 percent expected to pass through at least some of those costs to their customers. About one in five firms said that they had scaled back plans to hire staff or make capital expenditures because of uncertainty over tariff rates.

Who Will Pay for Tariffs? Businesses’ Expectations about Costs and Prices Federal Reserve Bank of Boston

Amid evolving global trade policy and rising tariff uncertainty, understanding how small and medium-sized businesses (SMBs) form expectations about future costs and adjust their pricing is critical for assessing how the recently imposed tariffs on US imports could impact consumer prices. To that end, this brief analyzes several waves of a survey of owners and other decision-makers at a nationally representative sample of US SMBs. It focuses on waves conducted during the period of December 2024 to August 2025. Key Takeaways from this paper include:

From December 2024 to April 2025, the share of SMBs expecting larger tariffs increased considerably; expectations about the size of future tariffs also increased over time.

In the August 2025 survey wave, SMBs whose costs are affected by the new tariffs reported paying an average tariff rate in July 2025 (11.4%) that was nearly double the average rate they paid in January 2025 (6.5%).

SMBs that believe the new tariffs will persist for a year or longer expect to pass through as much as three times more of their cost increases into consumer prices compared with SMBs that believe the new tariffs will be short-lived.

A back-of-the-envelope calculation suggests a 0.75 percent near-term increase in core consumer prices stemming from recent tariff increases on directly imported consumer goods.

Recommended Weekend Reads

The Geopolitics of Trump’s War on Drugs, America Loves Cocaine Again, What is Stablecoin?, How Many Manufacturing Jobs Will Tariffs Create, and The Growing Link Between Marriage, Fertility, and Partisanship

September 26 - 28, 2025

Each week, we gather up the best research and reports we have read in the past week and pass them on to you. Below is this week’s curated collection. We hope you find them interesting and informative, and that you have a great weekend.

The Geopolitics of Trump‘s War on Drug Cartels

The Wrong Way to Fight the Cartels Ryan Berg/Foreign Affairs

Since returning to the White House, U.S. President Donald Trump has pledged to defeat the Western Hemisphere’s violent drug traffickers by any means necessary. In a March address to Congress, Trump declared, “The cartels are waging war in America, and it’s time for America to wage war on the cartels.” Washington has left behind its traditional conception of the fight against transnational criminal organizations as a matter of law enforcement with its threats of “war” and consideration of military action against the cartels. A militarized approach may be a politically attractive way for Trump to project strength. And indeed, the United States can, and should, draw on many valuable lessons from the last two decades of counterterrorism missions during the “war on terror” in its campaign against the cartels. But there is a more productive path forward than drastically shifting the rules of engagement with transnational criminal groups.

The Geopolitics of Trump’s War on Drugs Americas Quarterly

Half a century after former U.S. President Richard Nixon launched the war on drugs, global cocaine output and consumption are at record highs. According to the UN’s latest drug report, cocaine production jumped roughly a third in 2023 to over 3,700 tons, with usage rising to an estimated 25 million people. Over the past decade, narcotics supply chains have diversified, and demand has hardly blinked. President Donald Trump’s second term has repackaged the drug war with sharper geopolitical edges. While fentanyl from Chinese sources seemed to be the president’s main focus during his campaign, the more traditional target of cocaine has lately become more prominent. Washington has pledged to “disrupt the supply chain from tooth to tail” and to “partner with – or otherwise hold accountable” source countries, language mirrored in the U.S. Drug Enforcement Administration (DEA) National Drug Threat Assessment 2024.

America Loves Cocaine Again—Mexico’s New Drug King Cashes In The Wall Street Journal

Cocaine sold in the U.S. is cheaper and as pure as ever for retail buyers. Consumption in the western U.S. has increased 154% since 2019 and is up 19% during the same period in the eastern part of the country, according to the drug-testing company Millennium Health. In contrast, fentanyl use in the U.S. began to drop in mid-2023 and has been declining since, according to data from the Centers for Disease Control and Prevention. For new users, cocaine doesn’t carry the stigma of fentanyl addiction. Middle-class addicts and the tragic spectacle of homeless crack-cocaine users in the 1990s helped put a lid on America’s last cocaine epidemic.

Geoeconomics

‘Capital absorption’ is big in economic development. But what is it? Federal Reserve Bank of Boston

The term “capital absorption” is not well-known or easily understood. But it’s critical in the local economic development world, and I recently heard an analogy I think can help people understand it. Picture an irrigation system designed to direct the flow of money to the projects that need it most. Such a system frees communities from merely hoping that the unpredictable “rainfall” of funding falls in the right place. Instead, the system guarantees it gets there. That’s what capital absorption is. It’s coordination that helps local places absorb capital investments in the kinds of projects that can literally change what these places look like – things like child care centers, or housing, or downtown building renovations. Reliable systems are established and run by prepared partners to accept the funding when it appears and move it exactly where it’s needed, so the work can get done in ways that strengthen local economies.

How Many Manufacturing Jobs Will Trump’s Tariffs Create? And at What Cost? AEI Center for Technology, Science, Industry, and the State Project

Secular decline in the share of manufacturing jobs in the labor force largely reflects the shift of consumer expenditures from goods to services. High tariffs cannot restore manufacturing jobs to the 27 percent share of the labor force experienced 60 years ago. Achieving Trump’s objective for eliminating the trade deficit in manufactures would require tariffs at least twice as high as those imposed through September 2025. The annual cost to American consumers of shifting each job from service employment to manufacturing employment through high tariffs exceeds $200,000.

