Recommended Weekend Reads

Is the US Going to be Hit With a New China Shock?, Looking at Russia’s Next Generation of Leaders, How the Global Economy Has Evaded Disaster, and Data Centers are Eating Capex

July 18 - 20, 2025

Below are a number of reports and articles we read this past week that we found particularly interesting. Hopefully, you will find them of interest and useful as well. Have a great weekend.

China

We Warned About the First China Shock. The Next One Will be Worse David Autor/Gordon Hansen, New York Times

Autor and Handson warn the US faces a second “China Shock” that tariffs are ill-equipped to counter. According to an Australian analysis, btw 2003 and 2007, the US led China in 60 of 64 cutting-edge sectors; by 2023, China led the US in 57 of the 64. The world’s largest and most innovative producers of EVs (BYD), EV batteries (CATL), drones (DJI) and solar wafers (LONGi) are all Chinese start-ups, none more than 30 years old. They attained commanding technological and price leadership not because President Xi Jinping decreed it, but because they emerged triumphant from the economic Darwinism that is Chinese industrial policy. The rest of the world is ill-prepared to compete with these apex predators. When U.S. policymakers deride China’s industrial policy, they are imagining something akin to the lumbering takeoff of Airbus or the lights going out on Solyndra. They should instead be gazing up at the nimble swarms of DJI drones buzzing over Ukraine.

Why China’s Should Revalue the Renminbi – And Why It Can’t Easily Do So Michael Pettis/Carnegie China

In a recent piece for the Financial Times, Gerard Lyons, a British economist who sits on the board of the Bank of China (UK), argued that China’s currency, the renminbi, is undervalued, and that by encouraging it to appreciate, China would help raise its international profile. While many analysts have made similar arguments, it is not at all clear that a rising renminbi would indeed increase its international role. There are nonetheless very good economic reasons for China to revalue its currency, along with reasons why a serious revaluation is likely to be difficult. With its persistent excess production and under-consumption, a revalued renminbi would help correct some of the deep structural distortions in the Chinese economy by shifting the distribution of total domestic income from businesses to households.

Is China’s Military Ready for War? M. Taylor Fravel/Foreign Affairs

A new wave of purges has engulfed the senior leadership of China’s military, the People’s Liberation Army. Since the 20th National Party Congress in October 2022, more than 20 senior PLA officers from all four services—the army, navy, air force, and rocket force—have disappeared from public view or been removed from their posts. The absences of other generals have also been reported, which could foreshadow additional purges. The fact that these high-profile purges are occurring now is not lost on outside observers. In 2027, the PLA will celebrate the 100th anniversary of its founding. It is also the year by which Xi expects China’s armed forces to have made significant strides in their modernization. Finally, the year is noteworthy because, according to former CIA Director Bill Burns, Xi has instructed the PLA to be “ready by 2027 to conduct a successful invasion” of Taiwan. Xi’s instructions do not indicate that China will in fact invade Taiwan that year, but, as Burns put it, they serve as “a reminder of the seriousness of his focus and his ambition.” With such ambitious goals set for the PLA, the question then arises as to how this new wave of purges could affect the PLA’s readiness.

China’s Stealth Trade Surplus Brad Setser/Council on Foreign Relations

China’s trade surplus has soared in the last five years. That basic statement maps to a host of well-known and easily verified realities. China now runs, for example, a large trade surplus in autos, when it ran a deficit as recently as five years ago. Net vehicle exports will top 6 million vehicles this year, net passenger car exports will easily top 5 million cars. It dominates renewables manufacturing (so much so that President Trump decided to essentially give up and take the U.S. back to the age of fossil fuels). China's export volume growth has consistently exceeded global trade growth. Moreover, it maps to standard economic theory: a large real estate crisis typically leads countries to rely more on exports to make up for the fall in internal demand (ask the IMF…) yet that surplus often seems to disappear when it comes to the statistics on global imbalances.

Russia

The Next Generation: Russia’s Future Leaders The Atlantic Council’s Eurasia Center

President Vladimir Putin is initiating a generational shift in Russia’s leadership. According to Kremlin insiders, during his current presidential term, Putin plans to retire some of his most influential and longest-serving allies, many of whom are well into their seventies. Putin himself, at age seventy-two, has no intention of stepping down. He sees himself as entirely irreplaceable. But he is gradually replacing other key figures with members of a younger generation, as the older officials age, fall ill, and become less effective. This transition began last year. It is hardly surprising that a significant portion of this new generation coming to power consists of the children of current top officials and Putin’s closest friends—or even his own relatives. In this sense, Russia increasingly resembles a feudal state, in which power is inherited at all levels. The children of the bureaucratic aristocracy are all, in one way or another, striving for government careers and positions of influence. This report examines the rising generation of the Russian elite and what this shift means for Russia’s future. It is based on extensive interviews with dozens of current and former Russian officials who spoke on condition of anonymity in order to discuss the inner workings of the Kremlin power elite without fear of reprisals.

China may not want Russia to lose – or to win – in Ukraine Asia Times

The South China Morning Post (SCMP) cited unnamed sources to report that Chinese Foreign Minister Wang Yi told his EU counterpart that China doesn’t want Russia to lose in Ukraine because the US’s whole focus might then shift to China. His alleged remarks were spun by the mainstream media as an admission that China isn’t as neutral as it claims, just as they and their alternative media rivals suspected. Both now believe that China will help Russia achieve its maximum goals, but that’s likely not the case.