What is a Stablecoin? McKinsey & Company

In the rapidly evolving world of digital assets, one innovation stands out for its potential to bring stability and reliability to the historically volatile blockchain-based currency market: the stablecoin. As the name suggests, a stablecoin is a type of digital currency designed to maintain a stable value. These digital currencies are pegged to a traditional fiat currency like the US dollar. Stablecoin use has increased significantly in recent years: In the past 18 months, the total market capitalization of stablecoins has more than doubled to $250 billion, from $120 billion, and industry forecasts expect it to reach up to $2 trillion by 2028. With major players like JPMorgan Chase experimenting with tokenized deposits and PayPal launching its own stablecoin, digital money is a major story in digital finance. For individuals and organizations looking to capitalize on the benefits of blockchain-based transactions, what exactly is Stablecoin?

US Political & Social Trends

The Growing Link Between Marriage, Fertility, And Partisanship The Institute for Family Studies

Conservative women born between 1975 and 1979—women who are finished having children—have a completed family size of 2.1, right at replacement. Moderate women in the same age group have 1.8 children, and liberal women just 1.5. Narrower gaps exist between conservatives born between 1985 and 1989, who have a completed fertility rate of 2.1, while moderates are at 1.9 and liberals 1.7. Conservative women born between 1995 and 1999 have, so far, only had 0.7 children, the same as moderates. Liberals in the same cohort average 0.4 so far. Differences between conservative and liberal women should not be overstated. Birthrates are lower for all groups when compared to the state of fertility before 1975. Marriage rates for all groups are lower, too. Yet the differences are large enough that the parties ultimately appeal to manifestly different constituencies.

It's Not Just You: Americans Are Still Not Hanging Out Generation Tech

The average American spent 38 minutes a day socializing in 2019 and 35 minutes in 2024. In 2024, for the first time, adults 50 and older spent (very slightly) more time socializing in person than teens and young adults. Young people’s social time is at an all-time low in the 21-year history of the survey. Fifteen- to 25-year-olds spend 26 fewer minutes a day socializing in person than they did in 2003. That’s three hours a week, 13 hours a month, and 158 hours a year less getting together with friends, having a face-to-face conversation, meeting for dinner, or chatting before seeing a movie together. No wonder so many more teens now describe themselves as lonely.

Why do only humans weep? The evolutionary puzzle of crying BigThink

In an excerpt from Steven Pinker’s new book, When Everyone Knows That Everyone Knows…, Pinker explains that crying is not just an expression of sadness but an evolved signal of surrender, helplessness, and a plea for comfort. However, tears can also mark moments of joy, compassion, and awe, reflecting the emotional opposites of the things that make us laugh. The unique human capacity to weep may have evolved to strengthen social bonds and generate common knowledge regarding our inner states.

If I Work Harder, Will You Love Me? Arthur Brooks/The Atlantic

Between teaching Harvard MBA students and speaking to a lot of business audiences, I’m often interacting with successful people who work extremely long hours. It’s common for me to hear about 13-hour workdays and seven-day workweeks, with few or no vacations. What I see among many of those I encounter is workaholism, a pathology characterized by continuing to work during discretionary time, thinking about work all the time, and pursuing job tasks well beyond what’s required to meet any need. Workaholics feel a compulsion to work even when they are already earning plenty of money and despite getting minimal enjoyment from doing so.

Recommended Weekend Reads

Latin America Can De-Risk Semiconductor Supply Chains, Why Russian-Indian Relations Have Remained Steady, and Why Tariffs Led to More Demand for Stablecoins Went Up and Less for the Dollar

August 29 - 31, 2025

Here are our recommended reads from reports and articles we read in the last week. We hope you find these useful and that you have a relaxing weekend. And let us know if you or someone you know wants to be added to our distribution list.

Americas

Latin America’s Role in De-Risking Semiconductor Supply Chains Center for Strategic & International Studies

While the semiconductor supply chain currently spans several continents, China has made efforts to develop a self-sufficient semiconductor manufacturing ecosystem through industrial policies such as “Made in China 2025,” which presents a direct strategic and economic challenge to the United States. De-risking the semiconductor supply chain, particularly that of “legacy chips,” is of paramount importance, particularly at a time in which the Trump administration considers imposing additional sectoral tariffs on semiconductors. Latin America sits at the juncture of possibility and opportunity at a critical time for the expansion of semiconductor manufacturing, providing some of the key elements and capabilities that allow for semiconductor assembly, testing, and packaging as well as final integration into electronics. For companies relying on semiconductor manufacturing, diversifying production sources is key to reducing the risks associated with supply chain disruptions and great power competition.

Latin America’s Opportunity in the AI Race Americas Quarterly

In recent weeks, two starkly different visions of the future of the digital world emerged from the globe’s AI superpowers. These competing philosophies have put Latin America in an uncomfortable position between them. The region now faces a digital dependency trap that could determine its technological fate for decades. Last month, the Trump administration released “Winning the Race: America’s AI Action Plan,” a comprehensive national AI strategy that frames artificial intelligence as a zero-sum competition where the U.S. must achieve “unquestioned and unchallenged global technological dominance. China then unveiled its “Action Plan on Global Governance of Artificial Intelligence.” For Latin American policymakers, these manifestos present what appears to be a binary choice. Choosing wrong could mean decades of technological dependency, limited sovereignty, and diminished prospects for indigenous innovation. The tension between the two paths, however, could offer the region an opportunity for growth.

On the Ground With a Top Mexican Cartel New York Times

For the last year, Paulina Villegas, an investigative journalist for The New York Times, had the daunting task of meeting repeatedly with members of the Sinaloa Cartel. The assignment had obvious risks: The Sinaloa Cartel is a U.S.-designated terrorist group. But the meetings, Ms. Villegas said, were vital to her quest to provide readers a clearer understanding of how powerful criminal groups operate, documenting the practices and root causes that both the Mexican and American governments are trying to address.

The Indo-Pacific

Why Russian-India Relations Have Been Steady in the Storm War on the Rocks

Russia has more friends than Western analysts like to admit, even three years into the Russo-Ukrainian War. While many have paid close attention to Russia’s beneficial partnership with Iran, the introduction of North Korea’s legions into the Ukrainian battlespace, or persistent materiel support from China, Russia’s other rising-power relationship is often underdiscussed — that of India. The Russian-Indian relationship is both of longer duration and deeper history than those Russia has with its other key partners. It is also sometimes ignored as it does not extend to shared adversarial relations with the greater West. This is a mistake, as India is one of Russia’s self-identified civilizational friends. Furthermore, despite various ups and downs, the partnership has proven quite resistant to third-party pressures, including recently from the anti-Russian Western coalition.

What’s New About Involution? Carnegie China

In recent months “neijuan” (内卷), or “involution,” has become one of the most important buzzwords in Chinese policymaking circles. It has come to describe a disruptive process of relentless competition and price cutting among Chinese businesses, and has been increasingly criticized by policymakers, from President Xi Jinping down, for leading to a zero-sum race to the bottom, marked by vicious price wars, large-scale losses, homogenous products, and improper business practices. An August 2 article in Caixin explains: China’s top economic planner vowed on Friday to intensify its crackdown on “involution,” pledging to curb disorderly corporate competition, rein in wasteful investment and standardize local governments’ business attraction practices to protect fair market order. The article is referring to the July 30 Politburo meeting that set out Beijing’s priorities for the second half of 2025. Of the three main priorities, two—the need to boost domestic consumption and the promise to support the real estate market—have been proposed regularly in the past three to four years. Much of the focus, however, was on the newest priority, which is to battle deflationary pressures by reducing “disorderly” price competition and overcapacity in manufacturing—measures, in other words, aimed at reining in involution.

Xi Unleashes China’s Biggest Purge of Military Leaders Since Mao Bloomberg

China’s leader has ousted almost a fifth of the generals whom he personally appointed while running the country, something his predecessors never did, according to a Bloomberg News analysis of TV footage, parliamentary gazettes, and other public records. Moreover, Xi’s purge has left the CMC with only four total members, down from seven when his third term started. That’s the fewest in the post-Mao era, the Bloomberg analysis shows. As more and more of China’s top military leaders fall, it leaves those trying to understand the nation grappling with a near-impossible question, given the opaque nature of the Communist Party: Is this all a sign of Xi’s political strength, or of his weakness? The implications reach around the world and across the global economy.

Geoeconomics

Tariffs, Stablecoins, and the Demand for Dollars Federal Reserve Bank of Cleveland

Several studies have shown that aggregate demand for US dollars fell following the announcement of tariffs by the US government on April 2, 2025. Using data on stablecoins as a proxy for dollar trading, we find that the decline in dollar demand is smaller for investors in countries that saw larger increases in tariffs. Our interpretation is that, as foreign investors anticipate that tariffs will make it more expensive to acquire US dollars in the future, they buy dollars today. This channel is stronger for more liquid stablecoins and for countries with tighter capital controls, consistent with the idea that, when actual dollars are hard to acquire, stablecoins may be regarded as a substitute. Our findings cast light on the effects of the tariffs on global foreign exchange markets, as well as on the degree to which stablecoins are considered a close substitute for dollars.

America’s Coming Crash: Will Washington’s Debt Addiction Spark the Next Global Crisis? Kenneth Rogoff/Foreign Affairs

For much of the past quarter-century, the rest of the world has looked in wonder at the United States’ ability to borrow its way out of trouble. Again and again, under both Democratic and Republican administrations, the government has used debt more vigorously than almost any other country to fight wars, global recessions, pandemics, and financial crises. Even as U.S. public debt rapidly climbed from one plateau to the next—net debt is now nearing 100 percent of national income—creditors at home and abroad showed no signs of debt fatigue. For years after the 2008–9 global financial crisis, interest rates on Treasury debt were ultralow, and a great many economists came to believe that they would remain so into the distant future. Thus, running government deficits—fresh borrowing—seemed a veritable free lunch. Given the dollar’s reputation as the world’s premier safe and liquid asset, global bond market investors would always be happy to digest another huge pile of dollar debt, especially in a crisis situation in which uncertainty was high and safe assets were in short supply. The past few years have cast serious doubt on those assumptions.

How Chips Factor Into a De Facto US Sovereign Wealth Fund OMFIF

In July 2025, former Intel Chief Executive Officer Pat Gelsinger called for a US sovereign wealth fund to ‘keep America’s technological edge’. Just a month in, a US SWF has materialized under Donald Trump’s administration – owning 10% of Intel Corporation, the only American company manufacturing advanced chips on US soil. Traditionally, sovereign wealth funds are state-owned investment funds that manage national surpluses. Norges Bank Investment Management, for example, manages Norway’s export surplus derived from its natural resources. However, the US SWF is from a trade deficit country. It is not one single fund authorised by the legislature. Instead, it’s a strategy driven by executive power. Unlike a conventional SWF, the US SWF has no formal, top-down asset allocation plan. That’s why in the months following Trump’s executive order for establishing the fund, the US SWF appeared first as an ad hoc collection of US stakes in business sectors, ranging from attempted control over TikTok to a golden share in the proposed Nippon Steel-US Steel merger, to equities in bitcoins formerly collected from various criminal and civil actions of the US government.

Recommended Weekend Reads

Did Trump Just Hand China the Tools to Beat the US in AI?, The Strategic Mineral Alliance the West Needs, US Construction’s 5 Decades of Decline, and Democrats Face A Voter Registration Crisis

August 22 - 24, 2025

Here are our recommended reads from reports and articles we read in the last week. We hope you find these useful and that you have a relaxing weekend. And let us know if you or someone you know wants to be added to our distribution list.