Geoeconomics

War, geopolitics, energy crisis: how the economy evades every disaster The Economist

Although today’s dangers are not in the same league as World War II, they are significant. Pundits talk of a “polycrisis” running from the covid-19 pandemic, land war in Europe and the worst energy shock since the 1970s to stubborn inflation, banking scares, a Chinese property bust and trade war. One measure of global risk is 30% higher than its long-term average (see chart 1). Consumer-confidence surveys suggest that households are unusually pessimistic about the state of the economy, both in America and elsewhere (see chart 2). Geopolitical consultants are raking it in, as Wall Street banks fork out on analysts to pontificate about developments in the Donbas or a potential Chinese invasion of Taiwan. The world economy appears impressively and increasingly shock-absorbent. Why?

What Happens When Big Tech Goes Nuclear? Jayita Sarkar/Time Magazine & The Carnegie Endowment for International Peace

Silicon Valley firms are advocating for the U.S. to embark on a nuclear energy renaissance... The ethos of Big Tech to “move fast and break things” could spur unprecedented innovation in nuclear energy, especially through the construction of small modular reactors, microreactors, and even fusion. But, just like Silicon Valley itself, which has historically flourished through the invisible hand of the state, the nuclear energy industry might also need increased guidance from the government in order to be safe, secure, and reliable.

The global persistence of work from home PNAS

Abstract: Work from home (WFH) surged worldwide during the COVID-19 pandemic, then partially receded as the pandemic subsided. Using our Global Survey of Working Arrangements covering dozens of countries, we find that average WFH rates among college-educated employees stabilized after 2022. The average number of WFH days per week is steady at roughly 1 d per week globally from 2023 through early 2025. Cross-country variation persists: WFH is about twice as common in advanced English-speaking economies as in much of Asia. These results show how the pandemic-driven shift to remote work has persisted and reached a new equilibrium, with implications for urban

Honey, AI Capex is Eating the Economy Paul Kedorsky’s Applied Complexity

Looking at the boom in building data centers in the US (and elsewhere around the world), Kedorsky looks at how the spending compares. Compare this to prior capex frenzies, like railroads or telecom. Peak railroad spending came in the 19th century, and peak telecom spending was around the 5G/fiber frenzy. It's not clear whether we're at peak yet or not, but ... we're up there. Capital expenditures on AI data centers are likely around 20% of the peak spending on railroads, as a percentage of GDP, and it is still rising quickly. And we've already passed the decades-ago peak in telecom spending during the dot-com bubble.

The Future of Election Polling

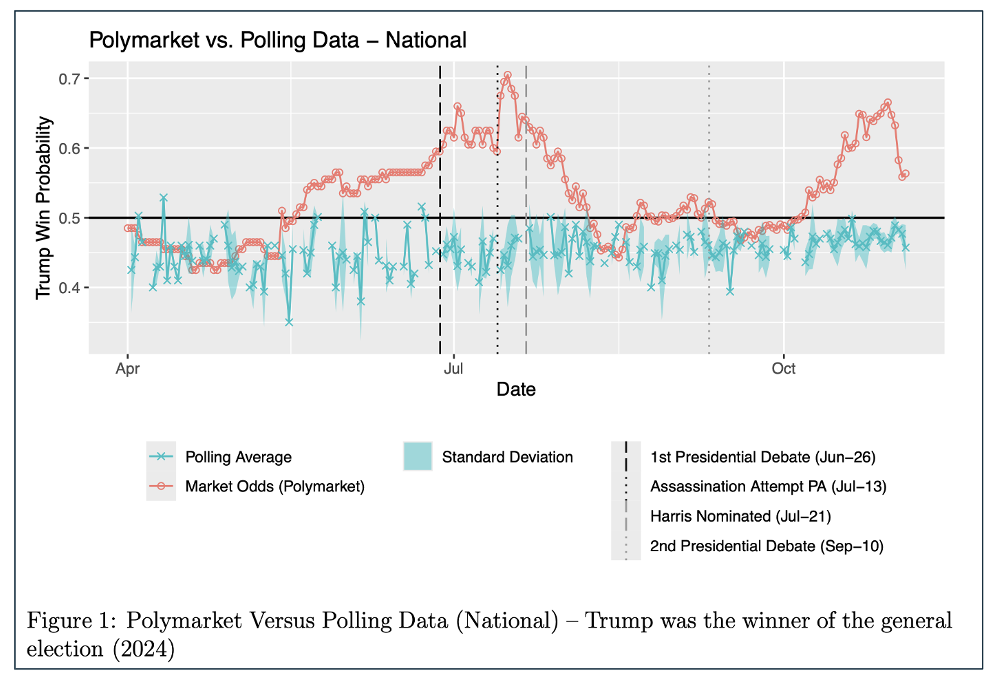

Are Betting Markets Better than Polling in Predicting Political Elections Institute of National Security, Peabody College, Vanderbilt University

In a new study conducted at Vanderbilt University, the prediction markets – and Polymarkets in particular - outperformed traditional national and state-level polling during the 2024 election. According to Professor Brett Goldstein, who oversaw the study, “Our research reveals a fundamental shift in how we might assess and forecast elections.”