AI’s impact on National Security and GDP

Trump Just Handed China the Tools to Beat America in AI Matt Pottinger & Liza Tobin/The Free Press

Pottinger, who served as Deputy National Security Advisor to President Trump in his first term, and Tobin, write President Trump’s team just gave China’s rulers the technology they need to beat us in the artificial intelligence race. If he doesn’t reverse this decision, they argue, it may be remembered as the moment when America surrendered the technological advantage needed to bring manufacturing home and keep our nation secure. They argue we should not believe the claims that these chips aren’t very advanced. China’s lack of unfettered access to U.S.-designed AI chips, they write, is America’s clearest advantage in the AI race. By reversing the ban, the White House is helping Beijing’s Communist regime close the gap.

Global Compute and National Security Center for New America Security

The United States faces a choice: leverage its current lead to promote U.S. AI infrastructure and applications globally, while preserving its edge at the frontier; or continue to primarily focus on protection, while other countries gradually narrow the gap. As Michael Kratsios, President Donald Trump’s science and technology advisor, put it: “It is not enough to seek to protect America’s technological lead. We also have a duty to promote American technological leadership.” The protect and promote strategy outlined in this report offers a path to sustainable leadership that both safeguards critical capabilities and expands American influence in the global AI ecosystem.

The Macro Impact of AI on GDP the Overshoot

Capital spending related to AI is growing so rapidly that it is now meaningful relative to the $30 trillion U.S. economy. Gross Domestic Product (GDP) was about 0.2%-0.3% larger in 2025Q2 than it would have been if businesses’ spending on data center construction, computers and peripheral equipment, and communications equipment had grown in line with the 2011Q1-2022Q31 trend. Moreover, this impact is likely understated, because existing methodologies are (probably) not fully capturing the investment being done by the five companies responsible for the bulk of the data center buildout: Amazon, Google, Meta, Microsoft, and Oracle. Those five companies also happen to be the ones with the five largest capex budgets in the entire S&P 500 in 2025Q2. I estimate that U.S. GDP would be about 0.4% higher than currently reported—or about 0.6% higher than if there had been no AI boom—if the capital expenditures of the big 5 were fully incorporated into the official data. Or put yet another way, the growth in direct AI-related capex by the big 5 since mid-2023 would correspond to about 10% of the total increase in the dollar value of U.S. GDP over the past two years. Including additional capital spending on power plants and electricity generation would lead to an even larger number.

Geoeconomics

Reform or Realignment? The Geopolitical Lessons of Bretton Woods Carnegie Endowment for International Peace

The history of Bretton Woods sharpens questions about the issues and interdependencies that can provide the basis for any reform of existing institutions.

Five Decades of Decline: U.S. Construction Sector Productivity Federal Reserve Bank of Richmond

Construction labor productivity in the US fell by more than 30 percent from 1970 to 2020, while overall U.S. economic productivity doubled over the same period; Despite potential biases in price deflators, multiple studies confirm that the productivity decline is real, with physical measures like housing units per worker showing similar stagnation, and; Increasing land-use regulations may be a plausible cause for the decline, as more strict land-use regulations disincentivize construction companies from pursuing larger projects, keeping them relatively small. In addition, this reduces incentives for technological innovation and economies of scale.

The Ghost in Capitalism's Machine: Industrial policy returns to global trade Peter Draper/ Hindrich Foundation

Industrial policy is the ghost in capitalism’s machine — always present, rarely acknowledged. Even laissez-faire economies flirt with it, while denying its existence. It attracts polarized views anchored in ideological conceptions over how much power to accord states, or freedom to markets. Industrial policy is making a comeback as geopolitical contestation amongst the major powers sharpens.

Russia, Ukraine, and the Economic and Security Implications of a Possible Ceasefire

Tanks, Tech, and Tungsten: The Strategic Mineral Alliance the West Needs War on the Rocks

What good is a tank if you can’t get the metals to build it? This week’s meeting between U.S., Ukrainian, and European leaders showed potential progress towards security cooperation. And while the new U.S.-Ukrainian Reconstruction Investment Fund agreement marks an important step toward increasing the resilience of both U.S. and European supply chains, there is more work to be done. Building on this momentum, the United States and the European Union should seek closer critical minerals supply chain cooperation. There are several opportunities for the two economies to work together by focusing on defense and security, rather than the economic and clean energy framing of the past. Tighter cooperation could strengthen the E.U. defense-industrial base, enhance military readiness, and strengthen NATO’s deterrence posture while enabling the United States to secure critical minerals, preserve manufacturing capacity, and redirect precious resources to the Indo-Pacific. Supply chain cooperation would also help both sides reduce dependence on China, which dominates the critical minerals market by creating oversupply and using export restrictions. Indeed, the China challenge requires the United States and Europe to work together.

Russia’s Imperial Black Sea Strategy Foreign Affairs

Russia’s aggression against Ukraine and other neighbors is transforming the Black Sea into Eurasia’s strategic frontier. Russia has disrupted flows of energy, food, and other commodities; generated millions of migrants; and heightened insecurity not just in Ukraine but also across the entire Black Sea region. These efforts constitute part of a much longer and larger strategy. Russia does not merely seek to dominate Ukraine. It wants to render each of the other five states that border the Black Sea—as well as Moldova, which borders Romania and Ukraine and whose waters flow into the sea—subservient to its interests so that it can exercise veto power over choices these countries make. Moscow also aspires to use the Black Sea as a platform from which to project power and influence throughout the Middle East, the Mediterranean, and the Caucasus.

U.S. Politics & Elections

The Democratic Party Faces a Voter Registration Crisis The New York Times

According to an analysis conducted by the New York Times, the Democratic Party is hemorrhaging voters long before they even go to the polls. Of the 30 states that track voter registration by political party, Democrats lost ground to Republicans in every single one between the 2020 and 2024 elections — and often by a lot. That four-year swing toward the Republicans adds up to 4.5 million voters, a deep political hole that could take years for Democrats to climb out of.

Trump’s Tariffs and ‘One Big Beautiful Bill’ Face More Opposition Than Support as His Job Rating Slips Pew Research Center

The latest national survey by Pew Research Center – conducted Aug. 4-10 among 3,554 adults – finds that a 53% majority say President Trump is making the federal government work worse, while only about half as many (27%) say he is making the government work better. (Two-in-ten say he is making things about equally better and worse.) Both Republicans and Democrats now offer more negative assessments of Trump’s impact on the federal government than they had predicted in a survey conducted in the weeks immediately following Trump’s inauguration. Six months into his second term, public evaluations of President Donald Trump’s job performance have grown more negative. His job approval stands at 38% (60% disapprove), and fewer Americans now attribute several positive personal characteristics to him than did so during the campaign. Two of the new administration’s signature accomplishments – the rollout of its tariff policies and the tax and spending law known as the “One Big Beautiful Bill” – garner considerably more disapproval than approval:

61% of Americans disapprove of Trump’s tariff policies, while 38% approve.

46% disapprove of the tax and spending law, while 32% approve (23% say they are unsure).

55% of Republicans and Republican-leaning independents now say Trump is improving the way the federal government works – while 16% say he’s making things worse and 29% say his effect is a mix of positive and negative. In the weeks after he took office, 76% of Republicans expected he would make government work better.

87% of Democrats and Democratic leaners say Trump is worsening the way government functions, up from 78% who said this at the beginning of his term.

Recommended Weekend Reads

The Trump Trade Wars Bring Major Shifts in US Chip Policy, Escalating Risk of Conflict on the Moon, 5 Facts About Global Demographic Changes by 2100, and What’s Going on with the Grid?

August 1 - 3, 2025

Below are a number of reports and articles we read this past week and found particularly interesting. Hopefully, you will find them of interest and useful as well. We hope you have a great weekend.

Trade Wars & Semiconductors

US alters tech policy, puts chips on the table Jennifer Lee & Fritz Lodge/The Strategist

A shift is underway in the Trump administration’s approach to tech policy. Nvidia said on 14 July that the US government would soon grant it licenses to resume exports of its H20 chips to China. AMD is expecting the same for its MI308 chips. This may appear surprising after multiple statements from Trump administration officials that controls on the export to China of higher-end AI chips, such as the H20, were off the table. This move doesn’t change the broader bipartisan consensus behind restricting China’s access to strategic tech, but rather fits into a pattern of recent decisions showing that tech export controls—previously viewed as a non-negotiable issue of US national security—can now be used as bargaining chips in trade talks with China. This shift exacerbates uncertainty for domestic and international tech firms and will encourage Beijing to push for further loosening of controls in future negotiations.

How Does Semiconductor Trade Work? Chris Miller/American Enterprise Institute

Trade data on semiconductors is skewed due to the underreporting of imported semiconductors found in finished products like cars and phones. Any tariffs on semiconductors must carefully consider the structure of supply chains to avoid unintended consequences. Much of the $40 billion of chips the US imports are actually made in the US, packaged abroad, and reimported, so tariffs would senselessly penalize domestic manufacturers. Since the US lacks packaging capacity, higher tariffs would raise costs and hurt competitiveness in key industries. The US should focus tariffs on Chinese-made chips while striking sectoral trade deals with allies that commit both sides to zero tariffs, reducing non-tariff barriers, and continuing to invest in diversified supply chains.

Demographics

5 facts about how the world’s population is expected to change by 2100 Pew Research Center

Here are five facts about how the world’s population is projected to change in the coming decades, based on a Pew Research Center analysis of the UN’s World Population Prospects. The latest data is from 2023, so the numbers for 2024 and beyond are projections.

1. Global population growth is expected to slow between now and 2100 (the population is expected to peak at 10.3 billion in 2084).

2. The world’s three most populous countries in 2025 are expected to have radically different trajectories in the coming decades (India will grow, China has begun to shrink and fall sharply, and the US is expected to grow slowly and steadily).

3. Five countries are expected to contribute more than 60% of the world’s population growth by 2100 (The Democratic Republic of Congo, Ethiopia, Nigeria, Pakistan, and Tanzania).

4. The world’s population is expected to get older (the median age is projected to rise to 42 by 2100, up from 31 today and 22 in 1950).

5. Africa is currently the world’s youngest region, and it’s projected to stay that way in 2100.

Why Is Fertility So Low in High Income Countries? Melissa Schettini Kearney & Phillip Levine/NBER

This paper considers why fertility has fallen to historically low levels in virtually all high-income countries. Using cohort data, we document rising childlessness at all observed ages and falling completed fertility. This cohort perspective underscores the need to explain long-run shifts in fertility behavior. We review existing research and conclude that period-based explanations focused on short-term changes in income or prices cannot explain the widespread decline. Instead, the evidence points to a broad reordering of adult priorities with parenthood occupying a diminished role. We refer to this phenomenon as “shifting priorities” and propose that it likely reflects a complex mix of changing norms, evolving economic opportunities and constraints, and broader social and cultural forces. We review emerging evidence on all these factors. We conclude the paper with suggestions for future research and a brief discussion of policy implications.

Depopulation Globally and in the Asia-Pacific: The Shape of Things to Come Nicholas Eberstadt/Fertility and Sterility

Abstract: This article addresses the prospect of global depopulation and its far-reaching implications. It argues that the advent of world population decline may come sooner than commonly anticipated, due to remarkable drops in birth rates underway in low-income regions as well as more developed locales. Notwithstanding uncertainties about the precise level of planetary fertility (due mainly to limited statistical capabilities in Africa), it is clear that overall childbearing patterns for our species are at most only slightly above the replacement level today—and might already actually have fallen below that significant threshold. Prolonged sub-replacement fertility will have far-reaching social, economic, and political ramifications. The following pages attempt to describe some of them, and to offer an introductory exploration of the new questions that could face problem-solvers in the future.

Africa’s future demographic dividend matters to Europe today ISS/African Futures

Africa’s demographic surge offers Europe a chance to rethink labor, migration and global partnerships through a lens of long-term interdependence. Europe’s population is shrinking, while Africa’s is growing. By 2050, Africa will be home to one in four people globally. Similarly, the EU’s labor force is shrinking and aging, while Africa’s is growing rapidly and becoming younger. By 2050, more than 60% of Africa’s people will be of working age. In Sub-Saharan Africa, the labor force will more than double. It will have increased from 505 million in 2023 to 1,058 million people, while Europe’s labor force will have declined from 370 million to 342 million.

The Growing Electrical Supply Challenge

AI Demand Drives Record Electricity Supply Costs In Largest US Market Financial Times

The cost of providing electricity in America’s largest power market will hit a record high owing to soaring demand from artificial intelligence data centers and delays in building new power plants, raising energy prices for consumers. Grid operator PJM said it procured energy supplies for $329.17 per megawatt day, a 22% increase compared with the previous year. The organization will pay power producers $16.1bn to meet its energy needs from June 2026 to May 2027, a 10% increase compared with the previous year. The operator said it expected a 1-5% rise for customers in their energy bills, depending on how utilities and states passed on costs. PJM sets prices at an annual capacity auction where power suppliers bid to provide the region’s projected demand. Earlier this year, PJM and some state governments took steps to try to keep power prices lower after last year’s capacity auction delivered a $269.92 per MW-day price — a more than 800% increase from 2023.

Power Check: Watt’s Going On With The Grid? Bank of America Institute

The US grid is facing an extended period of load growth. And while the drivers of this growth have changed over time, demand is largely due to 1) building electrification; 2) data centers; 3) industrial demand; and 4) electric vehicle (EV) adoption. If load growth forecasts continue to rise, utilities will need to invest to meet required reserve margins and increase spending on both power generation and transmission & distribution capacity. The good news? Deregulation and accelerated permitting may further help get more projects off the starting line, according to BofA Global Research.

Are Small Modular Reactors Worthy of the Hype? Oilprice.com

Nuclear energy is experiencing a political and technical renaissance. Around the world, nuclear fission is gaining traction as a critical piece of the puzzle for maintaining energy security while also slashing greenhouse gas emissions. Much of the renewed excitement over nuclear power comes from advances in nuclear technologies, particularly small modular reactors (SMRs), which are supposed to make nuclear capacity expansion cheaper, safer, and more efficient. However, Even though there is excitement from investors and policymakers alike, getting SMR models approved is taking much longer than anticipated. Only one model has been approved in the United States, and it is not yet operational. But many, many more designs are waiting in the wings.

Recommended Weekend Reads

Is the US Going to be Hit With a New China Shock?, Looking at Russia’s Next Generation of Leaders, How the Global Economy Has Evaded Disaster, and Data Centers are Eating Capex

July 18 - 20, 2025

Below are a number of reports and articles we read this past week that we found particularly interesting. Hopefully, you will find them of interest and useful as well. Have a great weekend.

China

We Warned About the First China Shock. The Next One Will be Worse David Autor/Gordon Hansen, New York Times

Autor and Handson warn the US faces a second “China Shock” that tariffs are ill-equipped to counter. According to an Australian analysis, btw 2003 and 2007, the US led China in 60 of 64 cutting-edge sectors; by 2023, China led the US in 57 of the 64. The world’s largest and most innovative producers of EVs (BYD), EV batteries (CATL), drones (DJI) and solar wafers (LONGi) are all Chinese start-ups, none more than 30 years old. They attained commanding technological and price leadership not because President Xi Jinping decreed it, but because they emerged triumphant from the economic Darwinism that is Chinese industrial policy. The rest of the world is ill-prepared to compete with these apex predators. When U.S. policymakers deride China’s industrial policy, they are imagining something akin to the lumbering takeoff of Airbus or the lights going out on Solyndra. They should instead be gazing up at the nimble swarms of DJI drones buzzing over Ukraine.

Why China’s Should Revalue the Renminbi – And Why It Can’t Easily Do So Michael Pettis/Carnegie China

In a recent piece for the Financial Times, Gerard Lyons, a British economist who sits on the board of the Bank of China (UK), argued that China’s currency, the renminbi, is undervalued, and that by encouraging it to appreciate, China would help raise its international profile. While many analysts have made similar arguments, it is not at all clear that a rising renminbi would indeed increase its international role. There are nonetheless very good economic reasons for China to revalue its currency, along with reasons why a serious revaluation is likely to be difficult. With its persistent excess production and under-consumption, a revalued renminbi would help correct some of the deep structural distortions in the Chinese economy by shifting the distribution of total domestic income from businesses to households.

Is China’s Military Ready for War? M. Taylor Fravel/Foreign Affairs

A new wave of purges has engulfed the senior leadership of China’s military, the People’s Liberation Army. Since the 20th National Party Congress in October 2022, more than 20 senior PLA officers from all four services—the army, navy, air force, and rocket force—have disappeared from public view or been removed from their posts. The absences of other generals have also been reported, which could foreshadow additional purges. The fact that these high-profile purges are occurring now is not lost on outside observers. In 2027, the PLA will celebrate the 100th anniversary of its founding. It is also the year by which Xi expects China’s armed forces to have made significant strides in their modernization. Finally, the year is noteworthy because, according to former CIA Director Bill Burns, Xi has instructed the PLA to be “ready by 2027 to conduct a successful invasion” of Taiwan. Xi’s instructions do not indicate that China will in fact invade Taiwan that year, but, as Burns put it, they serve as “a reminder of the seriousness of his focus and his ambition.” With such ambitious goals set for the PLA, the question then arises as to how this new wave of purges could affect the PLA’s readiness.

China’s Stealth Trade Surplus Brad Setser/Council on Foreign Relations

China’s trade surplus has soared in the last five years. That basic statement maps to a host of well-known and easily verified realities. China now runs, for example, a large trade surplus in autos, when it ran a deficit as recently as five years ago. Net vehicle exports will top 6 million vehicles this year, net passenger car exports will easily top 5 million cars. It dominates renewables manufacturing (so much so that President Trump decided to essentially give up and take the U.S. back to the age of fossil fuels). China's export volume growth has consistently exceeded global trade growth. Moreover, it maps to standard economic theory: a large real estate crisis typically leads countries to rely more on exports to make up for the fall in internal demand (ask the IMF…) yet that surplus often seems to disappear when it comes to the statistics on global imbalances.

Russia

The Next Generation: Russia’s Future Leaders The Atlantic Council’s Eurasia Center

President Vladimir Putin is initiating a generational shift in Russia’s leadership. According to Kremlin insiders, during his current presidential term, Putin plans to retire some of his most influential and longest-serving allies, many of whom are well into their seventies. Putin himself, at age seventy-two, has no intention of stepping down. He sees himself as entirely irreplaceable. But he is gradually replacing other key figures with members of a younger generation, as the older officials age, fall ill, and become less effective. This transition began last year. It is hardly surprising that a significant portion of this new generation coming to power consists of the children of current top officials and Putin’s closest friends—or even his own relatives. In this sense, Russia increasingly resembles a feudal state, in which power is inherited at all levels. The children of the bureaucratic aristocracy are all, in one way or another, striving for government careers and positions of influence. This report examines the rising generation of the Russian elite and what this shift means for Russia’s future. It is based on extensive interviews with dozens of current and former Russian officials who spoke on condition of anonymity in order to discuss the inner workings of the Kremlin power elite without fear of reprisals.

China may not want Russia to lose – or to win – in Ukraine Asia Times

The South China Morning Post (SCMP) cited unnamed sources to report that Chinese Foreign Minister Wang Yi told his EU counterpart that China doesn’t want Russia to lose in Ukraine because the US’s whole focus might then shift to China. His alleged remarks were spun by the mainstream media as an admission that China isn’t as neutral as it claims, just as they and their alternative media rivals suspected. Both now believe that China will help Russia achieve its maximum goals, but that’s likely not the case.

Geoeconomics

War, geopolitics, energy crisis: how the economy evades every disaster The Economist

Although today’s dangers are not in the same league as World War II, they are significant. Pundits talk of a “polycrisis” running from the covid-19 pandemic, land war in Europe and the worst energy shock since the 1970s to stubborn inflation, banking scares, a Chinese property bust and trade war. One measure of global risk is 30% higher than its long-term average (see chart 1). Consumer-confidence surveys suggest that households are unusually pessimistic about the state of the economy, both in America and elsewhere (see chart 2). Geopolitical consultants are raking it in, as Wall Street banks fork out on analysts to pontificate about developments in the Donbas or a potential Chinese invasion of Taiwan. The world economy appears impressively and increasingly shock-absorbent. Why?

What Happens When Big Tech Goes Nuclear? Jayita Sarkar/Time Magazine & The Carnegie Endowment for International Peace

Silicon Valley firms are advocating for the U.S. to embark on a nuclear energy renaissance... The ethos of Big Tech to “move fast and break things” could spur unprecedented innovation in nuclear energy, especially through the construction of small modular reactors, microreactors, and even fusion. But, just like Silicon Valley itself, which has historically flourished through the invisible hand of the state, the nuclear energy industry might also need increased guidance from the government in order to be safe, secure, and reliable.

The global persistence of work from home PNAS

Abstract: Work from home (WFH) surged worldwide during the COVID-19 pandemic, then partially receded as the pandemic subsided. Using our Global Survey of Working Arrangements covering dozens of countries, we find that average WFH rates among college-educated employees stabilized after 2022. The average number of WFH days per week is steady at roughly 1 d per week globally from 2023 through early 2025. Cross-country variation persists: WFH is about twice as common in advanced English-speaking economies as in much of Asia. These results show how the pandemic-driven shift to remote work has persisted and reached a new equilibrium, with implications for urban

Honey, AI Capex is Eating the Economy Paul Kedorsky’s Applied Complexity

Looking at the boom in building data centers in the US (and elsewhere around the world), Kedorsky looks at how the spending compares. Compare this to prior capex frenzies, like railroads or telecom. Peak railroad spending came in the 19th century, and peak telecom spending was around the 5G/fiber frenzy. It's not clear whether we're at peak yet or not, but ... we're up there. Capital expenditures on AI data centers are likely around 20% of the peak spending on railroads, as a percentage of GDP, and it is still rising quickly. And we've already passed the decades-ago peak in telecom spending during the dot-com bubble.

The Future of Election Polling

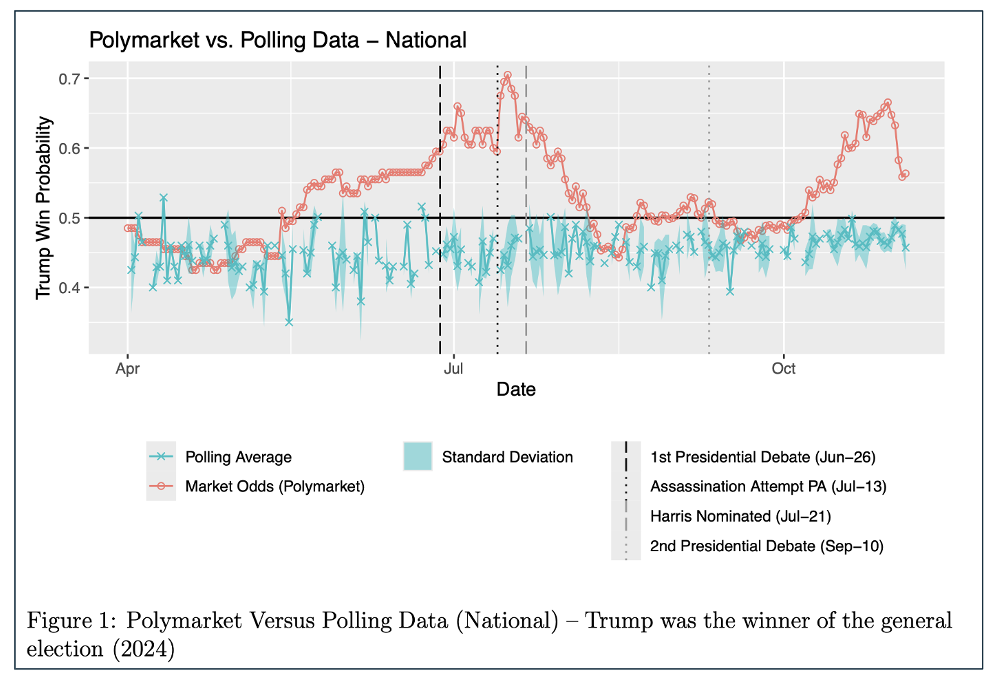

Are Betting Markets Better than Polling in Predicting Political Elections Institute of National Security, Peabody College, Vanderbilt University

In a new study conducted at Vanderbilt University, the prediction markets – and Polymarkets in particular - outperformed traditional national and state-level polling during the 2024 election. According to Professor Brett Goldstein, who oversaw the study, “Our research reveals a fundamental shift in how we might assess and forecast elections.”

Recommended Weekend Reads

The Taliban Become Major Critical Minerals Dealers, How the Trump Tariffs Are Reshaping Latin America, A New US-Africa Blueprint To Counter China, And Dollar Dominance After Liberation Day

July 4 - 6, 2025

Below are the reports and studies we found of particular interest this past week. We wanted to share them with you in the hope they will be useful to you. Please let us know if you have any questions. We hope you have a wonderful weekend.

Critical Minerals

Minerals for Recognition: The Taliban’s Shadow Diplomacy Geopolitical Monitor

Since the Taliban’s return to power, Afghanistan’s mineral and extractive industries have assumed growing strategic importance in the broader context of sustaining the country’s fragile economy. The abrupt loss of access to international financial assistance, the freezing of foreign-held assets, and the enforced curtailment of opium poppy cultivation have pushed the Taliban leadership to refocus on domestic resources, particularly the country’s vast mineral reserves. Yet, there is little indication that the Taliban intend to pursue full-scale exploitation or large-scale export of these resources in the immediate term. Rather, their approach appears deliberately cautious, treating Afghanistan’s natural wealth less as a means of short-term economic gain and more as a tool of political leverage and diplomatic bargaining on the international stage.

Trans-Atlantic Critical Mineral Supply Chain Cooperation: How to Secure Critical Minerals, Battery and Military Supply Chains in the European Theatre Instituto Affari Internazionali

Abstract: The intensifying US-China competition has profound implications for critical mineral supply chains (CMSCs), affecting trade, export controls and market dynamics. US and European firms face difficulties competing with China’s dominant market position, which has led to shutdowns and restricted access to essential materials. China’s state-backed industrial policy, integration of the Communist Party into commercial operations and use of market power for geopolitical leverage have enabled it to control key mineral-technology value chains, complicating international cooperation and raising security concerns. The global push for decarbonization has increased civilian demand for critical minerals, particularly in new energy technologies, outpacing defense sector needs and limiting its influence in securing resources. In response, both the US and EU have developed strategies to mitigate vulnerabilities in their supply chains, recognizing the need for diversified control, crisis management mechanisms and enhanced cooperation. The war in Ukraine has further underscored the urgency of strengthening the defense industrial base, with case studies illustrating the material demands for military technologies such as FPV drones. Drawing on the experiences of South Korea and Japan, and fostering transatlantic cooperation through trade agreements and intelligence sharing, the US and Europe can build greater resilience against geopolitical disruptions and the concentrated, mercantilist nature of current CMSCs.

Three U.S. Government Lists: Which Minerals Are the Most Critical? CSIS Critical Minerals Security Program

This interactive report reports on the existence of multiple, inconsistent lists of which minerals the US government considers most critical. The net effect is unnecessary complexity and uncertainty, undermining efforts to encourage private investment across critical mineral supply chains both domestically and internationally. Critical minerals are defined as resources essential to national security and economic competitiveness. However, the U.S. government lacks a single unified list of these minerals. Instead, the Departments of Defense, Energy, and the Interior each maintain their own distinct lists based on factors such as supply chain vulnerabilities and the minerals’ importance to national security, economic resilience, and manufacturing. Among the 70 materials identified across these lists, only 13 are classified as critical by all three agencies. These lists play a significant role in determining eligibility for federal funding and incentives, including Defense Production Act Title III grants, Inflation Reduction Act tax credits, and Export-Import Bank financing. Beyond funding implications, these lists send powerful signals to the private sector about which minerals are considered strategic priorities for U.S. investment.

Geoeconomics

Dollar Movements and Dollar Dominance in the Aftermath of Liberation Day Steven Kamin/AEI Economics Working Paper

Abstract: This paper provides econometric evidence in support of the view that following President Trump’s chaotic tariff announcements on Liberation Day, April 2, the dollar switched from being a safe-haven currency that appreciates in times of market volatility to a “risk-on” currency that moves inversely with volatility. We estimate an equation for daily changes in the DXY dollar index, using as explanatory variables daily changes in US-foreign interest rate differentials and the VIX, a measure of market volatility. We find a significant break in the relationship between the dollar and its primary determinants after Liberation Day, with the dollar falling below its predicted level. More importantly, in the two months after Liberation Day, the sensitivity of the dollar to the VIX shifted from positive to negative, suggesting that global investors ceased to treat the dollar as a safe haven in times of stress. Most recently, the dollar’s sensitivity to the VIX has retraced some of its earlier decline, but whether this signals a return of the dollar’s safe-haven status remains to be seen.

A Trump Risk Premium in the Dollar Robin Brooks Substack